Province Resources to harness ERM’s ESG expertise

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Province Resources Ltd’s (ASX:PRL) high-flying share price could receive another shot in the arm on Wednesday morning.

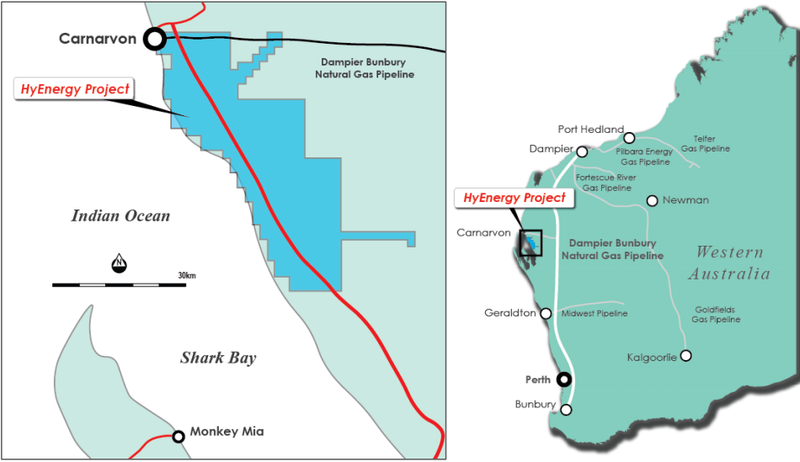

Today, PRL announced that it has appointed ERM as lead approvals consultant at its HyEnergy ZERO CARBON HYDROGENTM Project in the Gascoyne Region of Western Australia.

ERM has over 40 years’ experience helping clients plan, assess and deliver new projects on schedule.

The group helps companies in identifying and managing their environmental, social, and cultural impacts and risks throughout the project lifecycle.

This is an extremely important aspect of Province’s business as management has articulated its commitment to sound ESG administrative and operational practices, an issue that is increasingly at the forefront of the criteria for investor and corporate support.

There has been a groundswell of support for green hydrogen at all levels with the setting up of the $300 million Australian Government Advancing Hydrogen Fund complemented by the $70 million Australian Renewable Energy Agency and the $10 million Western Australia Renewable Hydrogen Strategy.

Don’t be surprised to see the Western Australian government inject more funds into the green hydrogen industry given that the state’s climatic conditions and available land mass lends itself to the production process.

From an investment perspective, it was recently reported by ‘’Bloomberg Green’’ that government and corporate ESG bonds to a value of $490 billion have been sold, while capital invested in ESG funds totalled $347 billion in 2020.

ERM addresses all aspects of ESG

The ERM global team of specialists provide expertise on international standards, as well as local regulatory systems and cultural sensitivities.

ERM understands the capital project design process and work with engineering teams to share their knowledge from the outset.

The group assists across areas such as project feasibility planning, stakeholder engagement, financial option analysis, as well as design phase impact and risks mitigation.

The risks associated with a changing climate are recognised as systemic to the global economy.

Pressure is increasing from investors, regulators, customers and society for business and governments to transition to a lower carbon economy.

ERM is distinctly positioned to help in the corporate and finance sector to navigate this transition, from strategic advice through to practical on-the-ground implementation.

This includes building new or repurposing existing infrastructure for the new lower-carbon economy which can include the likes of renewables, electricity networks, Liquid Natural Gas (LNG), hydrogen, and carbon capture, utilisation and storage (CCUS).

By the very nature of its HyEnergy ZERO CARBON HYDROGENTM Project, Province is playing its part in transitioning to a green renewable energy environment.

Green hydrogen produced from renewable sources, such as wind and solar energy, looks set to play a significant role in navigating the planet towards a decarbonised future and meeting the global aim of net zero emissions by 2050.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.