Pacifico proving up economic viability of Sorby Hills

Published 14-FEB-2019 09:26 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Pacifico Minerals Ltd (ASX:PMY) has completed phase I of its infill drilling campaign at the Sorby Hills Lead Silver Zinc Project, and results from 34 of the 52 holes analysed feature promising grades.

In terms of ownership structure, Pacifico has a 75% interest in the joint venture with the remaining 25% held by Henan Yuguang Gold & Lead, the largest lead smelting company and silver producer in China.

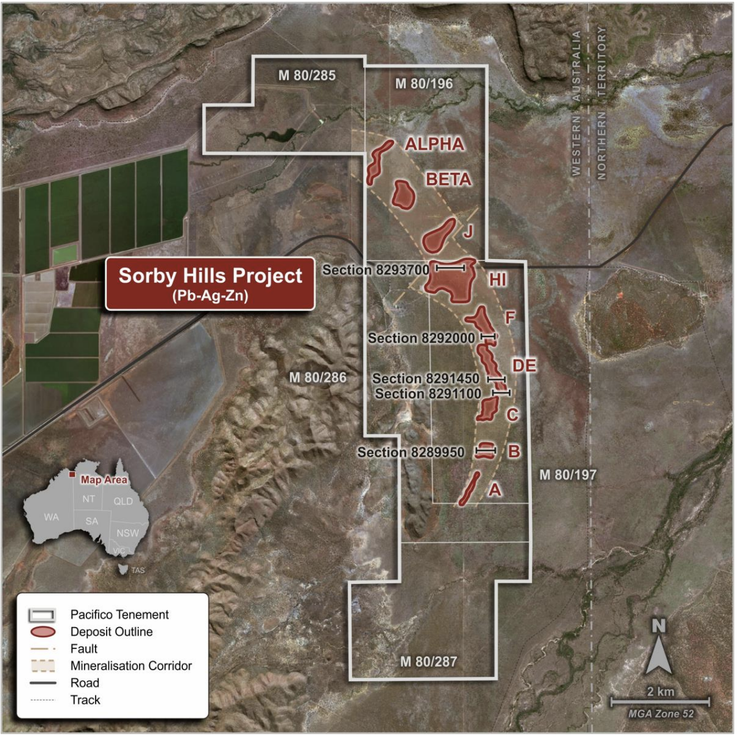

The Sorby Hills project which consists of a number of highly prospective targets is 50 kilometres north-east of Kununurra in Western Australia.

In discussing the merits of the Sorby Hills project, managing director Simon Noon said, “A combination of unique factors make Sorby Hills a potentially highly economic base metal deposit with shallow open-pittable mineralisation from 20 metres to 100 metres in depth, simple mineralogy allowing for low-cost beneficiation before plant treatment, robust metal recoveries, high silver credits and existing sealed roads to a nearby port”.

Updated Mineral Resource in mid-2019

Noon said that the updated Mineral Resource is expected to materially enhance the economics and confidence of an optimised prefeasibility study scheduled for mid-2019, following a second phase of drilling which should start in April.

Since taking control of the Sorby Hills Project, Pacifico’s focus has been on commercialising the project with an initial strategy of declaring a Maiden JORC Mineral Resource Estimate (MRE), increasing the confidence level of the MRE, and further optimising the project economics given recent advances in processing technologies.

As such, fresh drill core from this most recent campaign is being utilised to assess various density separation techniques designed to separate ore from waste rock to form a pre-concentrated product prior to further concentration via a lead flotation circuit, thereby significantly reducing capital and operating requirements.

Establishing an economically viable project will not only ensure that the project can proceed, but it will be crucial for Pacifico to attract partners to assist in funding.

Drilling strategy

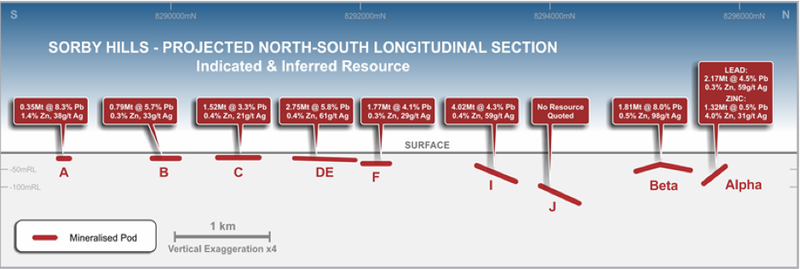

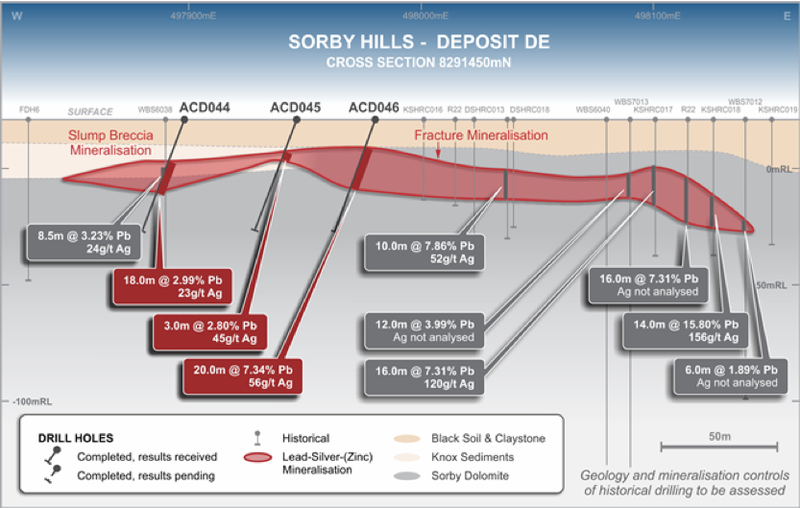

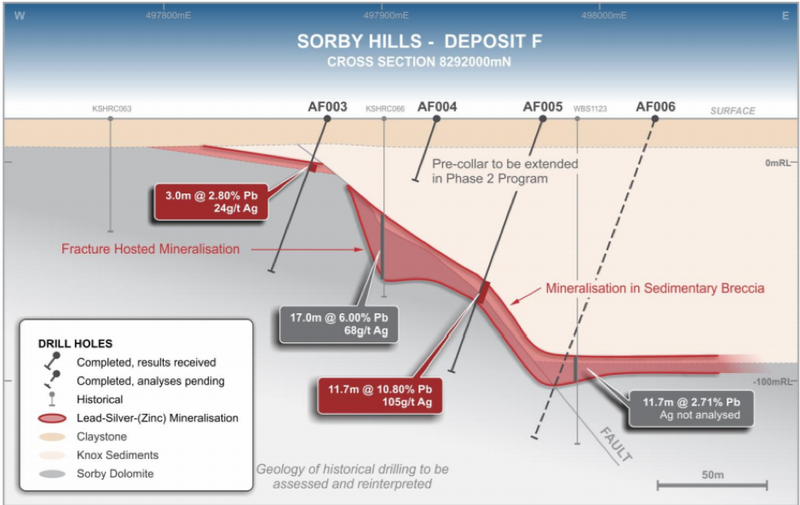

Geological logging and use of a portable XRF was used to confirm the project is a flat-lying sediment replacement deposit as indicated below.

Pacifico has carried out a systematic approach to increasing resource confidence by focusing on those areas of higher grade mineralisation and those closer to surface, thereby being more likely to deliver enhanced economics.

The latest drilling has served to confirm the geological continuity and increase the resource confidence of the deposit with material changes in the confidence of the global MRE expected 16.5 million tonnes at 6.0% lead equivalent.

The drilling campaign has clearly delineated between ore and waste and highlights the course grained nature of the galena which is favourable for pre-concentration prior to grinding and floatation.

Previous test work has shown that the ore can be gravity separated from the carbonate host “waste rock”.

Pacifico will undertake further variability test work to confirm the economic viability of various pre-concentration methods over the entire MRE, initiatives that will provide clarity and assist the company in definitively attributing a project valuation.

Drill results in isolation

As indicated in the image above, drilling zones progress from A to J, followed by Beta and Alpha.

Some of the standout individual results across the various zones included one of the most prominent from a thickness perspective, being DE deposit in drill hole ACD046.

The 20 metre intersection also featured a strong grade of 8.6% lead equivalent.

Drilling at deposit F included a section of 11 metres at 13.2% lead equivalent.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.