Promising seismic reprocessing at 88E's Project Peregrine

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

88 Energy Limited (ASX:88E; AIM:88E) has provided a promising update on Project Peregrine, situated on the North Slope of Alaska.

In 2019, seismic reprocessing work was undertaken over 88E’s Project Peregrine as well as on strategically selected regional 2D lines that extended into the Willow oil field to the north of the project area.

It is worth noting that more intensive petrophysical interpretation undertaken following the drilling of the group’s Charlie-1 appraisal well resulted in a substantial upgrade in the well’s net pay estimate, a development that triggered a significant share price increase for the company.

This has held firm in recent weeks despite oil price volatility that has negatively impacted some stocks in the sector.

Consequently, 88E presents as a company that is punching above its weight at its current size, and with the prospect of positive developments related to Project Peregrine, further upside could be imminent.

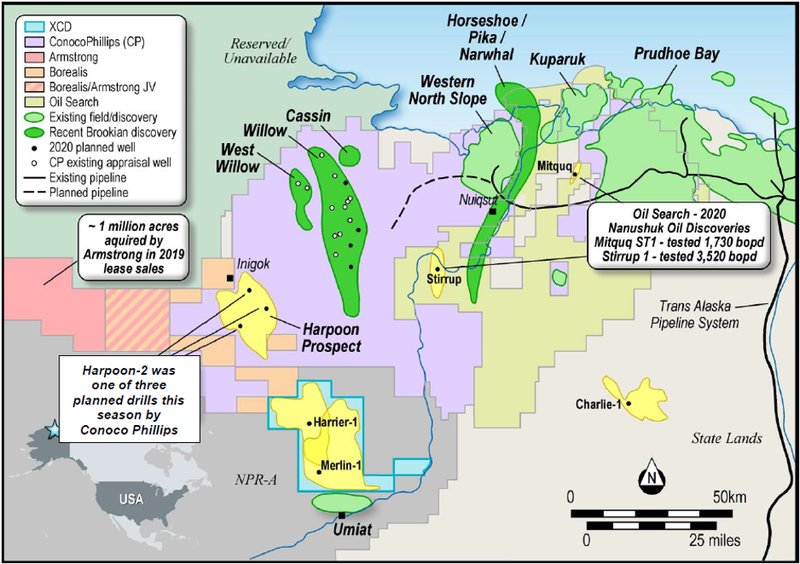

The prospective upside from this project is particularly enhanced by its location, as it is situated between major oil discoveries at Willow to the north and Umiat the south with the latter being one of Conoco Phillips’ (NYSE:COP) key assets in the region.

Willow considered a direct analogy to Merlin prospect

The Peregrine Project lies directly to the north of the Umiat oil accumulation that is estimated to have greater than 1.0 billion barrels of oil in place.

As indicated below (blue area), the Peregrine leases are also just 35 kilometres south of ConocoPhillips’ 450 to 800 million barrels of oil equivalent (MMBOE) Willow discovery.

Conoco has confirmed that it encountered hydrocarbons at its Harpoon prospect, which is interpreted to be directly on trend and analogous to the Harrier prospect at Peregrine.

The Willow oil discovery (750 million barrels) is considered a direct analogy to the Merlin prospect.

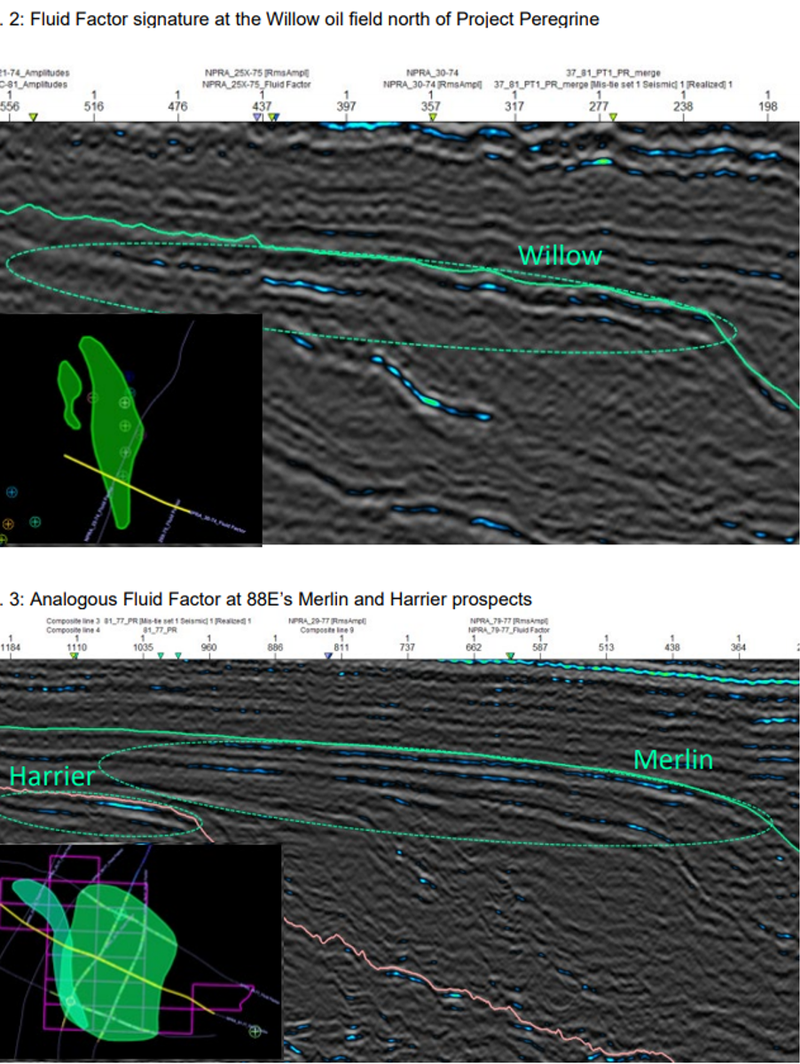

In its announcement released today, management said that seismic reprocessing work undertaken by 88E confirmed that the same shelf margins and geology extended from Willow south into the group’s acreage and analogous seismic signatures were evident at the discovered field and 88E’s prospects.

This was the basis for the mapping of the prospects and the independent resource estimate released in January 2020, which were subsequently updated in May 2020.

Following the reprocessing, amplitude vs offset studies (AVO) were also conducted and 88E has finalised its review of these products, with very encouraging results.

The studies were calibrated to the existing Willow oil field to determine if similar attributes (in addition to those observed on the reprocessed seismic) could also be observed at the Project Peregrine prospects, Merlin and Harrier.

As indicated below, the signatures observed, in particular for Fluid Factor, are very similar between the Willow oil field and the Merlin and Harrier prospects.

Adding further flavour to the story is the fact that the Harpoon prospect is just 15 kilometres north-west of project Peregrine’s lease position.

88E has identified two primary prospects, Merlin and Harrier that total over 1 billion barrels, targets that should be the subject of drilling in early 2021.

Conoco Harpoon-2 well de-risks Harrier ahead of low-cost drilling

Harrier has recently been de-risked by evidence of hydrocarbons at Conoco’s Harpoon-2 well.

88E will be undertaking low-cost options for well drilling, estimating that two wells are expected to cost US$15 million.

The Harrier-1 and Merlin-1 exploration wells will be drilled into the shallow Nanushuk reservoir using a lightweight workover rig that can be transported off-road in pieces by tundra-safe track vehicles, versus a heavier rotary rig which would require an ice road.

Existing gravel roads and snow trails will be used to conduct the entire exploration program.

Given both prospects are in the Nanushuk formation, the wells will only require drilling to about 5,000 feet to fully test, whereas a third prospect in the Peregrine block, Harrier Deep, has a Torok objective at about 10,000 feet.

Multiple parties interested in Project Peregrine

Harking back to today’s news, management said that the dataroom for the Project Peregrine farm-out has now been open for several weeks, with multiple parties at various stages of technical due diligence, several of whom are now progressing to commercial discussions.

88E is targeting close of a deal prior to year-end 2020.

Permitting and planning work related to drilling of up to two wells at Project Peregrine commencing in the March quarter of 2021 remains on schedule.

Commenting on the significance of these latest developments, managing director Dave Wall said, "The recent AVO work is highly encouraging and provides additional confidence in both the Merlin and Harrier prospects.

‘’Additionally, both planning and farm-out activity is progressing well towards the planned March quarter 2021 spud date, now less than 6 months’ away.”

Consequently, there are multiple potential share price catalysts on the horizon in the way of commercial transactions and drilling results, with success from adjacent players not to be discounted in terms of providing share price momentum.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.