Pointerra flags milestone completions

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

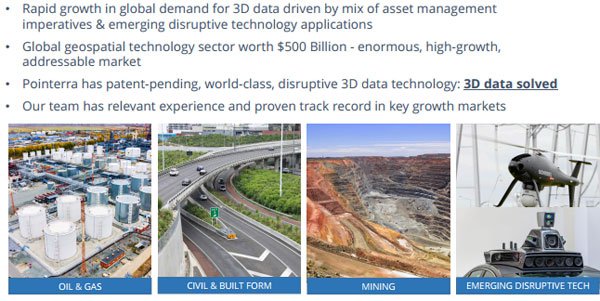

All the planets are aligning for 3D geospatial data technology group Pointerra (ASX:3DP) with important information coming to hand on Wednesday regarding technical and commercial milestones, progress with sales, important management appointments and robust support from existing shareholders.

With regard to technical and commercial milestones, 3DP has achieved a significant commercial milestone, with the release of a commercially saleable solution containing at least 100 billion points of 3D data.

This provides confirmation that the company’s world class technology has successfully passed the Class A Performance Share milestone hurdle, which as we discuss later is significant in terms of the conversion of Performance Shares into ordinary shares.

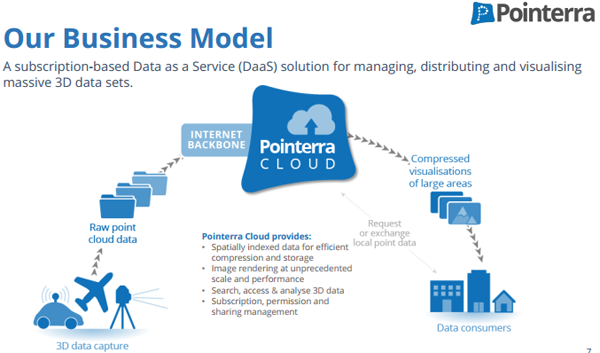

Through a combination of 3DP’s proprietary storage and visualisation technology and the massively scalable AWS cloud computing environment, the achievement of this milestone has allowed the company to begin scaling its Data as a Service (DaaS) offering to trial and paying customers.

This will also assist in attracting technology licensing opportunities with leading geospatial sector players such as the recently announced Memorandum of Understanding with AAM Group.

Of course, it is early stages with regards to this MoU and outcomes are yet to be determined, so investors should seek professional financial advice if considering this stock for your portfolio.

Exceptional technical progress made by 3DP, along with the establishment of valuable partnerships and the ever-changing dynamics within the core industry now sees trial users, paying customers, enterprise partners (and their customers) and technology licensing partners being able to rely on the company’s world first technology to deliver actionable 3D information to support a diverse range of digital asset management solutions.

As a result of these developments, 3DP is now poised to scale this capability to a global marketplace, and recent momentum has grown the group’s sales pipeline of DaaS trial and fee paying customers across multiple continents, necessitating the recruitment of additional sales resources to further grow the sales pipeline and turn trial users into full monthly recurring DaaS subscription customers.

As income from this source gains traction, in particular the level of recurring income, investors are likely to be attracted to 3DP’s business model due to its revenue visibility and performance predictability.

Corporate changes and conversion of milestone based Performance Shares

With an increasing focus on sales growth, 3DP announced that Non-Executive Director, Graham Griffiths will assume the role of Non-Executive Chairman effective July 1, 2017. The management restructure reflects the group’s evolution from a technology development company to a globally focused sales business, focused on leveraging the decades of international technology sales experience that Griffiths brings to the table.

In commenting on this development, Griffiths said, “Pointerra is at a pivotal point in its development, having established itself as a technology leader globally in a growth market with foundation indirect channel and technology partnerships in place and more under development”.

Griffiths highlighted that the customer value proposition is clear with the group having a proven technology leadership position to address the global market opportunity and a substantial sales pipeline.

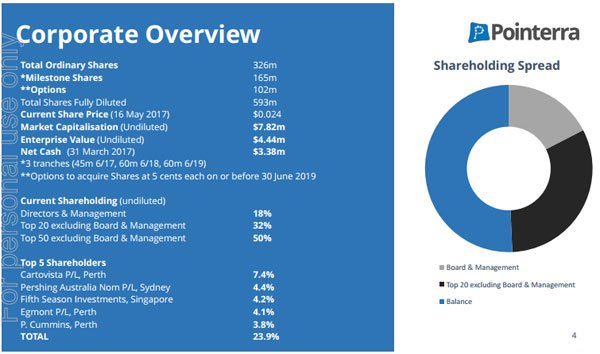

Having reached the commercial and technical milestones previously mentioned, the automatic conversion of 45 million Class A Performance Shares into ordinary shares has been triggered.

Importantly, the holders of approximately 52 million 12 month escrowed vendor ordinary shares and just over 120 million 12 month escrowed vendor class A, B and C Performance Shares have also voluntarily extended their escrow terms for a further 12 months commencing June 20, 2017.

This is clearly a vote of confidence in the company’s future, and importantly aligns management’s and major stakeholder’s interests with retail shareholders, a factor that has without doubt played a significant part in today’s substantial share price rerating.

The importance of this development is evident when examining the company’s shareholder distribution (see below) prior to the exercise of Performance Shares. Also note management’s substantial financial stake in the company.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.