Norway fast tracks critical minerals push - KNI in the box seat

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,582,223 KNI at the time of publishing this article. The Company has been engaged by KNI to share our commentary on the progress of our Investment in KNI over time.

Norway - known for fjords, codfish, aurora borealis - and lots of North Sea oil.

Norway is an extremely wealthy country owing to its oil riches and smart investing via its $1.4 trillion Sovereign Wealth Fund.

The one thing they don't have yet is secure access to the critical minerals required for energy transformation.

Norway wants to change this, quickly.

In 2022 88% of cars sold in Norway were Electric Vehicles (EVs).

The broader EU is banning the sale of petrol and diesel cars by 2035 - so it makes sense that Norway wants to move fast here.

To get a hold of all the metals required to support the energy transition, overnight Norway unveiled its new critical minerals strategy.

Norway’s strategy is designed to speed up the development of critical minerals projects inside the country by:

- Unlocking big swathes of capital - Norway is considering a Norwegian state mineral fund, which could mobilise private capital too. Details are scarce right now, but we think this could potentially be similar in style to its US$1.4 trillion sovereign wealth fund. In May the French launched a €2BN investment fund for critical metals and the Germans are planning something similar. Norway can certainly bring its own capital to the EU table.

- Slashing red tape - Norway wants to fast track the processing of licence applications - to accelerate the extraction and production of Norwegian minerals.

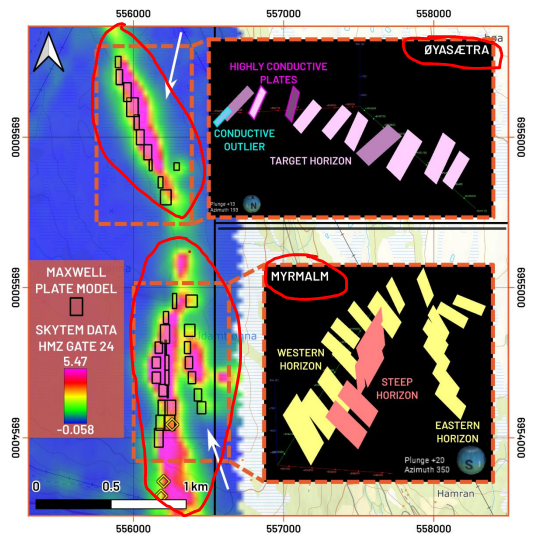

- More geophysical mapping - the government plans to conduct geophysical mapping across the country to incentivise more exploration. There’s nothing like a colourful blob to get a geologist excited for a discovery.

Norway’s strategic plans are in ADDITION to the EU’s Critical Raw Materials Act - which is aiming to have at least 10% of Europe's critical minerals produced inside the EU and at least ~40% processed inside the EU.

This is all good news for our Europe based exploration Investment Kuniko (ASX:KNI), which has a number of metals exploration projects in Norway.

KNI’s projects are targeting cobalt, nickel, and copper in Europe, and lithium in Canada.

KNI’s Norwegian exploration projects align with Norway’s critical minerals strategy - which provides support for an accelerated “discovery to development” process.

We Invested in KNI at the 20c IPO, and again at the most recent $1 placement.

It's been a fairly wild two years with KNI, with the share price peaking at $3.60 less than two weeks after its 20c IPO, during the peak of the raging bull market.

After a few exploration and drilling campaigns since listing, a big material discovery has eluded KNI so far - and the share price is now trading at 32c, almost back to the IPO price.

There are likely a few stale bulls on the KNI register who bought at higher prices than KNI is today. We think KNI has been subject to a fair bit of tax loss selling ahead of June 30th Australian end of financial year.

KNI currently has a ~$22M market cap, and had $4M in the bank at March 31st.

KNI has a very tight capital structure, with very few shares on issue, which sets the company up for success if it can kick a few goals.

Vulcan Energy Resources holds 20.4% of KNI shares.

Long term readers would remember Vulcan as one of our best ever investments. Vulcan’s second largest shareholder is Stellantis - one of the world’s largest automakers.

As for the rest of the top KNI holders, investors connected with KNI Chairman Gavin Rezos, hold another 6.2% of KNI shares.

As CEO or Chair, Rezos has transformed three startups that grew into ASX 300 companies - we are backing him to hopefully do the same for KNI.

Billionaire mining entrepreneur John Hancock is also a KNI shareholder.

KNI’s tight and sticky register means IF it can deliver some material exploration news, the KNI share price could move quickly - as we saw in the weeks after the company’s ASX IPO.

Over the last two years KNI has run a number of drill campaigns, progressed their projects, but hasn't managed to nail the big economic discovery YET.

Aided by the drilling data from its recent exploration programs, combined with ongoing exploration in the EU and at its new lithium projects in James Bay Canada (same region as $2.3BN Patriot Battery Metals), we think the company is honing in on a material discovery.

Over the next 6 months we are watching for newsflow across three key KNI exploration programs:

- Assay results from KNI’s recently completed drill program at its Norwegian copper projects.

- Geochemical sampling and target generation works across its Norwegian project portfolio.

- KNI’s planned rock chip sampling program at its James Bay lithium projects.

Given the breaking news overnight on Norway’s critical metals strategy, it's time we checked in with KNI.

Europe and Norway are desperate for critical minerals

The big news overnight was the launch of Norway’s critical minerals strategy.

If you want to read it in full, you’ll need to read Norwegian, or plug this document into a translator:

At a high level, the strategy builds on the recently released European Critical Raw Materials Act, with an obvious focus on the domestic critical minerals industry in Norway.

(Source)

The basis for the strategy document is that the world is reliant on China for supply of critical raw materials and that supply chains are fragile from a geopolitical perspective.

While the EU Act is focused on demand side incentives like aiming for ~40% of its critical raw materials to be processed inside the EU, the Norwegian strategy is focused more on incentivising a supply response from the mining industry.

(Source)

The primary supply side incentive is to fast track approvals for mining licence applications and to try and push the local mining industry to fast track exploration for critical minerals inside Norway.

The government also pledged to increase its own geological database with more geophysical mapping across Norway.

The major takeaway for us was also the discussions about the considerations being given to setting up a Norwegian state mineral fund - similar to the type of fund setup by the government with its oil industry.

For context - Norway’s sovereign wealth fund is one of the largest in the world and was set up off the back of the country's oil riches.

(Source)

If established, this would be the latest state funded investment vehicle chasing critical minerals projects inside the EU - in May the French Government talked up a plan to launch a €2 billion investment fund for critical metals.

(Source)

AND in April the German government also outlined a similar plan...

(Source)

All of these planned state backed funds sit on top of the existing EU Critical Raw Materials Act - which means there is a drive for coordination at the policy and fiscal level across the EU.

At a very high level it shows just how desperate the EU is to get its hands on critical minerals projects inside the EU.

At the moment the EU is almost solely reliant on China for imports of most of the critical raw materials used to produce Electric Vehicle (EV) batteries.

What does this mean for KNI?

KNI is well positioned to take advantage of the tidal wave of capital flowing into the EU critical minerals space.

The company is an early mover in Europe where junior exploration companies are few and far between.

With cornerstone backing from Vulcan Energy Resources and the team at Vulcan, we are hoping KNI is able to put itself into a position where the company is able to take one of its exploration projects and turn it into a development asset - just like Vulcan did with its lithium project in Germany.

Ultimately, KNI’s EU presence forms the basis for our Big Bet which is as follows:

Our KNI ‘Big Bet’

“To develop a sustainable battery metals mine within European borders that is of strategic importance - and hence highly valuable as an acquisition target.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our KNI Investment Memo.

For our summary of KNI’s progress over time and how today’s announcement contributes to our Big Bet see our KNI Progress Tracker:

KNI also exploring for lithium in James Bay Canada

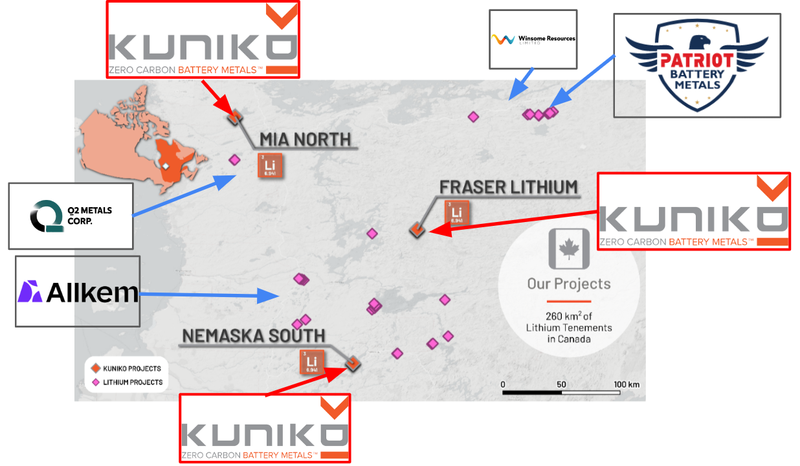

Below is a map of KNI’s James Bay lithium projects, with important lithium companies highlighted:

We covered the acquisition of these three projects in our recent note on KNI.

Here are KNI’s lithium projects, with key highlights:

Project #1 - Fraser Lithium Project

- 150 km2

- At least 30 mapped pegmatite outcrops

- In 2008 a pegmatite outcrop here was found to contain spodumene

- More mature, alternative style, granite hosted targets

Project #2: Mia North Lithium Project

- 80 km2

- Located in a prospective and largely unexplored greenstone belt

- Greenstones belts have played a role in a number of major lithium discoveries, both in the James Bay region and Australia - we see this as presenting more traditional targets

- 30 kms north of Q2 Metals’ Stellar project which has demonstrated spodumene pegmatite occurrences

Project #3: Nemaska South Lithium Project

- 44 km2

- At least 5 mapped pegmatite outcrops

- Also includes a greenstone belt

As of 9 March 2023, KNI had paid ~$710k in cash and shares to get access to the projects.

With “anniversary payments” of $1M kicking in 12 months from that date, this gives KNI roughly 9 more months to scope out the projects and start drilling.

If the projects look promising and high grade rock chips come back, KNI then can elect to proceed - or if not, it can drop the projects.

It’s essentially a ~$710k payment to see if the projects are any good - we think this is a good strategy.

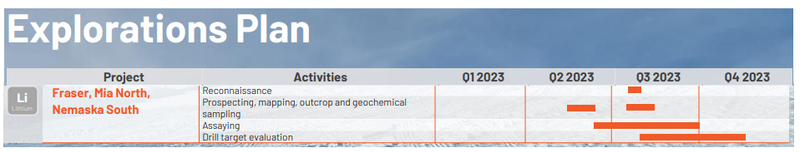

Exploration is happening in two stages, with sampling and analysis at Project #1 and Project #2, already completed.

The second stage will see the same activities completed at Project #3 during August.

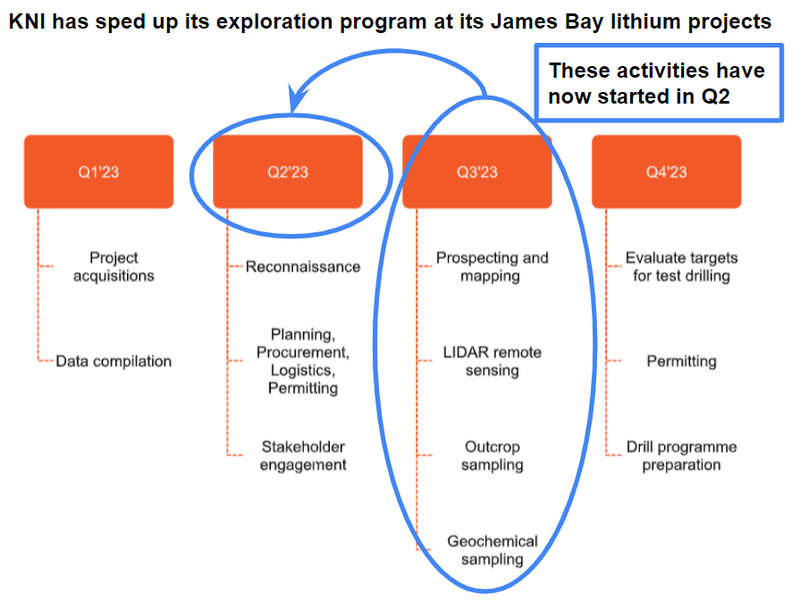

Below is the proposed timeline for exploration activities in James Bay, noting that recent Canadian wildfires could impact this schedule:

KNI previously said that despite those very nasty wildfires in Canada, KNI was able to complete a fieldwork at Project #1 and Project #2 on time.

A first pass at Project #3 will start in August.

Perhaps most importantly, “second stage exploration at the Fraser [Project #1] and Mia North [Project #2] projects is pending subject to assay results.”

This means we could get some rock chip assay results from these two projects in due course.

We see KNI’s Canadian lithium projects as a source of potentially outsized upside for the company, as it progresses its EU projects in parallel.

KNI’s latest batch of cobalt assays

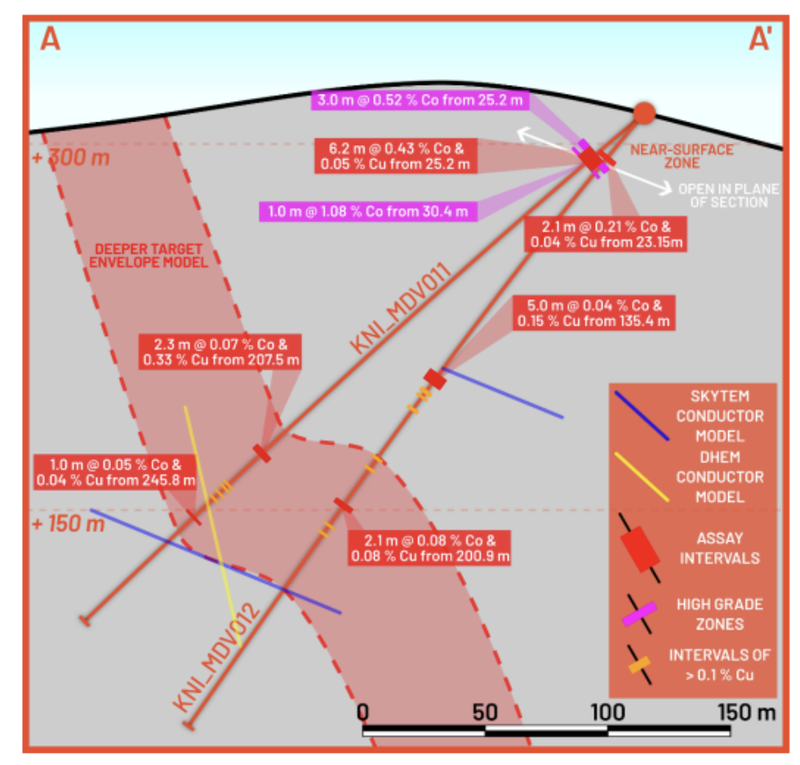

KNI released further assays from its Norwegian cobalt project on 31 May.

The new assays included:

- 2.1m @ 0.21 % Co from 23.2m

- 2.0m @ 0.08 % Co from 28.8m

Previously, KNI had hit an exceptional shallow area of mineralisation (6.2 m grading 0.43% cobalt from 25.2 m) and now has 520m of strike.

KNI is now working on the theory that intervals in the deeper mineralised zone (found in the initial assays) may be peripheral to a higher-grade "payshoot".

Below is the model KNI is now working with (blue and yellow lines are conductors):

While these assay results were a bit disappointing and didn't set the market alight, we think KNI has already shown that there is plenty of potential at its cobalt project and we are looking to see what further drilling may uncover.

New discoveries are rarely made off the back of one or two drill programs.

Typically companies will drill for years before making a large scale discovery that leads to a major re-rate in the company’s share price.

We have seen this happen with plenty of other Investments across our Portfolios.

We are long term Investors and will be backing KNI for multiple rounds of drilling.

Being inside the EU, IF KNI can deliver a discovery it will be in the right place at the right time which we hope leads to a larger re-rate to the upside in its share price.

What’s next for KNI?

Drill results from Norwegian projects 🔄

So far all of the assay results from 2 out of three of the projects drilled this year have been released.

We are now waiting for the final assay results from the company’s Undal-Nyberget copper project.

At its copper project, KNI is testing EM targets where the company has never drilled.

KNI had planned to drill eight drillholes across the two targets.

At this stage we view this drill program as a free option on a discovery and so our expectations are as follows:

- Bullish case = KNI hit copper mineralisation from one of the two geophysical conductors.

- Bearish case = Drilling returns no significant mineralisation.

Fieldwork across Norwegian projects 🔄

After the assays from the company’s copper projects, the focus for KNI will be on fieldwork to define new drill targets.

At a high level, the company will take all of the data from this year's drilling and then look to run geophysical surveys/rock chip sampling programs to define high priority drill targets.

We expect this work to start next quarter.

Rock chip sampling across Canadian lithium projects 🔄

We are conscious of the fires in Canada right now which have affected another one of our Investments exploration timelines so there is a risk KNI’s program gets delayed.

KNI did however confirm in a recent announcement that the fires wouldnt impact its exploration timeline, see that announcement here.

(Source)

Our KNI Investment Memo

Below is our KNI Investment Memo, where you can find a short, high level summary of our reasons for Investing including the following:

- Key objectives for KNI for the coming year

- Why we are Invested in KNI

- The key risks to our Investment thesis

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.