Pointerra proprietary geospatial technology sets the benchmark

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The share price of Pointerra (ASX:3DP) has surged in the last month, increasing 100% from 1.7 cents to yesterday’s closing price of 3 cents. However, as recently as Monday the company hit an all-time high of 3.9 cents.

Unlike the strong spike in the company’s share price which occurred under near-record volumes, the sell-off over the last few days has been under relatively small volumes, and arguably could be attributed to broader market weakness, particularly taking into account Wednesday’s All Ordinaries index decline of circa 80 points.

In 3DP’s case it is more relevant to focus on the solid newsflow in the last three months which has contributed to investor sentiment, but it is worth noting that the majority of the share price accretion has occurred just in recent weeks.

Of course it should be share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Knowing is one thing, understanding is another

This trend often prevails with stocks that are difficult to understand, and 3DP certainly fits this mould. However, this doesn’t detract from the company – it is merely a case of the group being an early mover in territory that, while being the way of the future, to some extent is still struggling to be understood.

This is particularly the case with 3DP as it is not just another player looking to cash in on the geospatial technology industry, it is breaking new ground in creating the software and hardware that will allow users of geospatial technology to operate more efficiently, maximising the advantages that the technology offers.

Consequently, while 3DP is at the cutting edge of unique technology, it has taken a few months for investors to understand the stock. It could be argued that this time lag provides a buying window for investigative investors who enjoy the challenge of tackling uncharted territory.

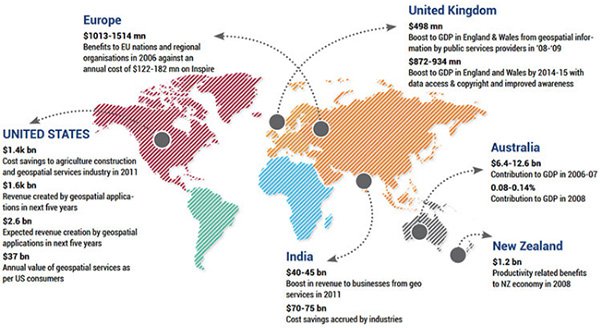

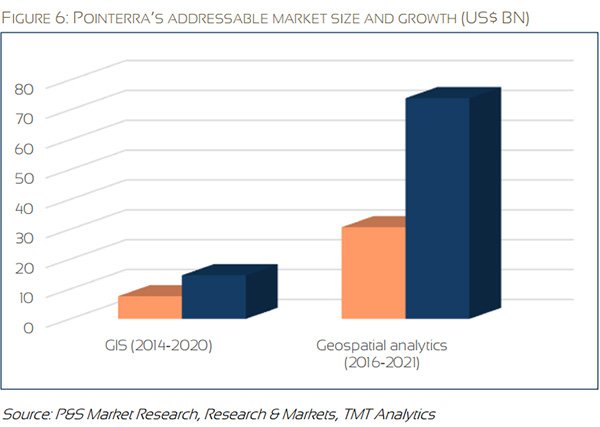

Looking specifically at end users of geospatial technology, it would have to be one of the fastest emerging market segments of the IT sector. As can be seen below, simply looking at the dollar value of various projects and the breadth of applications where the technology can be used speaks for itself.

Understanding geospatial technology and where 3DP fits in

A recent comprehensive report from TMT Analytics that was commissioned by 3DP provided investors with a better insight into the company’s technology, its business model and earnings profile. Aligning these three factors often provides the understanding required by the layperson to recognise a potential investment opportunity.

TMT analyst, Mark Kennis has provided insightful commentary on the company and as such Finfeed will look in part to quote directly from his research in order to accurately convey the story.

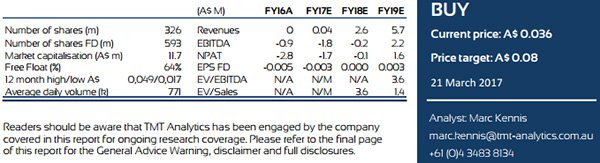

Kennis has a buy recommendation on the stock with a price target of 8 cents, representing a premium of 165% to yesterday’s closing price.

It is often difficult to find profitable small high-tech companies burdened by the costs involved in trying to make a mark in a new industry, while attempting to generate minimal revenues from a limited client base.

However, Kennis is of the view that 3DP can generate initial material revenues in fiscal 2018 and a maiden profit of $1.6 million in fiscal 2019 (see projections below) driven by year-on-year revenue growth of more than 100%.

Like past performance, broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

3DP assists enterprises in better managing files through smarter data handling

3DP makes 3D data files easier to manage through smarter data handling and encoding. Kennis explained that the company has also developed a novel way to render 3D data sets, enabling display on thin devices such as tablets and mobile phones (in addition to regular desk tops) making 3D images available on-the-go, suiting the likes of surveyors and field engineers.

The company’s proprietary compression techniques reduce a raw data file by

approximately 80% to 85%. This is done through a patent-pending methodology to partition

spatial data structures in such a way that they are more efficiently stored and retrieved.

Additionally, 3DP’s method enables faster access to 3D data while compressed (encoded) than other methods, enabling data manipulation in compressed form.

3DP also employs a 3D image rendering methodology that omits certain data points that may not be relevant for a user’s current view of a 3D image, but which need to be “on hand” in case the user changes perspective on his screen.

While existing 3D software works in a similar way, 3DP has taken this principle a step further, resulting in substantially faster 3D image rendering. This aspect of the company’s technology is also patent-pending.

Pointerra designed as a Cloud first solution running on Amazon web services

A crucial element of 3DP’s approach to 3D data management and processing is the Cloud-based design of the Pointerra platform. Rather than running a large and resource intensive computer program on a local desktop, Pointerra was designed to be a Cloud-first solution and runs on AWS (Amazon Web Services).

Kennis explains that the implications of this cloud-based design are far-reaching. As datasets get larger, the flexible AWS infrastructure allows 3DP to add more servers when needed. This enables parallel processing on AWS servers as opposed to sequential processing on desktop computers.

Regardless of the size of the data set, be it 10M points or 10BN, Pointerra is scalable with larger datasets. Kennis highlighted the fact that this is generally not possible with existing 3D software, such as AutoCad and MicroStation, which run on local desktops and are currently limited to processing approximately 40M points simultaneously.

Scalable platform allows 3DP to commercialise globally, targeting multiple industries

TMT believes the scalable platform aspect of Pointerra is extremely important as it enables

3DP to commercialize globally and through several different revenue channels.

However, it should be noted here that this company is still an early stage company and a speculative investment. Investors considering this stock for their portfolio should seek professional financial advice before making an investment decision.

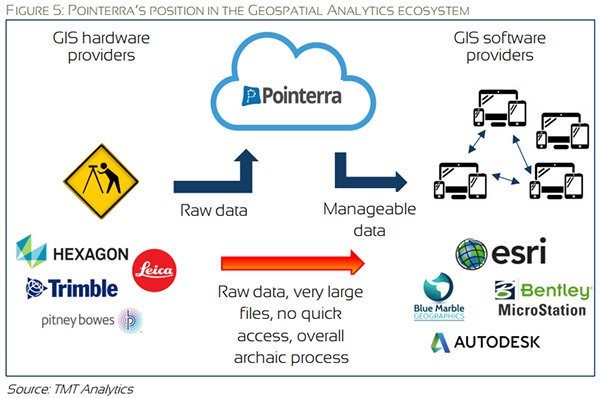

TMT made the point that 3DP doesn’t infringe on either the hardware or software side of the value chain, positioning it as a partner rather than a competitor in the Geospatial Analytics ecosystem.

This not only makes the company an early mover in a niche market, but from a longer term perspective, participants in adjacent sectors shouldn’t see adequate incentives to replicate 3DP’s technologies, rather they are more likely to outsource to the likes of 3DP.

On this note, Kennis said, “We believe 3DP’s unique, non-threatening position within the Geospatial Analytics industry potentially presents the company with an opportunity to become the de facto 3D data sharing standard in this industry”.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.