Offtake agreement to fund EUR’s Wolfsberg project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a major development for Austrian based emerging lithium producer, European Lithium Limited (ASX:EUR) has entered into an agreement with Shandong RuiFu Lithium Co., Ltd (Shandong) for the offtake of spodumene concentrates from its Wolfsberg project (Offtake Agreement) pursuant to a binding terms sheet (Terms Sheet).

In terms of the agreement, EUR will be supplying Shandong with up to 50,000 tonnes per annum of 6% spodumene concentrate produced at the company’s Wolfsberg project.

While pricing of the product hasn’t been agreed upon, there are some benchmarks that could be applied. Galaxy Resources (ASX:GXY) announced in December 2016 that its shipment of 120,000 tonnes of 6% lithium concentrate was priced at US$905 per tonne (FOB Esperance).

Conservative pricing implies annual revenues in excess of $40 million

However, this would appear to represent the sweet spot in the cycle. Analysts at Beer and Company Equity Research ran the ruler across Altura Mining (ASX: AGM) in February. The broker suggested that a conservative price out to 2021 would be US$650 per tonne with the possibility of a slight premium between 2017 and 2019.

Using US$650 per tonne as a long-term price which could be applied to the proposed EUR offtake agreement, this would equate to annual revenues of US$32.5 million, representing circa AU$44 million.

This is equivalent to approximately 80% of AJM’s projected 2017-18 revenues (as per Beer & Co forecasts), a company with a market capitalisation of circa $220 million. Given these metrics, it appears that EUR’s market capitalisation of $8 million doesn’t do justice to the revenue generating capacity of its assets.

However, using AJM as an example, one would expect a discounted market capitalisation. As at June 30, 2015 AJM’s market capitalisation was less than $20 million.

By June 30, 2016 it had increased more than ten-fold. Even using AJM as an example though, it could be argued that EUR’s market capitalisation is underdone given it has a relatively clear line of sight to development and the security of an offtake agreement which is also beneficial in terms of negotiating the financing stage of a project.

Early cash flow to assist in project development

In satisfaction of the terms of the agreement, Shandong will commence testing samples of Wolfsberg ore at its concentrate plant and a formal Offtake Agreement will be entered into within 90 days of signing the Terms Sheet.

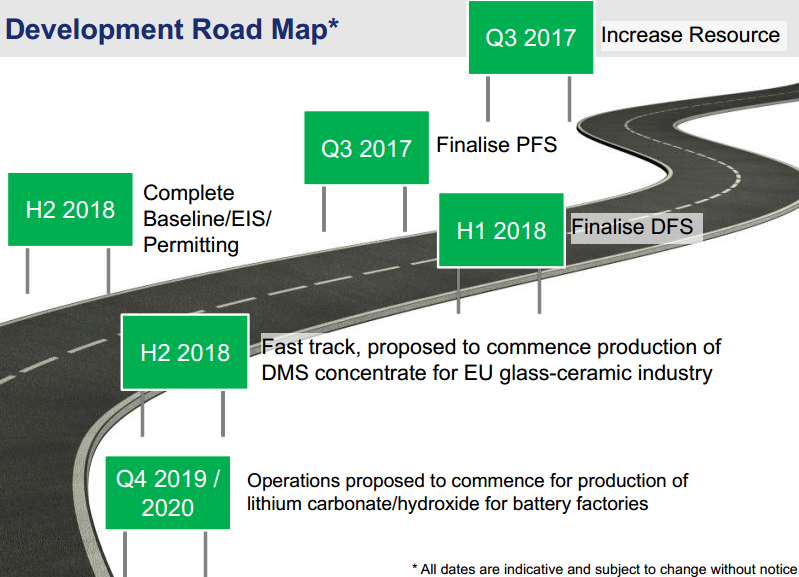

The generation of early revenues is extremely important for EUR in terms of funding the Wolfsburg project. As can be seen below, there are a number of relatively near-term milestones which will require capital investment, and to be able to partly fund those through material cash flows assists in derisking early stage development initiatives.

Shandong a major supplier of raw materials and products to Chinese battery industry

Having a high profile industry participant such as Shandong is a particularly positive development as it provides certainty around contract arrangements, and the fact that the company is a major supplier of lithium products and raw materials to the rapidly growing battery industry in China indicates that it will need substantial volumes of raw materials to meet demand from manufacturers.

Shandong has already flagged its anticipated need for lithium base products, having secured off-take agreements with Australian based, ASX listed lithium producers, Galaxy Resources and Pilbara Minerals.

Commenting on this development, EUR’s Chairman, Tony Sage, said “Securing a Chinese offtake partner for concentrate from Wolfsberg is a major milestone for the company, and early cash flows generated from concentrate sales will support the company’s strategy to fast track the development of Wolfsberg.”

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.