Sheffield prepares for Thunderbird’s are go

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in emerging mineral sands producer, Sheffield Resources Ltd (ASX:SFX) have taken a battering since mid-October falling from approximately $1.20 to recently hit a 12 month low of 55 cents.

Given that the 12 month consensus share price target currently sits at $1.25, one has to start running the ruler across the stock to see if there is a mismatch between its recent trading range and fair value.

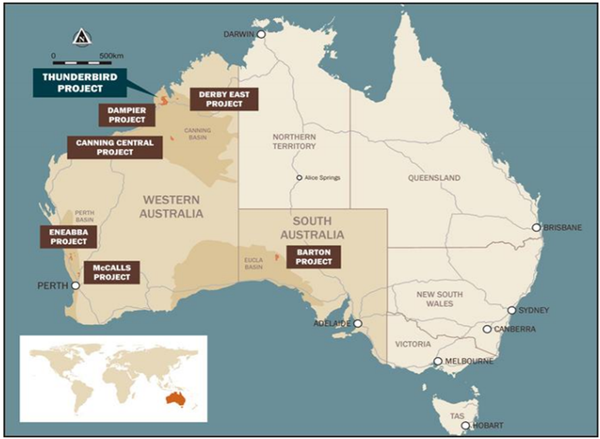

One factor that looms large for the company is funding for its world class Thunderbird Mineral Sands Project in Western Australia where Sheffield is targeting maiden production in the fourth quarter of 2020.

Sheffield recently appointed UBS AG, a leading global investment bank, to act as corporate adviser.

UBS will assist the company in considering third party strategic partner interest for the funding and development of the Thunderbird Project.

It is likely to involve a structured, formal process to evaluate and progress the introduction of a strategic party that would assist the company in achieving Thunderbird’s development objectives.

The fact that Thunderbird is a long life project works in its favour in terms of arriving at a flexible debt funded arrangement, but it is yet to be seen how that plays out.

Possible decision in eight weeks

While it is impossible to accurately predict the timing of a funding statement, Blue Ocean Equities’ analyst Stuart McIntyre is of the view that it will occur in the next 6 to 8 weeks.

Noting that the Sheffield’s share price implies a discount of more than 20% relative to the net present value of the development ready Tier 1 Thunderbird project, the broker sees significant, albeit speculative, upside.

This is also reflected in McIntyre’s share price target of $1.70.

Thunderbird is one of the largest and highest-grade mineral sands discoveries in the last 30 years.

Sheffield’s Bankable Feasibility Study shows Thunderbird is a technically low risk, modest capex project that is positioned to generate strong cash margins from robust levels of production over a mine life of 42 years.

Thunderbird will generate a high-quality suite of mineral sands products with specifications suited to market requirements.

These products include premium zircon suitable for the ceramic sector and LTR Ilmenite which will be one of the highest-grade sulfate feedstocks available globally.

Why the sell-off?

Analysts appear to be putting the sharp plunge in the company’s shares down to profit-taking, which could have some merit given that it coincided with negative sentiment towards equities markets.

It is also worth noting that the company’s shares have roughly doubled in the last 12 months, making the realisation of capital gains all the more enticing.

It is difficult to see Sheffield’s share price fall lower given its sharp discount to the project’s valuation, and on balance there appears to be a greater likelihood of a significant upturn.

Obtaining finance is an important phase in derisking a project and in the majority of cases the share prices of companies developing projects undergo a positive rerating when funding is finalised.

This suggests it may be time to capitalise on the group’s depressed share price.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.