Plymouth Minerals confirms presence of multiple potash beds at Banio project

Published 19-MAY-2017 16:19 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

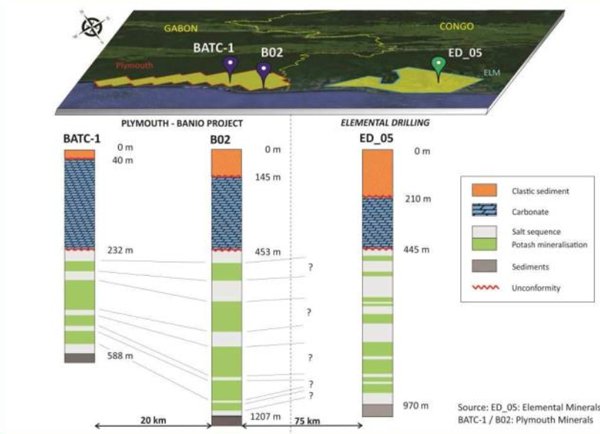

Plymouth Minerals (ASX: PLH) has completed the second Phase 1 drillhole (BA002) at its Banio Potash Project in Gabon. The company is targeting an area within the Gabon section of the Congo Basin, interpreted to be prospective for shallow sylvinite and carnallite. Results from the second hole have proved promising as they confirmed the presence of multiple potash beds.

As a backdrop, PLH owns 100% of the Banio and Mamana Potash Projects, which are targeting high-grade, shallow potash deposits that are favourably located on the coast of Gabon and on major transport river ways (barge) with direct access to export ports.

Banio has a multi-billion tonne Exploration Target of carnallite and sylvinite based on historical seismic and drilling data. The current drilling program aims to provide a more specific understanding of the size and geological characteristics of the sylvinite and carnallite mineralisation, as well as confirming current resource information and potentially expanding the resource.

Plymouth mobilised the exploration camp and drilling equipment in Q1 2016 and commenced drilling (BA001) as announced on 20 March 2017. The intersection of thick zones of potash mineralisation in this second hole supports management’s targeting philosophy.

It should be noted here that this is an early stage play operating in a high risk region. So investors should seek professional financial advice if considering this stock for their portfolio.

Geological logging in the second hole has confirmed the presence of multiple potash beds in close proximity to the top of the salt sequence. Significantly, at Kore Potash’s Sintoukola deposit, 85 kilometres to the south, these multiple beds are host to high grade sylvinite mineralisation as illustrated below.

Drillhole BA002 which was specifically designed to test for shallow wide zones of potash mineralisation, successfully intersected such mineralisation and was collared approximately 50 metres north of historical oil exploration drillhole BATC-01.

BA002 reached an end of hole depth of 516 metres. The drill core has been processed and samples dispatched to the laboratory for analysis. Integration of the results of the down hole data will assist PLH with confirmation of mineralisation and discrimination between the targeted sylvinite and carnallite mineralisation.

The potash mineralisation being targeted is interpreted to lie adjacent to a structural corridor trending broadly ESE-WNW within the Banio permit area, which coincides with the interpreted hinge line of the Gabon/Congo evaporite basin.

The boundaries of this corridor are interpreted to have been identified in BA001 and through further seismic data interpretation. With results from chemical analysis anticipated in June, there could be near-term share price catalysts for PLH.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.