The ups and downs of the small cap market

Published 25-FEB-2023 15:00 P.M.

|

18 minute read

Investing in small cap stocks is a rollercoaster of emotions.

Sometimes everything is going right and a rising share price is reflecting the progress.

These stocks will become the “golden child” of the portfolio.

Other times a combination of small problems, or one big problem, causes investors to run for the exits and the share price gets destroyed.

For this reason we take a portfolio model approach to Investing in small caps, maintaining a number of different Investments where a few outsized winners will hopefully offset the positions where risks have materialised.

Sometimes we can forecast and be aware of a risk, other times a risk that we didn’t expect materialises and we learn a new lesson for next time.

Today we cover two stocks that have delivered on their plan so far and that we think are looking to have a great run in 2023, contrasting with two stocks where certain risks have materialised, share prices have suffered and what we plan to do next.

Minbos Resources (ASX:MNB)

MNB is one of our favourite stocks for 2023.

MNB has been achieving all the objectives we want to see and looks like it will be the first stock across our entire portfolio to actually build a mine - a huge and rare achievement for a small cap stock.

This week we published a write up about our trip to Angola, Africa to see our MNB’s projects with our own eyes and to get a feel of the country as an Investment destination.

In case you missed it, our full trip report is here. It’s a long one but has a lot our observations as well as photos that you won’t find anywhere else:

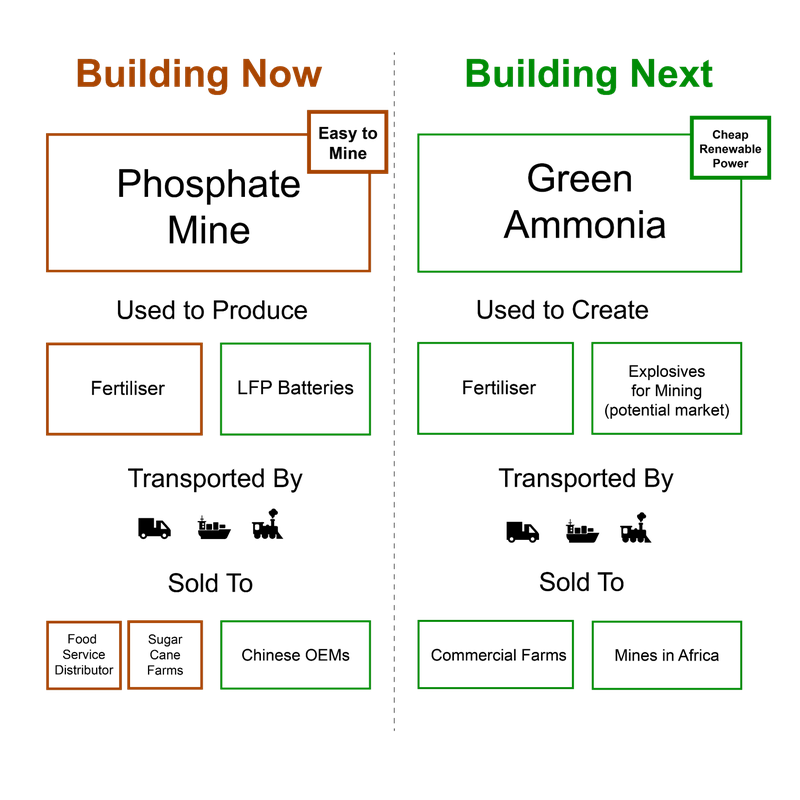

MNB, which was our 2022 Wise-Owl Pick of the Year, has two projects in Angola.

Its near “construction stage” phosphate fertiliser project (on track to be constructed this year) and its “studies stage” green ammonia project, for use in fertiliser production.

At its core, MNB’s mission is to help Angola become the agricultural hub of Africa.

We met the in-country team behind the project, who had a wealth of knowledge about the region as well as a big passion for the project.

And we got to see some of the key locations including, the phosphate deposit, processing site, ports, roads and railways:

Probably the most impressive thing we saw from an engineering perspective was the Capanda Hydroelectric Dam. This dam was built by Russia in the 1980s and is part of a hydroelectric network powering 70% of the country.

It was incredible to see such an advanced bit of engineering and construction up close - especially how a concrete wall could hold back such a huge body of water.

The photos don’t do justice to how powerful the giant stream of water was - this water goes into turning turbines and generating energy. The hydro electric dam gave us an up close idea of just how much clean, renewable energy can be generated by Angola and its existing infrastructure.

MNB has signed a deal for low cost surplus electricity from this hydro dam to create green ammonia, where electricity is the key input cost.

A big thank you to the entire MNB team for taking the time to show us around and explain about the projects and the country, and we look forward to first production later this year.

Sarytogan Graphite (ASX:SGA)

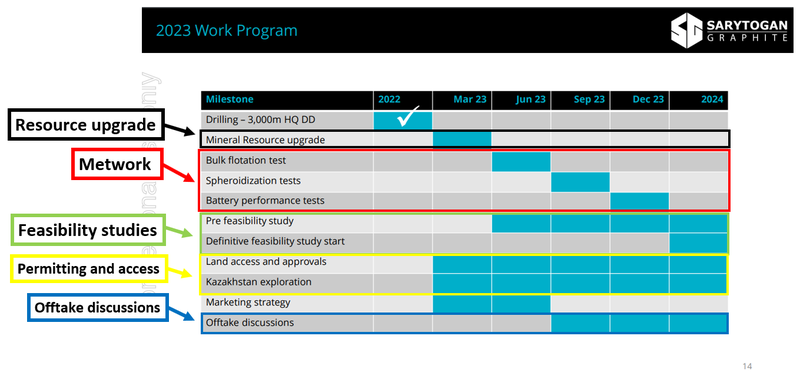

Another of our favourite stocks for 2023 is Sarytogan Graphite (ASX:SGA) and its giant graphite project in Kazakhstan.

SGA has been ticking off all the objectives we wanted to see and presented a solid forward plan for 2023 at the recent RIU conference in Perth.

We visited SGA’s graphite deposit in Kazakhstan in August last year with SGA management and other equities analysts.

Visiting a project site provides valuable insight into a company's project and opportunity to spend some time with the management team.

Like MNB, we liked what we saw on site in Kazakhstan and are hoping for big things from SGA, which we named as our Small Cap Pick of the Year for 2022.

You can find our full write up on that visit here, and the reasons it earned Pick of the Year status here.

The black stuff sticking out of the ground are graphite outcroppings.

SGA’s project has an existing Inferred Mineral resource of 209Mt grading 28.5% total graphitic carbon (TGC). This is the highest grade graphite resource of any graphite company on the ASX, and the second largest contained graphite resource behind $1.2BN Syrah Resources.

Perhaps more importantly though, SGA is targeting the battery anode market with a value-added fine spherical graphite product strategy.

SGA wants to produce “Uncoated Spherical Graphite (USpG)” which is priced at multiples of flake graphite products.

Behind our decision to name SGA as a Pick of the Year was its “breakthrough metwork result of 99.87% graphite purity” — a major step towards its graphite meeting battery anode specification of 99.95% purity.

Despite this, SGA’s market cap is multiples lower of its ASX listed graphite peers, even with SGA having the highest grade resource on the ASX and second largest sized resource.

SGA’s market cap is currently $49M, whereas other ASX companies that have adopted the same battery anode strategy are trading at ~10x SGA’s valuation.

Talga Resources and Renascor Resources are two peers that are also chasing a value-adding fine spherical graphite product strategy. The key difference is that they are more advanced than SGA, as they have each already developed an effective refinement process via metwork and are now at the feasibility studies stage.

Talga is currently trading with a market cap of $535M, while Renascor is capped at $558M.

This shows that there is plenty of room for SGA to re-rate if it can continue to tick boxes on its metwork and then commence feasibility studies.

SGA has a lot planned for the year ahead:

SGA Managing Director Sean Gregory recently presented at the RIU Explorers Conference. Here are the company’s presentation slides: SGA at RIU Explorers Conference.

And here’s Sean speaking to The Pick at the conference:

When things go wrong. Why an Investment Memo is important

SGA and MNB have been doing well and we think they could be some of the “golden children” across our Portfolios this year.

But it isn't always smooth sailing in small cap land.

Things can and do go wrong - now we are going to cover two examples of Investments where things went wrong and what we plan to do next.

This is why we take a diversification approach to our overall Investing strategy, where we place multiple “bets” with the hope that one or two of them perform exceptionally well.

By taking a diversified approach we mitigate the risk that a handful of investment losses will have a meaningful impact on our overall Portfolio performance.

To increase the chances of finding more winners than losers we always consider the “risks” facing a potential Investment and compare it to the “rewards” on offer if our “Big Bet” pays off.

We outline each of these risks in our Investment Memos, which are a key part of our decision to make, or not make, an Investment in a company.

Over the past two weeks some of the key risks for two of our Investments (that we outlined in our Investment Memo) materialised.

This can, and often does, happen with speculative small cap investments.

We accepted these risks at the time we Invested.

So it is important for us to diversify our Portfolio, and Top Slice our Investments when they go up, to protect our overall Portfolio performance.

You can read more about these strategies in our “Beginners Guide to Investing in Small Cap Stocks” in particular “Chapter 3: Diversify your stock portfolio” and “Chapter 4: Create a selling strategy, and stick to it.”

Here are two companies where a key risk has materialised and some of our comments on what went wrong:

FYI Resources (ASX: FYI)

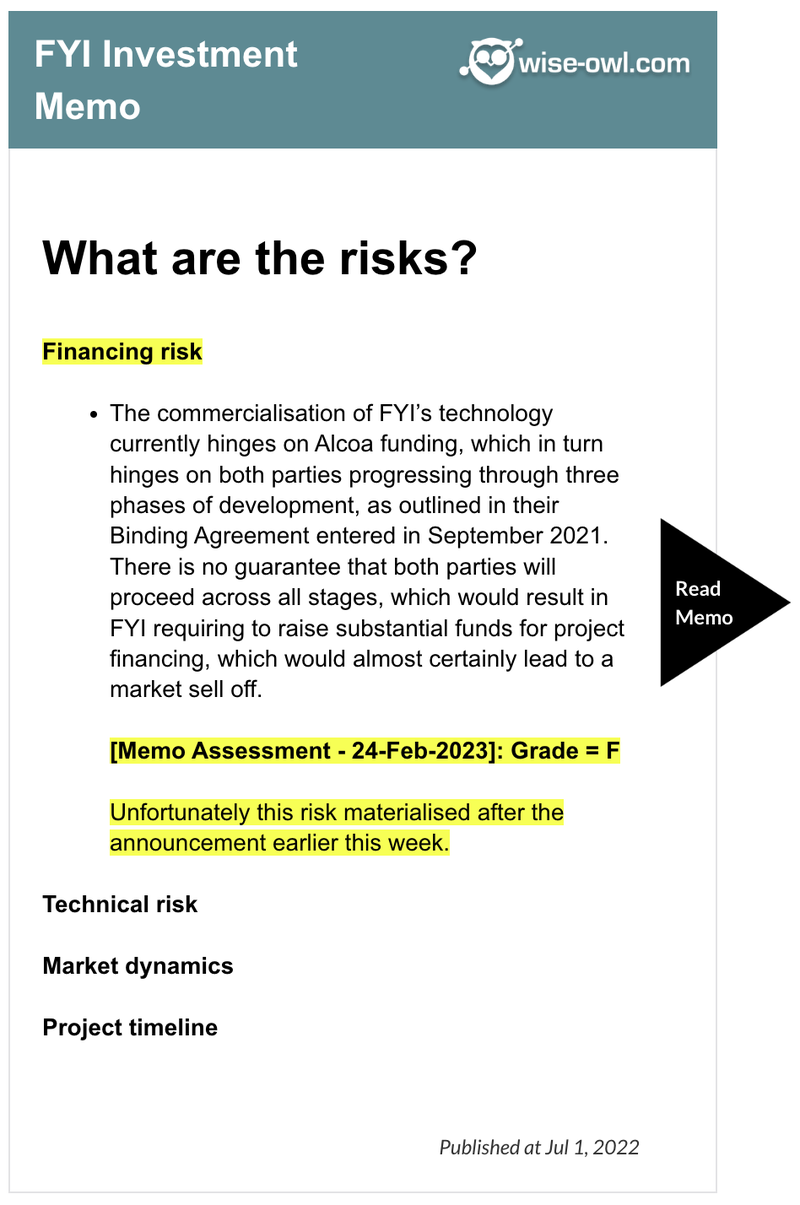

This week FYI Resources (ASX: FYI) came out with news that its Joint Venture partner Alcoa withdrew from its High Purity Alumina project, leaving FYI without a major financing partner for the project.

The market didn't like the news and sent FYI’s share price down ~60% on the day of the announcement.

Many investors had entered FYI on the prospect that global aluminium giant, Alcoa, would sign on to fund the development of the project, and subsequently exited when Alcoa’s withdrawal was announced.

While the news was unexpected, and all indicators pointed to a deal getting done, we did have a withdrawal by Alcoa listed as a key risk to our FYI Investment Thesis as part of our FYI Investment Memo - it was a risk we were aware of and willing to take.

While a major risk did materialise we still maintain our “Big Bet” for the company which is:

“We want to see FYI significantly re-rate by moving into High Purity Alumina (HPA) production and scaling its technology to other HPA projects”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our FYI Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

FYI now holds 100% of a project that has a Definitive Feasibility Study (DFS) completed with a Net Present Value (NPV) of US$1.1BN and a capital payback period of 3.2 years.

All of this while now trading with a market cap of $27.5M, $10.1M in cash (as at 31 Dec.) and an enterprise value of $17.4M.

While we are currently down on our Investment on paper, we think the fundamentals are still relatively strong for the company’s High Purity Alumina (HPA) project and we maintain the company in our Wise-Owl Portfolio.

To see our more detailed take on the news check out our full note here.

The Alcoa withdrawal was surprising and disappointing, but this can happen when global management of a giant company makes a decision that impacts partnerships like FYI way down the chain.

To date we have been impressed with the FYI’s project and its Managing Director Roland, and continue to hold our position in FYI.

With a couple of us in Perth this week, we reached out to the company and have been kindly offered the opportunity to visit FYI’s pilot plant and hopefully see some 4N High Purity Alumina - we will report back on what we see.

Thompson Resources (ASX: TMZ)

After a series of unfortunate events Thompson Resources (ASX:TMZ) announced a rights issue offered to all existing TMZ shareholders at a whopping 87.5% discount to the company’s last traded price.

At the same time, TMZ’s CEO David Williams resigned for personal reasons.

TMZ has been a very poor performer, even by small cap standards.

When things go wrong with most small caps, the share price may fall 40% to 50%, and have the chance to rebound by delivering some successful progress or finding a new project, allowing investors to recover some paper losses.

TMZ, however, is down 93% from our Initial Entry Price, so it's going to be a tough grind to get back to where we started.

We have held TMZ for over two years. While we Top Sliced ~12% of our position during that time, we held ~88% of the position all the way down to where it is today - not our proudest small cap Investment story.

But we are planning to take up our full rights issue (which is being offered to all TMZ shareholders) and also apply for any shortfall. Because after so much has gone wrong and the share price has performed so badly, it’s likely there will be a new plan and management appointed to try and soothe the pain for existing holders. TMZ is currently trading at a lowly $5M market cap.

Here is what we think went wrong with TMZ...

Our Big Bet was that ‘TMZ becomes a silver producer by first proving up a large enough silver equivalent resource base that makes its "hub and spoke" development strategy feasible and then by feeding these resources through its centralised processing facility’.

While TMZ was developing its hub and spoke model the silver price never took off and funding for the business dried up before the company had the opportunity to prove up its targeted 100 million oz. silver equivalent resource.

With access to capital being sparse for small cap companies, TMZ turned to the risky strategy of funding the business through a convertible note that could be converted to shares, which we think contributed to the downward spiral in the company’s share price and eventually the heavily discounted rights issue announced last week.

You can read more about funding risk from convertible note funding in this weekend edition: “Whoever has the gold makes the rules”.

This was one of the key risks we mentioned in our TMZ Investment Memo and unfortunately it led to the company’s share price moving sharply lower last week.

One risk we did NOT foresee was a big seller in TMZ.

When we first Invested, ASX listed “Silver Mines Limited” was a major shareholder of TMZ with 15.5%.

Silver Mines Limited unexpectedly started to progressively sell down its holding into the market and added to the downward share price spiral - their most recent substantial holder notice in 2022 showed their position had dwindled to ~7.9%.

We originally thought having a larger silver company on the share register was a good thing, we did not expect them to start selling into the market.

We have now learned to treat a large corporate holding as a potential risk as well as a potential positive.

We still maintain a position in TMZ, and will take up our entitlement under the rights issue in the hopes that the company can pull a rabbit out of the hat with a new acquisition or some progress on their existing assets BUT the company is no longer a core Portfolio holding for now.

We will wait to see what they do next before we consider whether to bring them back into the core Portfolio.

After this news we have decided to move TMZ to our “Bottom Drawer Portfolio”.

In summary

Investing in small cap stocks is risky.

Sometimes things are going right for a company and the share price is rewarded by the market, but other times risks materialise.

We try to go into each new Investment understanding what objectives the company needs to achieve to deliver returns for investors, but also being aware of all the potential risks that could materialise and negatively impact the share price.

Sometimes a risk materialises that we have not seen in our experience, and we add it to our future consideration when making a new investment.

We outline key objectives and near term risks for each of our Investments on the Investment Memo for that company.

This week in our Portfolios 🧬 🦉 🏹

🟢 New Investment: Okapi Resources (ASX: OKR) 🟢

Our new Wise-Owl Investment is in Okapi Resources (ASX:OKR).

OKR is a uranium explorer and developer with projects across four North American uranium districts (USA, Canada).

OKR is also finalising a material stake in uranium enrichment technology in the coming weeks.

This technology is a chemical process which could make uranium enrichment more efficient, safer and cheaper than other enrichment technologies.

The other ASX ‘uranium enrichment’ stock (Silex) has gone from $35M to a $1BN market cap in recent years.

Capped at ~$27M, OKR is the only ASX listed micro cap with an investment in the space.

One of our key Investment Themes for 2023 is critical materials in the USA, specifically for energy and resource independence in a rapidly de-globalising world.

OKR offers uranium enrichment technology combined with JORC-stage USA based uranium assets.

📰 Read our full Note: Introducing Our Latest Investment: OKR

Tyranna Resources (ASX: TYX)

This week our 2022 Catalyst Hunter Pick of the Year Tyranna Resources (ASX:TYX) reported big, high grade, near surface lithium hits from its first ever drill program at its project in Angola.

The assays included a hit of 22.75m grading 2.02% lithium oxide from 20.25m.

There is potentially plenty more lithium at depth, and only 2% of the project’s pegmatites have been sampled.

There’s still another 800 or so pegmatites to go...

The question then is, how big could this project be? And what does the company need to do to get it there?

📰 Read our full Note: Scratching the Surface: TYX big lithium hit on first drill

Mandrake Resources (ASX: MAN)

On Wednesday our Investment Mandrake Resources (ASX:MAN) unveiled its new high-grade lithium brine project in Utah, USA.

MAN has a healthy ~$19M in cash, and is now chasing the commodity of the decade, in the country of the moment.

Lithium is classified as a critical mineral by almost every government in the world.

The USA in particular is pushing a tidal wave of capital into securing local lithium supplies.

What’s more, MAN’s new project has attracted interest from the $344M capped Galan Lithium - which is investing $1.5M into MAN for a ~5% cornerstone shareholding in the company.

We think that Galan’s decision to invest directly in MAN and have its shareholding escrowed for 12 months is a clear sign of validation of the potential of MAN’s project.

📰 Read our full Note: MAN Secures USA Lithium Brine Project

Minbos Resources (ASX:MNB)

As we covered above, on Thursday we provided a (long) summary (you’ll need to sit down) of our site visit to MNB’s projects in Angola.

We believe fertilisers for food security will be a key global issue over the coming years.

And we think MNB can play a prominent role in addressing this issue.

MNB is one of the largest positions in our Portfolio, so we decided to pay a visit to MNB in Angola and learned a lot from the experience.

📰 Read the full Note: On the Ground in Angola: Our MNB Site Visit

FYI Resources (ASX:FYI)

As mentioned above, one of the key risks to our Investment in FYI Resources (ASX:FYI) materialised this week, when its project partner Alcoa Australia pulled out of their partnership.

While this came as disappointing news, and FYI’s share price lost ~60% after the announcement, we like that FYI resumes control and is fully committed to the High Purity Alumina (HPA) project project and will now develop an alternative plan and schedule.

📰 Read our full Note: Alumina giant Alcoa pulled out of its JV with FYI Resources - What now?

Macro News - What we are reading 📰

Battery Materials:

‘They want to eat our lunch’: BHP warns on global resources race

Biden-Harris Administration Driving U.S. Battery Manufacturing and Good-Paying Jobs

India’s Foray Into the EV Battery Market Lacks Some Key Ingredients

Oil and Gas:

China taking control of global LNG as demand booms

Hydrogen:

Samsung joins Coleman’s green hydrogen punt

Hydrogen market growth to surge in 2023 despite slowing global economy

Australia ‘falling off the pace’ in global hydrogen race

Lithium:

Chinese lithium prices fall 30% as demand for electric vehicles weakens

Mexico's Lopez Obrador orders ministry to step up lithium nationalization

Ford Plans to Build EV Battery Plant in Michigan With Chinese Partner

US based commodities:

China to Scrutinize Ford-CATL EV Battery Deal to Ensure Core Technology Isn’t Shared

EU Trade Envoy Sees Deal on US Climate Package Ahead of Visit

Uranium

Inflation Reduction Act Keeps Momentum Building for Nuclear Power

Australia debates use of uranium and nuclear power

This week’s Quick Takes 🗣️

DXB: How big could a Dimerix partnership/licensing deal be?

EXR: Green hydrogen project: Term sheet with Softbank subsidiary

GTR: Ground picked up next to $18BN Cameco’s uranium plant

KNI: Massive sulphides hit at nickel project AND cobalt drilling

LCL: LCL seeks JV partners for another new copper-gold target

LRS: Tesla looking to buy Brazilian lithium developer?

LYN: Helicopter EM surveys identify potential drilling targets

NHE: Noble Helium finishes seismic, does deal with Helium One

TEE: New seismic acquisition program over 715 bcf gas target in QLD

TG1: Option exercised to acquire nickel-copper-PGE project

TMR: Final assays from 2022 drill program - JORC resource next

⏲️ Upcoming potential share price catalysts

Updates this week:

- GAL: Is undertaking a second round of drilling at its Callisto PGE discovery in WA.

- This week GAL reported met work test results, as we covered here.

- KNI: Drilling the first of its three Norwegian battery metals projects inside the EU.

- KNI hit more massive sulphides at its nickel project AND started its second round of drilling at its cobalt project, as we covered here.

- TMR: Maiden JORC resource estimate for its Canadian gold project.

- Drilling results extended the known strike of the Blue Vein and the No 9 Vein with ‘bonanza’ and high-grade gold intersections. See our take on the news here.

- TYX: Assay results from the company’s maiden drill program.

- Big, high grade, near surface lithium hits reported. See our take here.

- PRL: Awaiting final execution of a joint development agreement with Total Eren.

- PRL remains suspended pending “a material update in relation to the Binding Term Sheet entered into with Total Eren”.

No material news this week:

- 88E: Drilling for oil in the North Slope of Alaska next to UK listed Pantheon Resources.

- EV1: Updated DFS looking to improve on the already relatively strong US$323M NPV; Framework Agreement with the Government of Tanzania.

- GGE: Preparing to drill its US helium project looking for a commercially viable flow rate.

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.