Roots blossoms with early pot proof-of-concept results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Ag-tech innovator, Roots Sustainable Agricultural Technologies (ASX:ROO), this morning unveiled encouraging interim results for its world-first proof-of-concept to cool medical cannabis roots grown in a greenhouse in northern Israel.

Impressively, these results show a more than 25% vegetative growth increase and enlarged stem diameters on cooled root zone cannabis plants compared with uncooled control plants.

This proof-of-concept, which will wind up in November, is a collaboration with Canndoc Limited, one of Israel’s leading medical cannabis growers. ROO’s innovative Root Zone Temperature Optimisation (RZTO) technology is being used to cool the root systems of cannabis seedlings and stabilise temperature between scorching hot summer days and cooler nights.

These encouraging interim results look to offer sizeable value to farmers in the blossoming medicinal cannabis space — a market that’s expected to be worth up to $31 billion globally over the next four years.

Current pot prices in the Californian medicinal cannabis market sit at US$2-3 per gram. Given that, the Canndoc control crops have typically produced 600 grams of flowers per plant each growing cycle, making them worth US$1200-$1800.

Roots CEO, Dr Sharon Devir, noted that these early results are very promising. “When you consider that most commercial cannabis greenhouses have thousands of plants, the increased yields, shortened growing cycles will add up to a significant financial benefit to farmers,” Devir said.

“It is one reason we were keen to get into the ag-tech sector providing micro-climate control equipment for the root zone area to growers in the medicinal cannabis market – which expects up to $31 billion in sales globally over the next four years.

“Like other high-value crops where quality is of paramount importance that we have done proofs-of-concept on, we’re finding that by applying our RZTO technology to keep root zones at optimum temperatures, we’re able to greatly increase yields and shorten growing cycles..

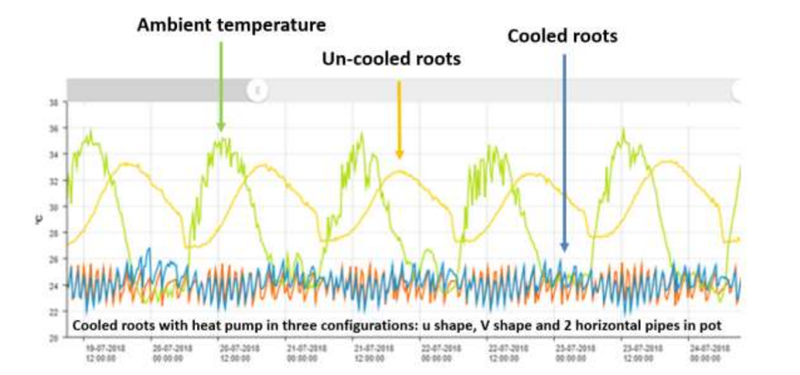

“So far in this summer pilot we have been able to keep the root zone of cannabis plants at more than 7 degrees below the root zones of the control crops. RZTO is providing increased protection against heat and stabilising the temperature range between night and day.”

The pilot will continue until November — only a couple of months from now — at which point ROO and Canndoc will examine the effects of root zone cooling on cannabinoid profile, content and composition, crop yield and weight, quality, uniformity, stem diameter and growing cycle duration.

In recent months, ROO has demonstrated how its disruptive technology can be used in everything from hydroponic lettuce growth and winter basil to the buzzing medical cannabis space, and these pleasing results make for a further confidence boost for its finely honed technology.

And investors seem to concur. On the back of this morning's news, ROO has been on a high, currently up 6% at 26.5 cents.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.