PharmAust has success with gelatin encapsulated liquid monepantel

Published 04-NOV-2019 11:16 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Clinical stage oncology company, PharmAust Ltd (ASX:PAA) has provided recruitment guidance for its anti-cancer trialling goals with treatment naïve B cell lymphoma.

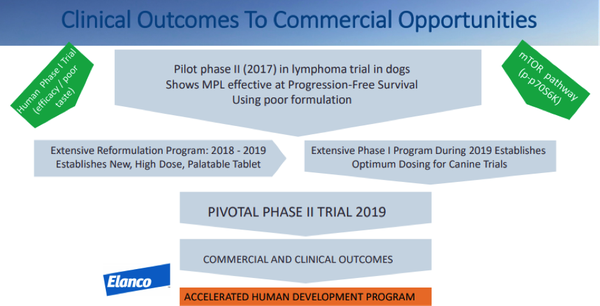

Previously, PharmAust demonstrated that six of seven dogs with treatment-naïve B cell lymphoma achieved stable disease, or progression free survival, with reductions in tumour size following 14 consecutive days of gelatin encapsulated liquid monepantel treatment.

PharmAust is now repeating this study with the newly developed high dose and highly palatable GMP monepantel tablet formulation.

This comes on the back of a busy period for PharmAust on the corporate front with the recent appointment of experienced pharmaceutical and healthcare executive Colin La Galia has joined Epichem, a wholly owned subsidiary of PharmAust, as its new chief executive officer

The company’s success has been reflected in its share price performance over the last six months as it increased from 3.3 cents to a 12 month high of 17 cents in September.

Weakness in broader equity markets appeared to be central to the retracement in October, but with the company trading in the vicinity of 10 cents, it is still up about 200% since May.

Funds raised to accelerate human clinical trials

PharmAust also raised $2.4 million in October through a placement at an offer price of 12 cents per share with a significant proportion of the proceeds be used to accelerate human clinical trials of Monepantel.

From a broader perspective, PharmAust specialises in repurposing marketed drugs lowering the risks and costs of development.

The group’s subsidiary, Epichem, is a successful contract medicinal chemistry company that is forecasting $4.2m revenues in FY2019/20.

As the company’s lead drug candidate, Monepantel is a novel, potent and safe inhibitor of the mTOR pathway – a key driver of cancer.

The drug has been evaluated in Phase 1 clinical trials in humans and dogs, and it was well tolerated, producing a significant reduction in key prognostic biomarkers.

PharmAust is uniquely positioned to commercialise Monepantel for treatment of human and veterinary cancers as it advances the drug in Phase 2 clinical trials.

Eligible dogs recruited from Sydney and Melbourne

A collaboration agreement between PharmAust and U-Vet in Werribee, whereby the University of Melbourne’s Department of Veterinary Clinical Sciences is the managing body, will assist in the recruitment of eligible dogs both from Melbourne and areas further afield.

All inventory, including antibodies and blood collection tubes have arrived on site.

A similar hub and spoke system is being employed in Sydney through the Animal Referral Hospital in Homebush, the body that conducted the previous trial using the gelatin encapsulated liquid capsules to successfully treat pet owners’ dogs with cancer.

Management hopes to replicate this type of system in other geographic areas, enabling local veterinarians to facilitate recruitment.

Trial data release will occur when a clear and meaningful trend becomes apparent and this will depend upon dog recruitment rates across the participating sites, highlighting the importance of scale in terms of the number of veterinary sites involved.

PharmAust anticipates an update to the market next month.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.