Roots technology increases crop yield by 30%

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Roots Sustainable Agricultural Technologies Ltd (ASX:ROO) has successfully used its Root Zone Temperature Optimisation (RZTO) cooling technology to increase the harvest yield of basil plants by 30% under extreme heat in the Arava desert in Israel.

While basil is grown and harvested in warmer months, the plant is highly susceptible to extreme weather conditions, leading to high mortality rates for producers and unprofitable farming practices.

Using RZTO cooling technology, Roots was able to reduce plant mortality by more than 60%, resulting in a 30% increase in yield compared to uncooled control crops.

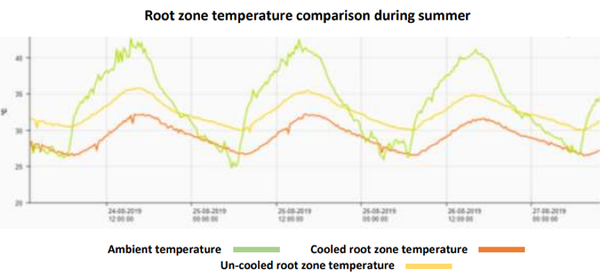

The following chart shows substantial impact that RZTO technology has in terms of both lowering the temperature and maintaining a more balanced growing environment without the peaks and troughs (green line) normally experienced during summer.

Israeli government investing $17.6 million in precision agriculture

The positive results follow previous tests in winter near the Mediterranean coast where Roots’ RZTO technology was used to heat the roots of basil to increase yields by 66% and average plant size by 35%.

Highlighting the support for the industry, a 30% subsidy has been provided to basil growers by the Israeli Government under the Precision Ag Program.

This is part of a collaboration between the Israel Ministry of Agriculture and the Ministry of Finance, which is investing $17.6 million in innovative ag-tech and machinery.

Underlining the flexible farming options and financial benefits of RZTO, Roots chief executive, Dr Sharon Devir said, “The basil cooling test results reaffirm Roots’ product offering and validates the value we can offer producers year-round.

‘’Our RZTO cooling technology significantly improves yield on a range of crops, including basil, when compared to uncontrolled crops and saves on plant replacement costs due to reduced risk of mortality rates from volatile weather conditions.

“RZTO offers options for producers with increased planting cycles during traditional off-seasons and provides significant savings on energy costs when compared to commonly used air heating and cooling systems.’’

Roots opens stronger

Today’s news comes only a month after the company announced that it had initiated a planting program specifically aimed at examining the effects of its technology in improving several protein laden crops.

Trial planting has begun with a view to entering the plant-based meat market with high protein beans and peas chosen for planting.

If successful, Roots will continue to allocate further marketing resources to progress this initiative.

This development was well received by investors with the company’s shares increasing some 60% on the back of the news.

While there has been a retracement in the group’s share price in recent weeks, further success in its traditional markets as announced today could result in some positive share price momentum.

Roots’ shares traded as high as 5 cents in the first 30 minutes of trading, up 4.2% on Friday’s close.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.