Online lessons sales strengthens Velpic’s revenue model

Published 02-NOV-2016 17:26 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Provider of cloud-based video e-learning, Velpic Group (ASX: VPC), announced on Tuesday that its online Lesson Marketplace product was live, a development which is important in terms of enhancing the company’s revenue model.

The product offers customers the ability to purchase ‘off-the shelf’ e-learning lessons on demand with VPC’s library currently offering a selection of more than 90 lessons.

Customers can purchase lessons from the company’s velpic.com website with pricing ranging between $1.05 and $15 per lesson charged on a per registered user basis.

The library is made up of lessons that have been sourced and licensed from leading e-learning creators including Learning Heroes. Content available is most relevant to small to medium size enterprises (SMEs), and it is pitched at the delivery of everyday essential learning tools rather than contributing to the attainment of qualifications.

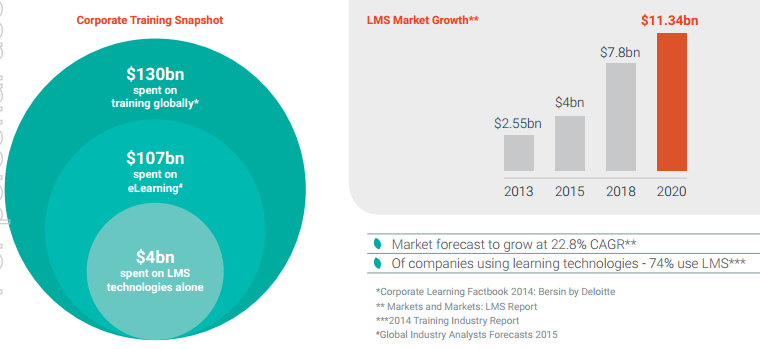

As indicated below, more than $100 billion annually is invested in upskilling employees through the global e-learning market.

VPC stands to generate income from a wide range of industries including human resources, environmental awareness, project management and consumer rights. This diversification along with the fact that it targets base skills provides insulation against cyclical movements across industries.

Looking at where this fits into VPCs broader strategy Chief Executive Russell Francis said, “In addition to building Velpic’s revenue model, the new Lesson Marketplace is expected to become a differentiator in the decision-making process of potential new customers with the expectation that more will convert to paying subscribing customers driving the company’s recurring SaaS revenue”.

It should be noted that Velpic is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

Francis also highlighted that the pay per seat licensing model has significant scalability potential. While this development appears to pave the way for future growth, potential investors should not make assumptions regarding such developments as they may not be achieved.

Those considering an investment in this stock should seek independent financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.