TMZ Pressing Ahead with Highest Grade Undeveloped Silver Project in Australia

Published 08-FEB-2022 15:18 P.M.

|

15 minute read

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 5,472,728 TMZ shares and 112,500 TMZ options at the time of writing this article. S3 Consortium Pty Ltd has been engaged by TMZ to share our commentary on the progress of our investment in TMZ over time.

Thomson Resources (ASX:TMZ) is working on Australia’s highest grade undeveloped silver project.

TMZ has quietly been executing on its ‘Hub and Spoke’ strategy with the aim of making a collection of smaller silver projects economically viable.

This is an ambitious plan which needs multiple factors to click into place - and we’ll show you what this looks like in a moment.

But for now our focus is on one factor that just got ticked off...

Today, TMZ released the results of its metallurgy studies which reveal a substantial improvement on historical recoveries.

Often overlooked by investors, metallurgy or “met work” is a critical part of mine development and it feeds directly into the project’s economics.

Prior to the met work, TMZ also announced a $5M finance facility which allows it to draw down funds as needed, so that it can progress its “Hub and Spoke” strategy - and deliver the all-important Mineral Resource Estimates needed to validate an economic project.

Silver made a strong move starting in early January which we believed played a part in a recent TMZ share price rise.

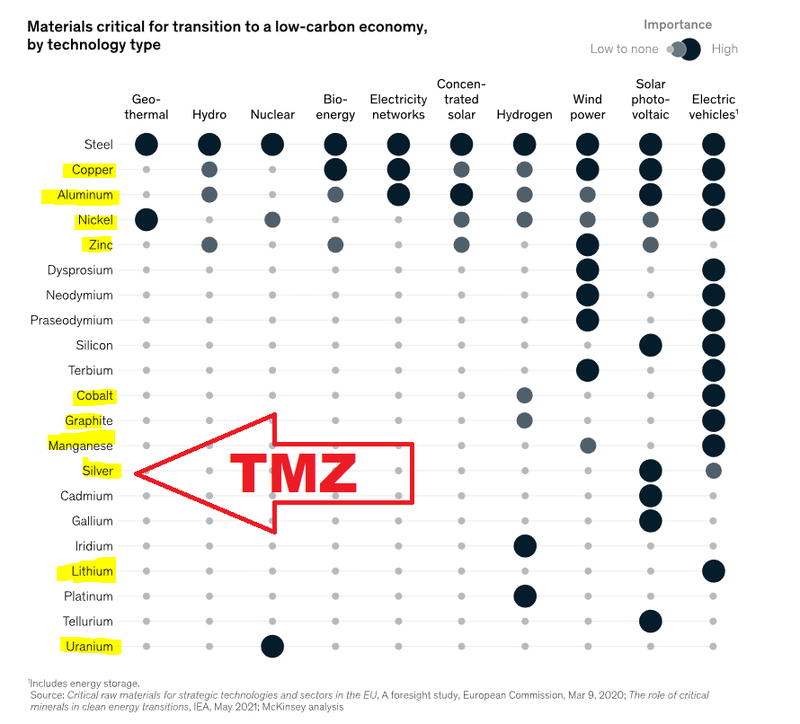

We’re currently seeing a tightening rate environment in the US to counter runaway inflation, and heightened geopolitical tensions in Eastern Europe/Asia combining requiring very specific battery metals. You can see our exposures to the various metals in this portfolio theme below (TMZ highlighted):

As a result of this emerging macro theme, we think this is an ideal time to re-examine our position in TMZ.

The silver that TMZ is aiming to mine has an important place in our portfolio with its two-fold appeal:

- Precious metals like silver could be used as hedge against inflation

- Silver is an important ingredient in solar cells as the world’s energy transition accelerates

TMZ is on the cusp of releasing four new Mineral Resource Estimates, which could see it hit the crucial 100Moz Silver Equivalent mark.

This is a key threshold which TMZ thinks is necessary to make their ‘Hub and Spoke’ strategy work.

TMZ is our key exposure to silver in our portfolio - almost a year ago after we first invested in TMZ we got excited about silver in general and bought some silver bars which we are still holding today...

We have been holding TMZ shares since December 2020 - our entry prices for TMZ are 8.8c and 10c - today the stock is trading at ~7c

We hold 87.7% of our total position in TMZ.

For a quick high-level summary of why we invested in TMZ, why we continue to hold TMZ, key objectives for 2022, and risks click below:

Here’s how we’ll proceed today:

- TMZ’s “Hub and Spoke” strategy

- Met work summary (todays’ news)

- How the new Mineral Resource Estimates progress TMZs project and when we expect them

- Why TMZ is pursuing the “Hub and Spoke” strategy

- What TMZ has to do for this strategy to work

- Why metallurgical studies are crucial for TMZ’s success

- Details of new financing arrangement

- What we expect to see next as per our TMZ Investment Memo

The Silver Jigsaw - TMZ’s Hub and Spoke

Despite the market’s impatience, TMZ’s approach to development is diligent and meticulous.

We’re of the view that good things take time.

TMZ’s strategy is to combine multiple resources to bring together the firepower necessary to make the project economically viable.

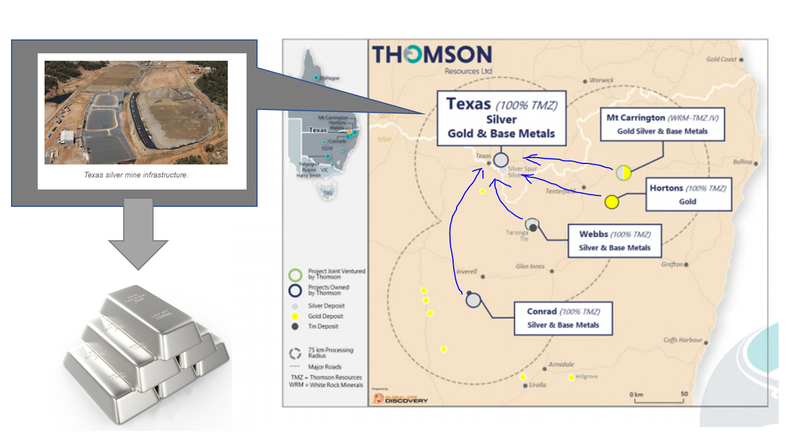

They call it the ‘Hub and Spoke’ strategy because it looks like this:

It's been a while since we have written about TMZ, but the company has been busy progressing its Silver “Hub and Spoke” consolidation strategy in the New England Fold Belt, on the NSW and QLD border.

We have previously written about the Hub and Spoke strategy and why TMZ’s approach to growing the size of its project is a little bit different to what investors might be used to.

Most of the time with exploration companies we will see them make a discovery and then slowly grow it by further defining that single ore-body. This normally happens by extending the strike zone vertically and horizontally.

The companies will then bring that deposit to a place where they think they have defined as much of the resource as possible before taking the project into the different feasibility stages.

TMZ however doesn’t have one single deposit - instead they are further defining several different smaller scale deposits within close proximity to each other. These will will form the basis for a large silver resources hub (plus gold, zinc, lead, copper, tin) all of which is processed through one central processing facility.

To see our deep-dive on this strategy see our previous article.

More on today’s met work news

TMZ today announced the initial met work test results from three of its deposits (Twin Hills, Mt Gunyan, and Silver Spur) which make up the larger “Texas District” area.

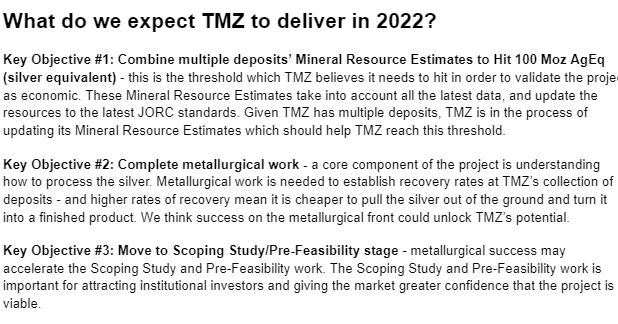

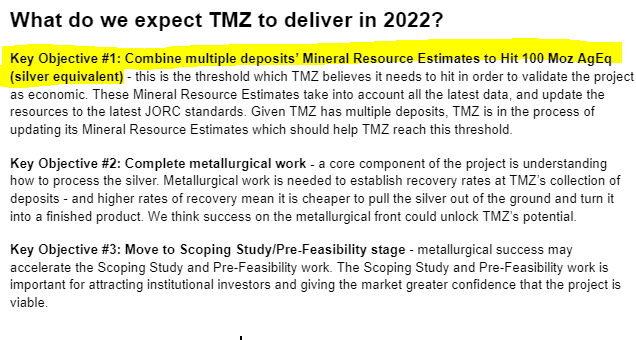

Today’s news directly advances Key Objective #2 in our TMZ Investment Memo:

Met work is a way of testing processing efficiency at a deposit - higher rates of recovery mean it is cheaper to pull the silver out of the ground and turn it into a finished product.

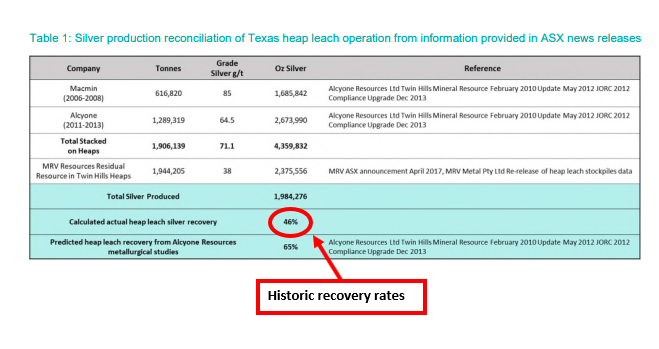

The history of TMZ’s Twin Hills deposit shows how inefficient processing recoveries can leave a project stranded.

Twin Hills was mined between 2007 and 2008 by a previous owner, Alcyone Resources.

Mining had commenced utilising a heap-leach processing strategy which was expected to yield recoveries of at-least 65%, but the reconciliation TMZ did suggest the actual silver recoveries were <50% over the life of the operation.

The mine was eventually shut-down as a result.

After the shutdown of the operation, Moreton Resources took control and after ~8 months of operating the project, had to again shut-down the mine due to inefficient recoveries.

Mining the deposit using the same processing solution won’t secure the recoveries TMZ needs for a viable project, so TMZ tested an improved met work solution to hopefully change the project’s economics.

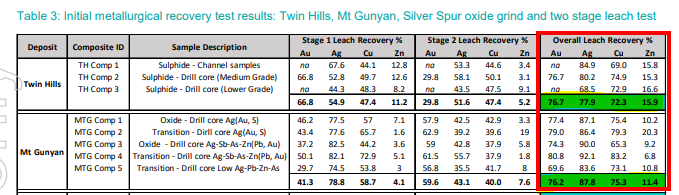

TMZ in today’s announcement showed that by using a series of grind, flotation, and then leaching processes the recovery grades were increased at the Twin Hills deposit up to an average recovery grade of 77.9%.

By putting in place a different type of processing flow-sheet, TMZ has effectively managed to increase the recovery from ~46% to 77.9% over the Twin Hills deposit.

Using the same process TMZ was able to return an average recovery rate of 87.8% silver for the Mt Gunyan deposit as well.

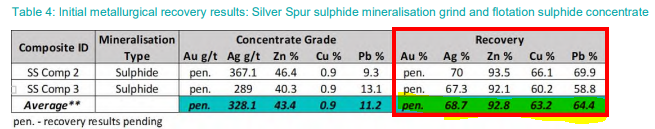

As for the Silver Spur deposit, TMZ is trying a grinding, rougher flotation, and then cleaning process where recoveries for silver were 68.7% which wasn’t as high as we had hoped but importantly the zinc recoveries were 92.8% which goes a long way in putting together an economic mining solution for the deposit.

The key take-aways for us from today's announcement are:

- Twin Hills was previously operated at sub-50% recovery rates and TMZ from the initial met work test results achieved recoveries of ~77.9%. A material improvement. ✅

- Using the same processing methodology, TMZ also achieved an average silver recovery rate of 87.8% for the Mt Gunyan deposit.✅

- Using a slightly altered processing solution for the Silver Spur deposit, TMZ achieved a relatively low silver recovery rate but made up for this with an extremely strong Zinc recovery rate of 92.8%. An improvement in overall recoveries✅

TMZ’s Pathway to Feasibility Studies

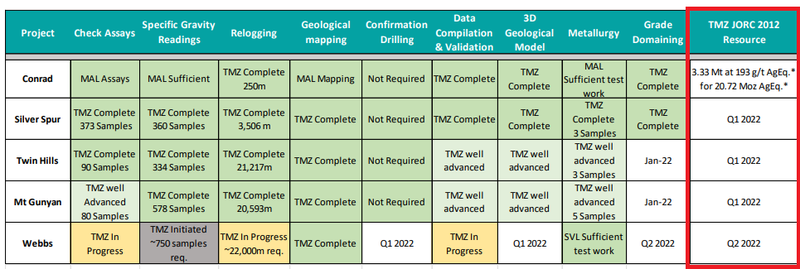

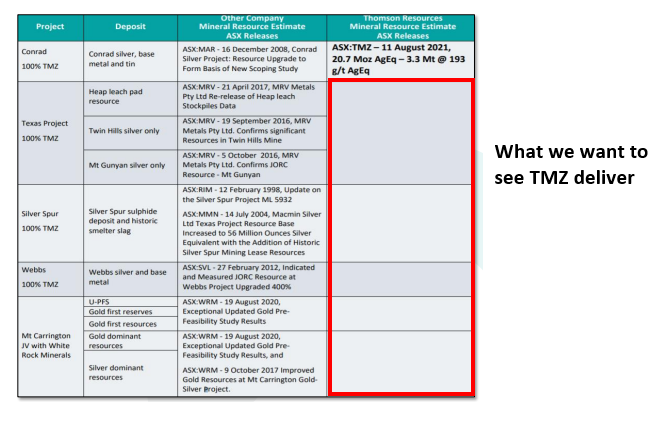

Four new Mineral Resource Estimates are due for TMZ’s project in Q1 of this year (this quarter):

Mineral Resource Estimates are important as it sets the foundation for TMZ to undertake Scoping and Pre-Feasibility studies for its “Hub and Spoke” strategy.

Indeed, these Mineral Resource Estimates are Key Objective #1 for us in our TMZ Investment Memo, and form an important part of TMZ’s strategy:

Once these resources are defined, the project as a whole has a resource base from which it can commence “feasibility studies”.

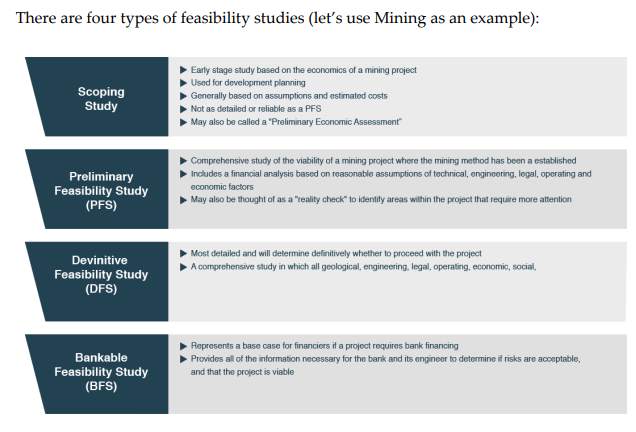

Scoping studies like this are basically the first time a company sits down and starts putting together all of the information gathered doing on the ground works, like securing a Mineral Resource Estimate and identifying recovery rates for different deposits.

From there, the task becomes synthesising that data to determine economic viability.

Scoping Studies build in a certain amount of uncertainty, with most of the inputs based on assumptions and estimated costs while the outputs are seen as more of a benchmark than something a company would go and make an investment based off.

After Scoping Studies are done then TMZ can move into the “Pre-feasibility Stage” (PFS) where things start to become more granular.

We believe that given the amount of work TMZ has put in to date, the Scoping Study and PFS stage may be more compressed in terms of timeframe.

For those that have not had a look already, we recommend checking out our e-book, particularly the chapter labelled “Introduction to Investing in Small Cap Resource Stocks.”

This chapter is where you can find a deep-dive on the different stages of the feasibility study process and how resources stocks move through these stages before a final investment decision can be made.

Why is TMZ pursuing a “Hub and Spoke” strategy?

One of the key reasons for this approach is that single deposits are more expensive to develop and the efficiency gains from scale are what makes multiple different deposits economically viable.

Smaller deposits are often shunned by investors as the massive upfront capital investment is seen as too risky given the modest returns profile.

It is easy to understand why the market perceives smaller deposits like this.

Namely, spending $50M on a small processing plant to mine maybe $100-200M in commodities without knowing exactly what the price will be for the entire 5-year mine life can be a tough sell.

This is where TMZ sees an opportunity. By consolidating all of these smaller deposits rather than on a standalone basis, previously “uneconomic” deposits become part of a viable single operational entity.

TMZ can then build a central processing facility to feed ore into from multiple deposits.

In other words, with each deposit being located close to this ‘Hub’ the value of the “spokes” can be unlocked.

The biggest opportunity for TMZ comes from its ability to pick up those smaller deposits at deep discounts to what a company would have to pay for much larger, more standalone deposits.

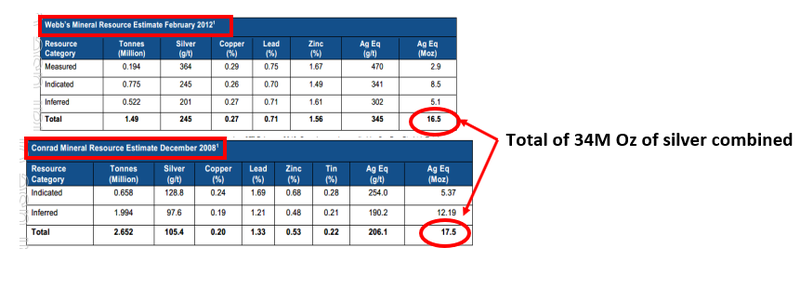

The perfect example of this is when TMZ acquired two additional deposits of Silver Mines (Conrad and Webbs), the two initial deposits that set the wheels in motion for the “Hub and Spoke” strategy.

TMZ at the time paid $1.2M in cash, 75M TMZ shares and 50M options with an exercise price of 12.4c. The transaction was completed in March-2021 with the 75M in shares which at the time were worth ~$9M (TMZ share price was 12c), taking the total consideration paid to Silver Mines to $9.3M.

Both of these deposits at the time had a 2004 JORC resource estimate completed for them by Silver Mines. The Conrad deposit had a 17.5MOz silver equivalent resource and the Webbs deposit had a 16.5MOz silver equivalent resource. A total of 34M Oz of silver.

TMZ essentially paid 27c for every ounce of silver resource it purchased.

Compare this with a hypothetical - if you had purchased Silver Mines who own the large-scale bowdens silver deposit which has a ~275Moz silver resource and Silver Mines at the time had a 21c share price + was capped at $250M. That’s almost $1.10 for every ounce of Silver resource.

A rough back of the napkin calculation reveals that that’s almost 4x what TMZ paid for the two additional silver projects.

Here’s the key bit of info - TMZ paid 27c per ounce of silver resource whilst at the same time investors were paying $1.10 on-market for every ounce of resource Silver Mines had at the Bowdens project.

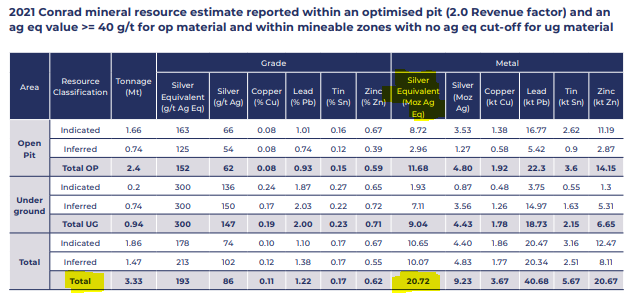

Of-course the JORC was a 2004 estimate, so this also plays some role in explaining this disparity. But since then, TMZ have updated the JORC resource for the Conrad deposit and have actually increased the resource to ~20.7M silver equivalent ounces.

For TMZ, the Conrad and Webbs transaction epitomises what the Hub and Spoke strategy is all about.

TMZ can go out, consolidate these smaller projects at a fraction of what the market would be willing to pay had they had “scale”, then bring them all together to create that “scale” and capture the value created in the re-rate.

Just based off that one transaction alone, the re-rate potential would have been going from a $9.3M consideration to what TMZ paid to Silver Mines, adding the scale element to the projects and hoping to see the market re-rate it to around the $1.10/Oz of resource (~$38M).

That “scale” is simply the market placing value on a company being able to build one large processing plant that is operating the mine instead of having to build say, 10 processing plants at 10 smaller deposits.

Scale also means that the upfront capital costs and any future investments into the mining fleet are shared across all of those smaller deposits.

It makes sense when you think about it, a conveyor belt upgrade at the processing plant would have had to happen 10x at 10 different plants whereas with the Hub and Spoke model, it happens once and all of the deposits benefit from it.

It all comes back to economies of scale, and the market may be willing to pay up for this. TMZ’s strategy is taking unloved smaller deposits that lack scale and bolting them together to capture the re-rate on scale being achieved.

What does TMZ need to do to progress the Hub and Spoke strategy?

The first thing TMZ needs to accomplish is to get a better understanding of the deposits they are working with.

Furthering this aim, are Mineral Resource Estimates which attach a number to how much silver is in the ground at their various deposits.

To do this, all of the drilling data both historical and new, needs to be analysed and modelled to bring these estimates up to scratch with the JORC guidelines.

TMZ has set an ambitious goal of hitting 100Moz in silver equivalent (AgEq) which would include around 60Moz Ag and around 40Moz of other metals such as lead, zinc and gold.

Currently, TMZ has several outdated resource estimates which combined sit at around 78.4Moz - and 100Moz is what they think they need to have an economically viable resource.

As we mentioned earlier in the article, the Conrad deposit is the only one to have had TMZ complete a resource update/upgrade on, taking it from a ~17.5M Oz silver equivalent JORC resource to now sitting at ~20.7M Oz silver equivalent resource.

This represents an almost 20% increase in the historic resource and gives us a clearer understanding of what TMZ is trying to do.

The ultimate aim of the resource re-estimation phase that TMZ are going through now is to get the resources re-stated in accordance with the most up-to-date JORC guidelines and set a base off of which TMZ can go and look to expand.

If the same ~20% increase can be achieved across the other deposits, then TMZ will be well on their way to reaching that 100M Oz target. We don't expect this to happen though, as there will likely be some of the resources that are increased and some that might be lower when re-stated.

Financing announced late last-week

On Friday last week, TMZ also announced that a $5M “Equity Funding Facility” had been put together with financier “Securities Vault”.

The facility is an “at the market” facility that is basically a pool of capital. In TMZ’s case this is $5M, which TMZ can access whenever they see fit.

Once a draw-down of that cash happens TMZ issues shares to Securities Vault totaling the amount of cash drawn-down from the facility.

It is relatively similar to a “convertible note” except there is no interest attached to TMZ’s facility.

Every time TMZ does a draw-down it will receive the gross amount drawn minus a 6% commission. This is pretty similar to the fees TMZ would have had to pay to a broker group to get a placement done so the facility looks like a good move.

We particularly like that TMZ dont have to draw-down any of the facilities, they have the option but have no obligation.

With only $557k in cash at the end of the December quarter this now de-risks the capital raise risk for TMZ, this doesn't mean they wont do another raise but it just means they don't have to.

What’s Next and Why We Invested in TMZ

We’ve been rolling out Investment Memos across our portfolio in order to better track companies.

An “investment memo” is a short, high-level summary of why we continue to hold TMZ and what we expect the company to deliver in 2022. The purpose is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our TMZ Investment Memo you’ll find:

- Key objectives for TMZ in 2022

- Why we continue to hold TMZ

- Risks

- Our investment plan

Click the button below to read the TMZ Investment Memo:

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 5,472,728 TMZ shares and 112,500 TMZ options at the time of writing this article. S3 Consortium Pty Ltd has been engaged by TMZ to share our commentary on the progress of our investment in TMZ over time.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.