Sandfire injects further funds into Red Mountain project

Published 16-JUL-2019 10:53 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

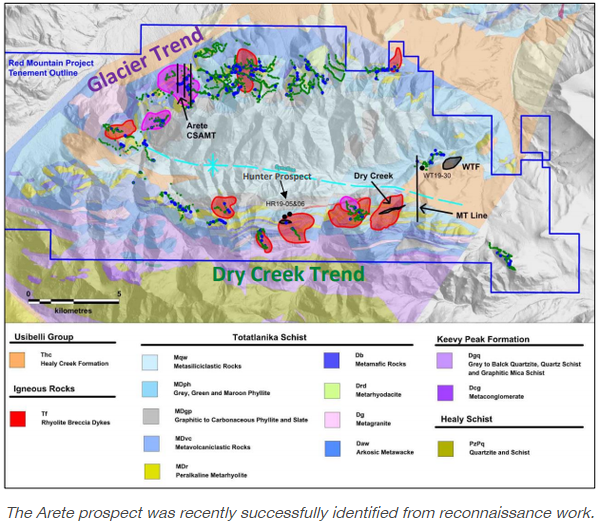

White Rock Minerals Ltd (ASX:WRM) informed the market on Tuesday that in conjunction with its joint venture partner Sandfire Resources NL (ASX:SFR) an additional US$1.5 million had been committed by Sandfire to extend the current on-ground exploration activities into September at White Rock’s Red Mountain Project.

White Rock entered into an Earn-In and Joint Venture Option Agreement with Sandfire in March for the exploration and development of Red Mountain with a four stage funding package, including an option to spend a minimum of $20 million over that period to earn 51%, with a minimum contribution of $6 million in 2019.

This represented a substantial commitment by Sandfire, suggesting additional investment by the group is an acknowledgement of the quality of the project, perhaps more specifically its read on what appear to be positive early stage exploration results in 2019.

A high-grade zinc and precious metals VMS project in central Alaska, Red Mountain already has two high grade deposits, with an Inferred Mineral Resource of 9.1 million tonnes at 12.9% equivalent, for 1.1 million tonnes of contained zinc equivalent.

2019 exploration budget to exceed $8 million

White Rock is the manager of this year’s program, and management said that the additional US$1.5 million expands the total 2019 budget committed to exploration at Red Mountain to in excess of $8 million.

Funds will be allocated to extend drilling by a further five weeks to allow a number of new high priority targets to be drill tested.

Drilling is focused on testing new targets defined from the ongoing field activities that include geological reconnaissance, surface geochemistry and modelling of the recent 2019 airborne electromagnetic (EM) survey.

The increased funding will also facilitate additional geological reconnaissance, surface geochemical sampling and ground electrical geophysics surveys across the 475 square kilometre strategic land package, identifying new priority targets for drill testing in 2019 and subsequent field seasons.

This should allow follow-up modelling and interpretation of airborne EM targets to assist in drill hole targeting and the continued use of down hole EM surveys.

Highlighting the significance of the additional funding, White Rock’s managing director, Matthew Gill said, “The additional US$1.5 million committed by Sandfire, over and above the $6 million already committed for the 2019 field season, is a strong endorsement of the quality and potential of the strategic land holding we have and the targets being generated for drill testing.”

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.