PolarX confirms there is life on Mars

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

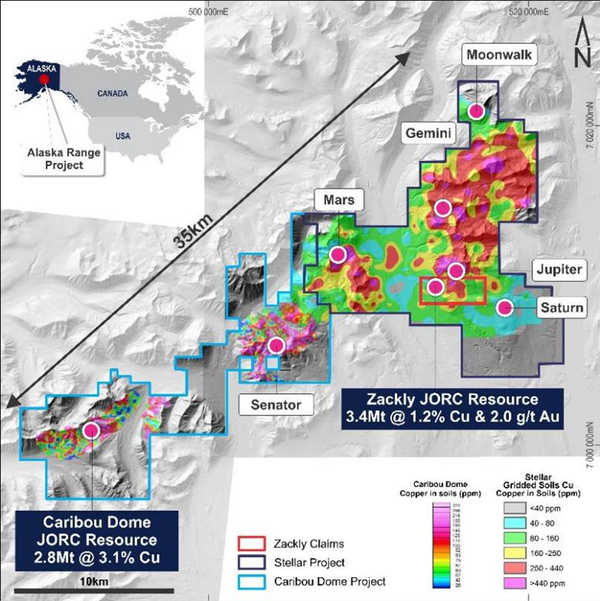

PolarX Limited (ASX:PXX) has provided a promising update on the single diamond drill hole completed into the Mars porphyry target within its Alaska Range Project.

With highly anticipated assay results due in November there is the prospect of PolarX experiencing further share price upside following last week’s robust gains.

The Mars porphyry target occurs in the Stellar Project, an area subject to the strategic partnership with global mining group, Lundin Mining Corporation.

Mars occurs at the western end of a 12 kilometre long mineralised corridor which also hosts the high‐grade Zackly copper-gold skarn and the Saturn porphyry target.

A single angled hole to a final down‐hole depth of 417 metres has been drilled into the Mars target by PolarX.

The hole was stopped whilst still in mineralisation in heavily broken ground which coincided with increasingly heavy snow falls necessitating the termination of the drilling program.

It was just at the start of October that Finfeed underlined the nature of a preliminary program of core drilling to evaluate Saturn and Mars, an initiative that was undertaken in August and September.

At that stage we noted that initial results of the core drilling program designed to evaluate the Saturn and Mars porphyry targets within its Alaska Range Project had provided evidence supporting management’s expectations that a deeper porphyry source may be present at the prospect.

Confidence increasing at Mars

While acknowledging at the start of October that further work needed to be done to combine a range of geological information to confirm current consensus of a deeper porphyry system, managing director Frazer Tabeart highlighted the significance of the upcoming developments in saying, “Visual confirmation of porphyry-style veins containing chalcopyrite and molybdenite in the first hole at Mars is extremely encouraging.

‘’Given the large size of the coincident copper-gold-molybdenum geochemical anomaly and the geophysical anomalies at Mars, this has the potential to be a very large mineralised system and clearly warrants considerable follow-up drilling.”

Speaking with greater confidence on Monday morning, Tabeart said, “Visual confirmation of even more intense porphyry‐style veining containing chalcopyrite and molybdenite from 321 metres to the end of the first hole at 417 metres depth at Mars is extremely promising.

‘’The 400 metres+ down‐hole thickness of mineralisation, the large size of the copper‐gold‐molybdenum surface geochemical and geophysical anomalies at Mars support our view that a very large mineralised system may be present.”

While further drilling is required to make definitive statements regarding the orebody, there are some important key takeaways to be noted that suggest PolarX may be onto something big.

Current data provides positive outlook

Firstly, mineralised porphyry‐style veins occur from within 6 metres of the surface to the end of the hole at 417 metres down‐hole depth.

Further, the veins cross‐cut highly magnetic andesitic lavas and diorite intrusions, strongly altered to chlorite, epidote and carbonate, locally with more intense sericite‐carbonate‐silica alteration.

Providing further confidence, the mineralisation intensity broadly increases with down-hole depth, but quite noticeably increases at 321 metres to the end of the hole with abundances of chalcopyrite visually estimated at between 0.5% and 2.0% within this interval.

Importantly, the mineralisation changes from pyrite dominated to chalcopyrite dominated with increasing depth down hole.

Taking these factors into account, there could be a continuation of last week’s positive share price activity, particularly given assays for base and precious metals are expected in November.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.