Sun shines on smallcaps as health care blue chips are battered

Published 03-JUL-2018 11:51 A.M.

|

13 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It has taken a long time, but the unravelling of the seemingly bullet-proof Ramsay Health Care (ASX:RHC) finally materialised on Thursday, June 21 with the company’s shares tumbling from the previous day’s close of $62.17 to an intraday low of $54.35.

The sell-off has continued with the company’s shares trading as low as $53.00 on Monday, a level it hadn’t traded at since 2014.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

With the company’s large hospital ownership and management position seemingly providing it with substantial pricing power and the ability to be a price maker rather than a price taker, Ramsay was seen as one of the safest investments on the ASX.

Let’s face it, people will always get sick and with an ageing population Ramsay was seen as having excellent leverage to that thematic.

However, it now has to check itself into the emergency ward for a thorough examination and investors should seek professional financial advice if considering this stock for their portfolio.

A company that was arguably in every blue-chip superannuation portfolio, Ramsay announced that it was taking a $125 million charge in relation to its UK hospital assets.

Furthermore, earnings per share growth guidance provided in February was downgraded from a mid-range of 9 per cent to circa 7 per cent.

Downward momentum had been building

Loyal shareholders had already been rattled by the poor fiscal 2017 and first half fiscal 2018 performances reported in August 2017 and February 2018.

Last year’s result triggered a share price decline from about $76.00 to $62.00.

The response to the interim result in February put paid to a slight recovery as the company’s shares fell from approximately $69.00 to once again find a bottom in the vicinity of $62.00.

However, there hasn’t even been a sign of a dead cat bounce following this latest sell-off and it is difficult to see any near to mid-term catalysts for the one-time market darling.

Investors figured that a company with such a commanding hospital portfolio in Australia and some prime assets overseas couldn’t go wrong.

Premium valuations need to be accompanied by proportionate growth

Interestingly, there are many healthcare stocks with lofty market capitalisations that aren’t delivering the high growth normally expected of companies that are trading on premium price-earnings multiples.

To give you an idea of how out of kilter the valuations are, even after the recent retracement, Ramsay is trading on a fiscal 2018 price-earnings (P/E) multiple of about 20 with consensus forecasts pointing to earnings per share growth of circa 7 per cent in both fiscal 2018 and fiscal 2019.

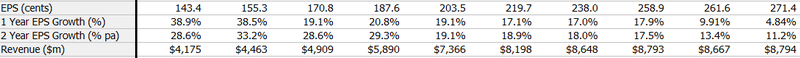

The following data shows Ramsay’s growth profile between June 30, 2013 and December 31, 2017 inclusive.

The data is on a six monthly basis, and the key areas to look at other earnings per share growth and the revenue growth.

As indicated, revenues more than doubled over the course of four years, and for the first three years the company was delivering earnings per share growth of between 17 per cent and 39 per cent.

While the downturn started in 2016/2017, investors just couldn’t believe what they were seeing.

However, there is nothing like the downfall of a big name to bring reputations into question, and it wasn’t surprising to see some companies in the sector that look similarly overvalued take a hit since the Ramsay news broke.

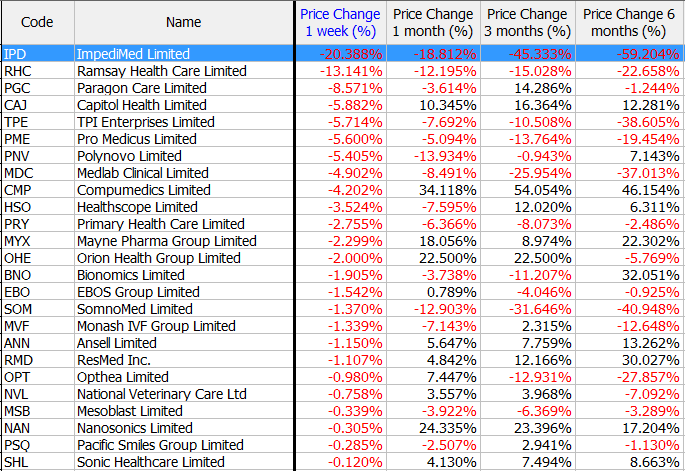

As can be seen below, two of the big names that came under the knife last week were the $20 billion ResMed (ASX:RMD) and the $10 billion Sonic Healthcare (ASX:SHL).

Even Mayne Pharma (ASX:MYX) which has been trading strongly over the last six months and is still up 18 per cent on a month-on-month basis felt the brunt.

While the fallout from Ramsay was interesting to watch, from an analytical basis it was worthwhile trying to track where the money was going.

Notably, aside from marginal gains in go-to stocks such as CSL and Cochlear, investors appeared to be targeting the smallcap end of the market.

There also seemed to be a tendency to steer clear of companies that have the propensity to run into the same challenges as the likes of Ramsay – trying to manage capital intensive businesses with plenty of moving parts and an ever-changing regulatory landscape.

High Flyers Take a Hit

Emerging Companies Fly High

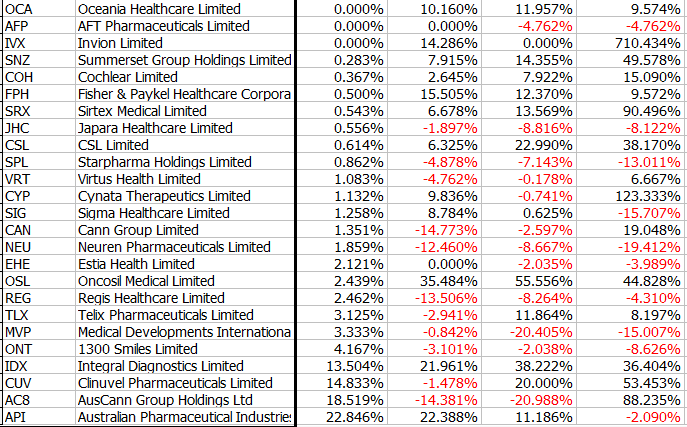

In the plus $100 million market capitalisation healthcare universe, the four stocks that weathered the storm best were Australian Pharmaceutical Industries (+22.8%), AusCann Group Holdings (+18.5%), Clinuvel Pharmaceuticals Ltd (+14.8%) and Integral Diagnostics Ltd (+13.5%).

The past performance of these products is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Steer clear of capital intensive stocks

In Australian Pharmaceutical Industries (ASX:API) you have a major player in the Australian retail pharmaceutical industry with noted brands that are pitched at both the discount market and full-service pharmacy offering, a seemingly resilient model well-removed from managing hospitals.

Clinuvel is a global biopharmaceutical group focused on developing and delivering treatments for patients with a range of severe genetic and skin disorders.

The company benefits from its advanced proprietary technology in a niche area with a substantial addressable market.

Integral Diagnostics, a company that provides the full spectrum of pathology services including CT and MRI scans, as well as nuclear medicine, was the other stock to record double-digit growth.

Once again, this is a scalable business where the initial outlay for equipment is the major capital expenditure, and as customer growth increases earnings margins just get better.

Cannabis stocks losing their speculative tag

Among the top four though, arguably the most interesting and perhaps surprising was AusCann Group Holdings (ASX:AC8).

As you can see from the table, this company isn’t just an overnight sensation that will fall as quick as it has risen.

AusCann’s share price has increased 90 per cent over the last six months, and since the start of the year it has found a range roughly between $1.30 and $1.70.

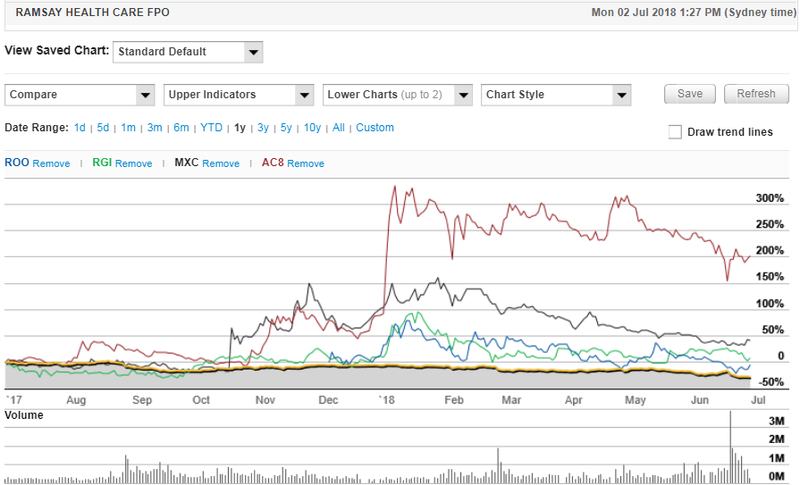

The following share price chart also demonstrates the outperformance of similar smaller stocks which stand to benefit from growth in the cannabis products sector.

The yellow line is the $11 billion Ramsay Health Care, well outclassed by the smaller stocks in the cannabis products sector, and we go on to examine the merits of these companies in more detail.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

However, for those looking to target the next AusCann it would pay to look at the sub-$100 million market capitalisation companies as this is a stock that was trading in the vicinity of 40 cent in October last year – that was the time to snare it.

One other thing to bear in mind before searching for that diamond in the rough is that one of the most appealing aspects of AusCann has been its ability to acquire and develop manufacturing facilities rather than relying on third parties to manage growing.

Finding the next big thing

MGC Pharmaceuticals (ASX:MXC) is a notable emerging player with a market capitalisation of approximately $80 million.

The company’s core strategy is centred on pharmaceutical product research and development and active pharmaceutical ingredient extraction, including those that incorporate cannabidiol.

MGC is the only medical cannabis company listed on the ASX with a combined Israeli, European and Australian clinical research strategy.

However, there are other factors to bear in mind if we hark back to AusCann’s success.

It should be noted before we go further that MXC is a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

MXC offers product and market diversification

Not only does the company have licensed cultivation operations in Malta and the Czech Republic, but it also has established a manufacturing facility in Europe.

Providing confidence in the stock is its ability to meet milestones, most recently the production of its first pharma grade medicine in April 2018.

MXC is benefiting from its diversified business model which spans pharmaceutical products, hemp neutraceuticals and supplements and CBD (cannabidiol) skincare and dermatological applications.

In mid-June the company informed the market that 18 products from its MGC derma collection were to be launched by the UK’s leading retailer, Harvey Nichols.

This is a premier luxury fashion and beauty retailer renowned for sourcing new and innovative products.

Supply chain management a key attraction

As management refers to it, the company has a ‘seed-to-sale’ operation (very similar to AC8) where it has stringent supply chain control, maximising efficiencies and ensuring reliability of distribution.

MGC’s shares spiked 15 per cent under higher than usual volumes on June 29.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

As this wasn’t news related it would appear that investors may be taking advantage of the recent retracement and/or they too noticed the share price movements post the Ramsay news.

Regardless of the rationale behind the heavy buying, it could be the start of a broader rally.

RotoGro uses technological expertise to position itself in cannabis market

RotoGro International Ltd (ASX:RGI) has a distinct ‘we have the technology’ advantage in the hydroponics space.

It has used this as a platform to enter the cannabis market, and the company is now well placed to leverage off its proven expertise and technologies.

The company has licensed, proprietary, patented, and patent-pending technologies in the stackable rotary hydroponic garden space.

RotoGro holds worldwide exclusive licenses for lawful medicinal and recreational cannabis markets.

It also has worldwide non-exclusive licences for all other purposes including pharmaceuticals, nutraceuticals and perishable foods.

Scalable business model

Once again, this is a company that can expand its operations off a relatively fixed cost base and proven technology, and as such is a very scalable business.

As the top line grows, margins will improve and a large proportion of earnings will drop to the bottom line.

This should enable management to accelerate its expansion by acquisition strategy, while also generating strong organic growth.

Hanson Fertigation provides industry and geographic diversification

On the acquisition front, Roto-Gro finalised the purchase of Hanson’s Water Treatment Inc’s Hanson Fertigation last week.

Hanson operates the business of water treatment and fertigation services, focused on commercial installations in Nevada.

Fertigation is the injection of fertilizers, soil amendments, and other water-soluble products into an irrigation system.

The group has a specialized business line for water treatment and nutrient management in the viticulture, perishable foods and lawful cannabis space.

To date Hanson Fertigation has successfully provided design solutions, installations and ongoing service for more than twelve licensed lawful cannabis facilities in Nevada.

From a broader perspective, the acquisition provides a specialised business line for water treatment and nutrient management in the viticulture, perishable foods and lawful cannabis space.

This expands RotoGro’s diversification both by product, intellectual property and geographic representation.

Given that the company paid a nominal multiple of three times earnings before interest, tax, depreciation and amortisation relative to the group’s fiscal 2017 earnings, one would expect that the return on investment will be considerable.

Although any return on investment at this stage is speculation and investors should seek professional financial advice for further information.

Acquisition opportunities continue to be monitored

Management recently said that RotoGro would continue to focus on opportunities that provide it with synergies to expand its industry position.

Notably, the company is exploring strategic partnerships and complementary acquisitions in related markets which include lawful cannabis licence ownership.

Management is also looking at opportunities in the growing services sector, industry leading nutrients, emerging tissue culture expertise and other supporting faculties of hydroponic growing.

Roots entry into cannabis sector triggers sharp share price rerating

It was only on Monday that Roots Sustainable Agricultural Technologies (ASX:ROO) informed the market that it had entered the Ag Tech sector, supplying the US$7 billion US cannabis market, the catalyst for a circa 15 per cent share price spike.

The company is conducting a pilot using Roots’ Root Zone Temperature Optimisation (RZTO) technology with American Farms Consulting LLC (AFC).

The pilot represents Roots’ entry into the Ag-Tech sector supplying equipment to the US cannabis market, which is expected to increase to US$22 billion by 2021.

The company’s equipment and technology will be installed in Trinidad, Washington, a semi-desert climate characterised by high temperature variances between day and night.

The pilot will consist of the installation and use of Roots’ RZTO technology and associated products by AFC, a licensed breeding platform for cannabis growers for the legal cannabis industry in Washington State.

They will cool the roots of cannabis in part of a 30,000 square feet open field licence awarded to the farm owner.

Assuming the pilot is deemed a success, AFC will then purchase the RZTO system for future use.

The pilot is not expected to generate any significant revenue for Roots, rather demonstrate its benefits to operators in the cannabis market.

Given the low set-up costs and ongoing operating expenditure, the technology could resonate with growers.

Roots’ chief executive, Dr Sharon Devir said, “This pilot is the first time RZTO system technology has been used in a cannabis open field, a growing cannabis production method with increasing popularity due to lower initial capex and low opex.

“It should demonstrate how the Roots RZTO technology optimizes the root zone temperatures – in this instance by cooling - until the optimum temperature of the cannabis plant is reached and maintained.”

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.