Positive scoping study prompts Prospect Resources to fast track Arcadia development

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Emerging lithium producer, Prospect Resources (ASX:PSC) released the Scoping Study for its Arcadia project on Tuesday. This relates to the proposed development of the company’s lithium deposit in Zimbabwe.

Before we go too far, it should be noted that this project is located in a region which carries sovereign risk. As an early stage initiative operating in a high risk region where getting mining projects up and running is no simple feat, those considering this high risk stock as an investment should seek independent financial advice.

However, it needs to be borne in mind that the Scoping Study referred to in the report is based on low-level technical and economic assessments, and is insufficient to support estimation of ore reserves or to provide assurance of an economic development case at this stage. Consequently, the Scoping Study does not in any way provide certainty that the potential outcomes referred to in the report will be realised.

Management highlighted the fact that the potential quantity and grade stated by the exploration target is conceptual in nature and there has been insufficient exploration to estimate a mineral resource over the exploration target area and that it is uncertain if further exploration will result in the estimation of a mineral resource.

That said, to date PSC has consistently delivered quality exploration results featuring strong grades and the assumptions contained in the report appear consistent with current data.

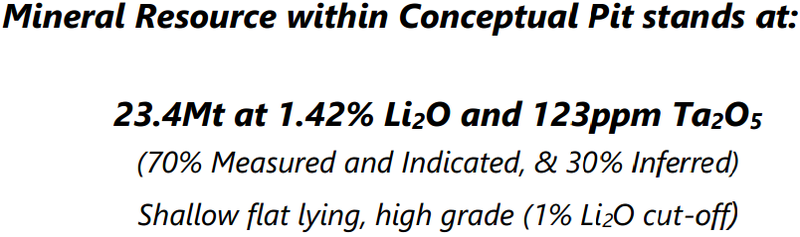

The headline numbers were as follows.

Crunching the numbers

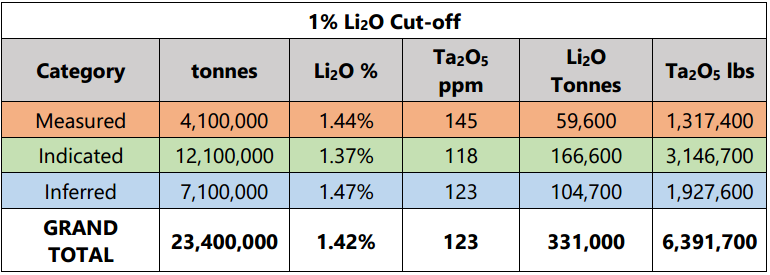

Looking at the key data within the Scoping Study, it implied a 70% increase in measured resources which conceptually speaking could support a mine life of between 15 years and 25 years.

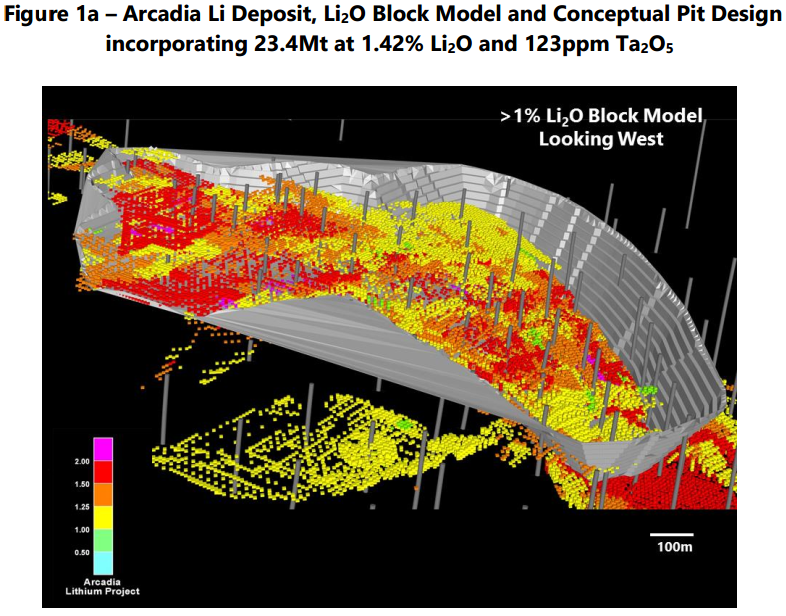

From a broader perspective, based on the geometries, thicknesses and depths to which the pegmatites have been modelled, plus their estimated grades, open pit mining would be the logical method being assessed during feasibility studies.

Those considering an investment in PSC shouldn’t base their decision on forward looking statements or forecast data. It should also be noted that as a company operating in Zimbabwe there is a degree of sovereign risk.

The conceptual pit design supports extraction of near surface, high grade lithium mineral resource of 23 million tonnes grading 1.42% lithium dioxide and 123 ppm Ta2O5 (tantalum pentoxide) with a low strip ratio, a factor that should work in the company’s favour when it moves to ascertain the economic development viability.

Material assumptions and modifying factors relating to the scoping study and in particular the conceptual pit process flow sheets and plant design have to date not incorporated the extraction of tantalum pentoxide and accordingly it is not considered a determining factor to the project’s viability.

However, if PSC were to facilitate the extraction of this product there is a good chance of the group finding a ready market for it given that it is used in the production of lithium tantalate single crystals.

From a commercial perspective the single crystals are cut into wafers and are used as a substrate for manufacturing surface acoustic wave filters (SAW filters).

These are used in mobile end devices such as smart phones Tablet PCs, ultrabooks, GPS applications and smart meters as they ensure precise frequency control as well as optimised selectivity and reduced distortion.

Production to start in 2017

The current mining plan envisages a series of open pits with production commencing from the first high-grade pit, anticipated to start in mid-2017 with the second larger pit coming into production thereafter.

This would be an impressive outcome at a time when many of PSC’s peers are a good way off first production. Early production would also work in favour of shareholders as near-term cash flow assists in meeting development costs.

Funding and offtake agreements

With regards to the broader funding scenario, management indicated it is looking at a mix of equity and debt with the prospect of pre-payments from offtake contracts hopefully limiting the degree of internal financing required.

One of the key near-term factors in terms of derisking the project will be the establishment of offtake arrangements. On this note, management said, “As the first ore delivery date becomes more certain, so can offtake discussions be completed”.

However, management did confirm that offtake arrangements are currently being discussed.

The company is of the view that Arcadia’s early production and near term delivery of lithium oxide concentrate will command a premium in today’s supply constrained environment.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.