Pacifico seals the deal at Sorby Hills to become majority owner

Published 10-OCT-2018 10:19 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Pacifico Minerals Ltd (ASX:PMY) has finalised a Binding Terms Sheet with Quintana MH Holding Company LLC to obtain all of the shares in KBL Sorby Hills Pty Ltd and Sorby Management Pty Ltd.

KBL Sorby Hills Pty Ltd owns 75% of the Sorby Hills project with China’s largest lead smelting company and silver producer Henan Yuguang Gold & Lead Co. Ltd (“HYG”) owning the remaining 25%.

With all conditions precedent having now been satisfied or waived since the original agreement was struck in June, the acquisition has been completed.

This sees Pacifico as the majority owner of the largest undeveloped near surface lead-silver-zinc deposit in Australia on granted mining licenses with environmental approval in Western Australia.

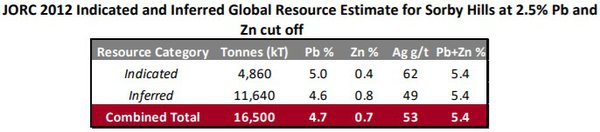

Importantly, the project has been significantly de-risked with extensive resources as outlined below and a prefeasibility study already undertaken.

It is worth noting that the ore is situated close to surface which could potentially provide Pacifico with a high margin operation.

Commenting on the company’s near term strategy, Pacifico’s Managing Director, Simon Noon said “The acquisition of Sorby Hills is an exciting step forward for Pacifico and provides us with a high-quality cornerstone asset.

“With the transaction now completed Pacifico will shortly commence extension and infill drilling at the project, aimed at significantly upgrading the Resource.

“The company looks forward to providing further details of the upcoming drilling program prior to commencement which is planned to take place in around two weeks.”

Of course any results from this program are speculative at this stage, so investors should seek professional financial advice if considering this stock for their portfolio.

Excellent infrastructure access

The project is only 50 kilometres by road from the mining hub of Kununurra.

Should the company move to production, there are established roads to transport concentrate via road train from the Sorby Hills site to the facilities at Wyndham Port, approximately 140 kilometres.

Operations will utilise existing port facilities, with no additional infrastructure required to enable shipping of concentrate.

Pacifico also has interests in Mexico where the company is advancing the Violin Gold-Copper Project located within the Guerrero Gold Belt.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.