TTM Defines a 3 million oz. Gold JORC Resource

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,899,250 TTM shares at the time of publishing this article. The Company has been engaged by TTM to share our commentary on the progress of our Investment in TTM over time.

It's been three years in the making - and it's finally arrived.

We first Invested in our copper-gold exploration Investment Titan Minerals (ASX:TTM) back in July 2020.

At the time, TTM had picked up a gold asset in Ecuador that we thought had multi-million ounce potential.

The project already had a foreign resource estimate hosting 2.1 million ounces of gold, and 16.8 million ounces silver.

In order for it to be fairly compared to other gold development companies on the market, TTM needed to convert its resource size under JORC classification.

That day has arrived.

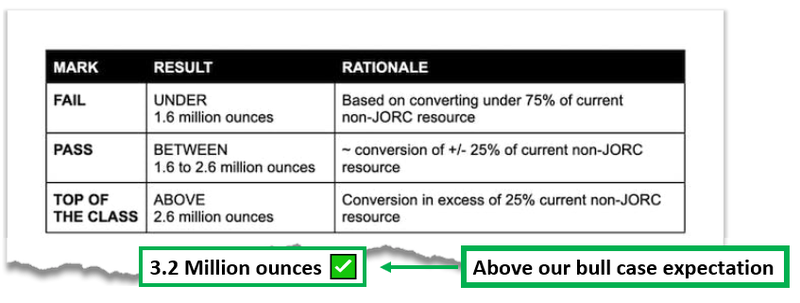

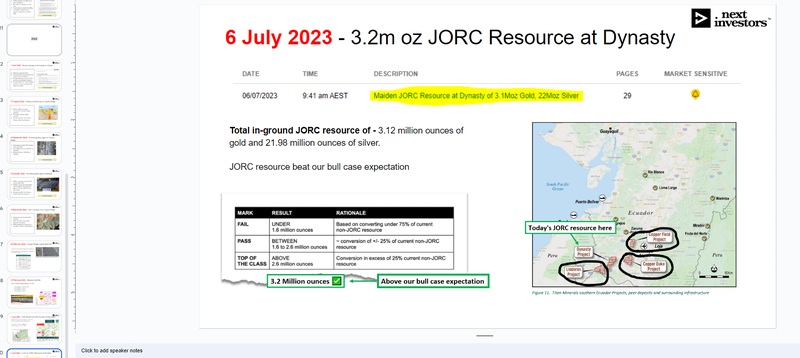

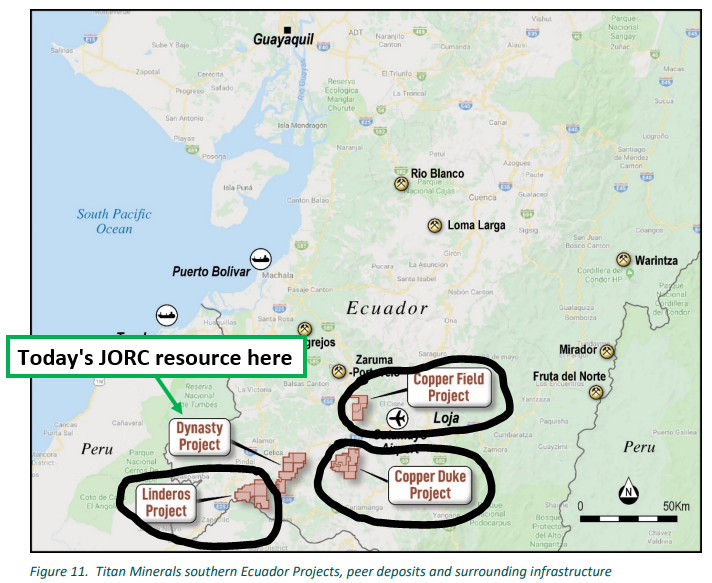

Today, TTM announced its maiden JORC-compliant resource estimate:

- 3.12 million ounces of gold and 21.98 million ounces of silver.

It's shallow too - with the entire resource based on drilling at depths no greater than 100m.

TTM’s resource has grown by ~60% vs the previous foreign estimate.

The result came in way above our bull case expectation which we set for the company at >2.6 million ounces back in March 2022:

🎓 To learn more about JORC resources read: JORC Resources Explained.

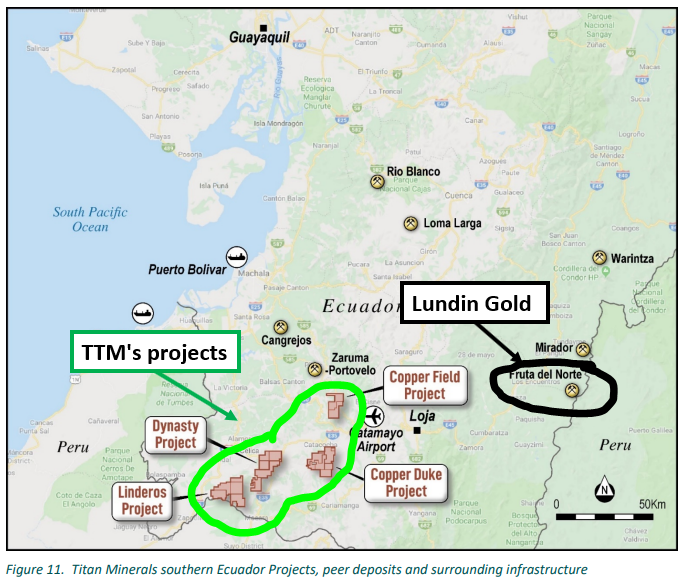

Ultimately, the blue sky case for TTM is that it can deliver a discovery with similar size/scale potential as TTM’s regional peer - Lundin Gold.

Lundin Gold’s core asset is the 9.8 million ounce Fruta Del Norte project in Ecuador.

Lundin is capped at ~$4.5BN.

The Fruta Del Norte project is said to be one of the highest grade, lowest cost mines in the world.

The mine started operation in 2019 - and in 2022 total revenue was $841M.

TTM has delivered 3 million ounces nearby - so almost a third of the way there in terms of resource size - and it has a market cap of $99M (at 7c per share).

Of course, TTM getting to the scale of Lundin’s Fruta del Norte is no guarantee here. The example just sets the context for what TTM is trying to achieve in Ecuador.

Aside from the maiden JORC resource at TTM’s Dynasty gold project, it also has two more compelling copper-gold porphyry targets - Copper Duke, Linderos, and Copper Field. These assets provide a healthy bit of exploration upside in TTM.

When we first Invested ~3 years ago, in order for TTM to deliver a meaningful, sustained re-rate, we wanted to see TTM achieve the following:

- Drill out and validate all of the existing data ✅ - TTM’s foreign resource estimate was based on 1,160 trenches and 26,733m of historic diamond drilling data. We wanted to see TTM modernise that data and bring it up to JORC compliance.

- Test additional targets looking to increase the size/scale of the project ✅ - At the time, the gold resource was centred around three targets. We wanted to see TTM test other regional targets and increase the size of the resource beyond what was in the foreign resource estimate.

- Prove the project had genuine multi million ounce potential ✅ - After bringing the resource up to JORC compliance, we thought it would be of sufficient size/scale that a major player in the gold/copper space came in for the project.

After today’s announcement TTM’s JORC resource sits at:

- 43.54Mt (of rock) with gold grades of 2.23g/t and silver grades of 15.7g/t.

A total in-ground JORC resource of:

- 3.12 million ounces of gold and 21.98 million ounces of silver.

TTM is currently capped at $99M (at a 7c share price), which based on today’s resource values the company at ~$31 per ounce of gold.

We think that on that basis alone, the company is trading at levels that would put TTM on other companies/investor groups radars.

However - the one thing TTM is lacking at the moment that would give it a stronger re-rate is a strong balance sheet.

TTM had US$193k in the bank at the end of March quarter, with US$2.5M in receivables owed to it, and it has debts totalling US$2.5M.

On that front, we do note one interesting bullet point in today’s announcement:

Time will tell if that eventuates.

The process of proving up a gold discovery and getting interest from a mining major has always been the fundamental basis for our TTM Big Bet which is as follows:

Our TTM Big Bet:

“We want to see TTM prove up a $1BN plus copper or gold discovery in Ecuador which is so attractive that a mining major acquires the company.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our TTM Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Our key takeaways from TTM’s maiden JORC resource

Looking through today’s announcement, we have three key takeaways:

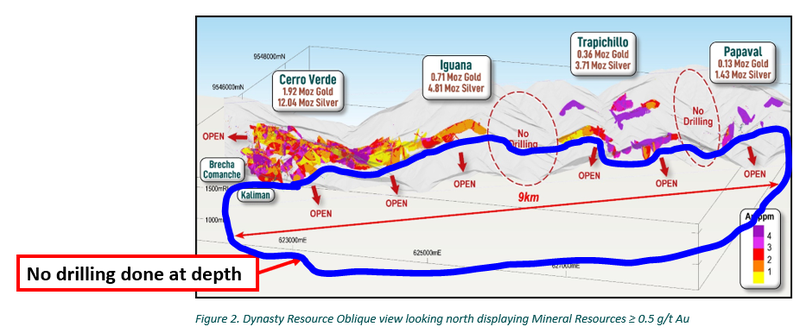

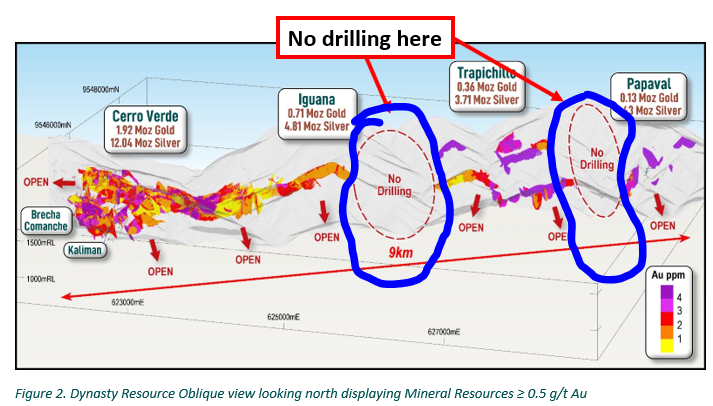

- Resource doesn’t include drilling beyond 100m (leaving potential for growth)

- Undrilled targets still exist between the JORC resource

- Source mineralisation yet to be uncovered

1) The resource is based on drilling down to depths of ~100m.

At the moment, TTM has only included drill holes down to a depth of 100m.

Typically resources with the ounce and grade profile of TTM’s sit deep underground, and it’s rare for deposits grading ~2.23g/t found at depths this shallow.

For some context, grades of 1g/t are considered economic for mines that can be open-pit mined in WA.

We think that there is still plenty of scope to keep growing the resource with drilling at depth and along strike.

(Source)

2) Undrilled targets between the existing JORC resource

TTM still has a 9km long corridor of targets to test which could yield more ounces.

(Source)

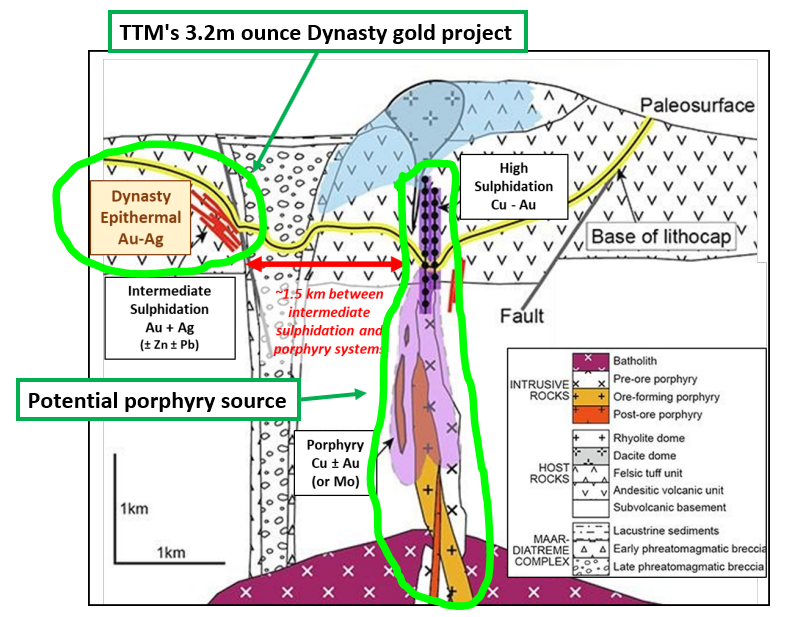

3) The potential source of the mineralisation untested

TTM also thinks there is a chance the company could find the source rock to its Dynasty JORC resource.

The working theory is that TTM’s 3.2 million ounce resource is just one layer on the outskirts of a potential copper-gold porphyry system.

(Source)

Finding a source (porphyry system) would be a big step change for TTM.

We think a discovery like that would take TTM’s project from the level that is usually owned by mid-cap explorer/developer to a project that belongs in the hands of the top 3-4 gold-copper players in the world.

Think - Newcrest, Newmont, Barrick etc...

We see this as the blue sky upside scenario and haven't made it our base case expectation for the project - we are conscious that these type discoveries are extremely rare.

What does success look like for TTM?

The direct comparable to what TTM is trying to discover and define is the project owned by Canadian listed Lundin Gold.

Lundin owns the Fruta del Norte gold project which sits on almost identical geology to TTM’s project - an “epithermal gold-silver intermediate sulphidation” system.

(Source)

The Fruta del Norte project sits on a structure ~1.3km wide and ~300m wide (much smaller than the areas TTM is working with) BUT hosts a much larger ~9.81 million ounce gold and 15 million ounce silver resource.

Lundin acquired Fruta del Norte in 2014, put it into development in 2017 and started producing in 2019.

Fruta del Norte is one of the world’s highest grade and lowest cost gold mines, and just last year it generated ~$841M in revenue for Lundin.

The project is Lundin’s main asset and the company has a $4.3BN market cap:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

While it's hard to directly compare TTM’s project to Lundin’s right now (given TTM’s is at a much earlier stage and pre-revenue), it provides good context for what TTM is trying to achieve in Ecuador.

TTM right now is capped at $99M (at 7c per share) and has a resource that is ~1/3rd the size of Lundin’s project.

What we want to see from TTM now

We think that today’s JORC resource announcement puts TTM in a position where the market can start to attach a firmer value to the company’s projects.

Having a JORC resource means the company has an in-ground resource that (we hope) can finally start to attract investment from big investor groups AND major mining companies looking for projects with serious size/scale potential.

We also note that this is just one of TTM’s multiple projects.

TTM still has three other projects that could yield additional upside due to their exploration potential:

(Source)

With an in ground JORC resource now established, we now want to see TTM leverage the inherent value of its assets and re-capitalise the company at a corporate level.

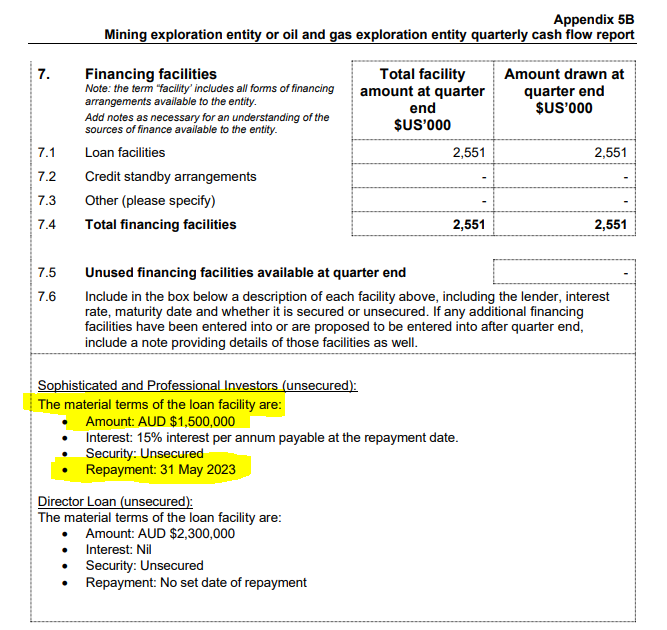

TTM’s capital structure and funding

We are conscious of the company’s cash balance being low at US$193k in cash on 30 March 2023. TTM also had ~ US$2.5M in receivables owing to it from the previous sale of non-core assets.

However, TTM also had US$2.5M in loans that it owed other parties.

As is typical of the small cap market, when companies have low cash balances, the market generally expects the company to eventually do a capital raise that is dilutive to existing holders.

When a capital raise is looming, investors who may otherwise be interested in buying shares in the company choose to hold off the buying decision and in most cases even look to sell their existing shareholdings in the company, in anticipation of discounted future funding rounds.

The thinking is that investors will get a chance to re-enter at a discount to the current price AFTER a capital raise is done.

As a result, we think given the low cash balance TTM has, and despite the rise in TTM’s share price this morning, the threat of a looming capital raise could act like an anchor on TTM’s share price in the short-term.

Aside from today’s news, TTM’s share price over the last 12 or so months may be reflective of its low cash balance:

As a result, we think in order for TTM’s valuation to sustainably grow, TTM needs to shore up its balance sheet and demonstrate it is strongly capitalised to be able to execute on future growth plans.

This can typically be done through one of the following three pathways - along with our commentary on what TTM could do:

- A standard capital raise - this would be like ripping the band-aid off. It may sting in the short term, BUT in the long run, this pathway would remove the weight on TTM’s share price, which we think would be positive for shareholders over the long run. Time heals all wounds...

- A strategic investment - this type of raise could give TTM an opportunity to bring in a strategic partner who is willing to hold their shares for the long-term. This approach would likely create less short-term pain as the potential investor wouldn’t immediately look to sell the shares on market.

- A project partner - TTM could look to sell off some portion of one of its projects to raise funds. The negative here would be that TTM loses a portion of the project, but it would also need a deeper pocketed partner to do the heavy lifting from a funding perspective. It would also avoid the short-medium term dilution and churn problems that a capital raise brings.

In reference to pathways 2 and 3 above, we did notice that today that TTM made mention of:

“Ongoing discussions with strategic investors for Dynasty and other projects progressing”

TTM has left it open as to whether those discussions are at a project level or at the corporate level.

A strategic investor coming on board is the type of deal that has the potential to surprise investors the most.

If the deal is strong enough to fund the company to the point where a capital raise may not be needed, OR a much smaller raise is done post-deal, then it could be a catalyst for a re-rate in TTM’s share price.

IF the strategic partner is also bringing expertise to the deal, then it would be an added bonus as opposed to just a financial bonus...

(Source)

Whatever approach TTM takes, we think some kind of new funding will ultimately be beneficial for long term shareholders like us given the company's existing financing position.

At the end of the March quarter, TTM had US$2.5M in debts outstanding of which A$1.5M was interest bearing and the remainder loaned from directors, which was interest free and had no maturity date.

The interest bearing loans were due on the 31st May 2023 - which means TTM will need to arrange repayment of these loans as soon as possible, unless of course the lender and TTM have negotiated other arrangements.

It isn't uncommon for loans to be extended or for these type deals to be refinanced behind the scenes, especially when the loan amount ($1.5M) is relatively small compared to TTM’s market cap ($99M using a 7c share price).

In the short-term, the overdue loan is the key risk to the company.

(Source)

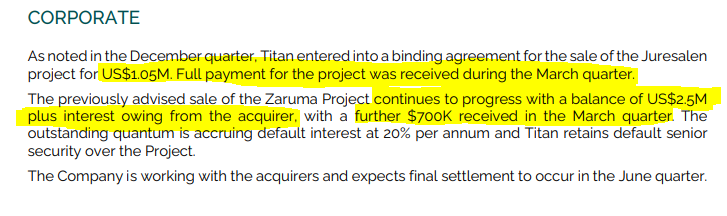

Payments due to TTM from asset sales

One way TTM has managed to continue funding itself is through sales of its non-core assets.

During the December quarter last year, TTM sold its Juresalen project for US$1.05M and received the full payment during the March quarter.

Most of those funds were used to fund drilling and project development activities.

At the same time, TTM also received US$700k from the sale of its Zaruma project - from which TTM is still owed ~US$2.5M.

TTM references the US$2.5M in its March quarterly report as part of its “cash and receivables”.

TTM confirmed in its recent March quarterly report that it expected the final settlement from the acquirer of the project during the June quarter - which just ended.

To date we haven't seen any update from TTM on this front, but we are hoping that this was part of a strategy to try and pay down debts and fund working capital. We may hear more about this in the upcoming quarterly report.

(Source: TTM March 2023 quarterly report)

What’s next for TTM?

More exploration at Dynasty 🔄

TTM still has plans to continue drilling out and testing regional targets at the Dynasty Project.

Ultimately the goal here is to expand the resource and add new discoveries BEFORE the company moves into the feasibility stage for the project.

Target generation works at the Copper Duke project 🔄

Here TTM is currently running surface mapping, soil and rock chip sampling programs over high-priority target areas.

All of the ongoing work is part of the pre-drilling target generation works - eventually after permitting is organised, TTM plans to drill those targets.

Desktop work for the Linderos project 🔄

Here TTM is currently processing the results from the maiden drill program.

The next step here is to plan for the company’s 2nd phase of drilling either by building a 3D geological model to base its drilling on OR by running an IP geophysical survey which will inform where TTM drills next.

What are the risks?

Right now, the primary risk to our Investment in TTM is “Funding risk”.

With only US$193k in cash in the bank (on 30 March 2023), there is a risk that the company will run out of funds OR has to stop spending on progressing its projects.

While we do think the company’s projects have enough value to warrant getting a capital raise closed, we are mindful that the current macro environment makes it a tough time to be trying to raise capital.

In markets like these, investors may look for large discounts to market share prices - which current TTM holders may not be entirely happy with.

In the short term, this is the key risk we want to see TTM mitigate.

To see all of the risks listed in our TTM Investment Memo click the image below:

Our TTM Investment Memo

Below is our March 2022 TTM Investment Memo, where you can find a short, high level summary of our reasons for Investing.

In our TTM Investment Memo, you’ll find:

- Key objectives we want to see TTM achieve

- Why we are Invested in TTM

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.