Navarre to acquire complementary gold project in Ballarat region

Published 09-JUN-2020 12:40 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

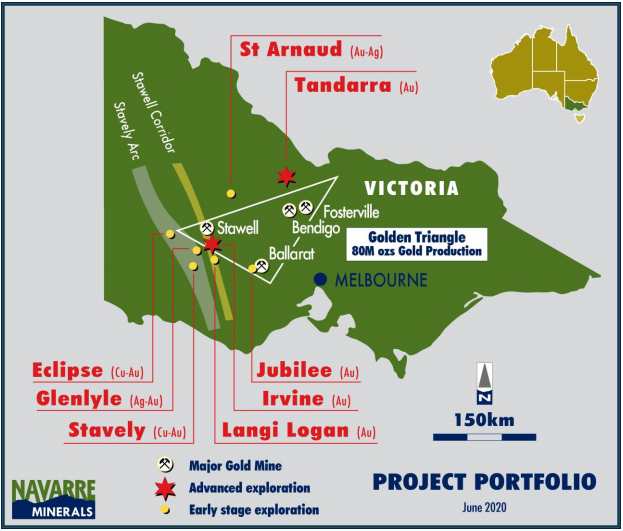

Navarre Minerals Limited (ASX:NML) has completed an Asset Sale Agreement to acquire 100% of the Jubilee Gold Project, a complementary and strategic high-grade gold exploration licence, 25 kilometres southwest of Ballarat, and to the south of the company’s existing projects.

The Jubilee Gold Project includes the historical 620 metre deep Jubilee Gold Mine (mined 1887 – 1913) that produced approximately 130,000 ounces of gold at a recovered grade of around 12 g/t gold from a single east-west trending quartz reef.

Since the mine's closure in 1913, there have been no reported modern attempts at sustained exploration, and no drilling has occurred.

The property is located within a highly prospective and prolific mining district in close proximity to a significant operating gold mine and processing facility within the historical 12 million-ounce Ballarat Goldfield.

This acquisition represents an extremely promising and complementary opportunity in light of the company’s other gold assets in Victoria, as indicated below.

Only 25 km from processing facility and mine infrastructure

Commenting on this development, Navarre’s managing director Geoff McDermott said, “We are extremely pleased to add this property to our gold portfolio.

‘’While the focus of Navarre is the ongoing diamond drilling program at Resolution Lode within the Stawell Corridor Gold Project, the acquisition of a highly prospective gold tenement within close trucking distance of an operating 12 million ounce goldfield is a significant step forward.

“This outstanding exploration property has a history of delivering relatively uniform and continuous high-grade gold mineralisation from within quartz lode structures, all just 25 kilometres from a significant processing facility and mine infrastructure.

‘’The existence of transverse quartz reefs represents a rare opportunity for exploration as these structures have never been drill tested.’’

Navarre will commence exploration immediately and will look to add extra geological resources to manage the additional workload.

A systematic exploration program will target extensions and repetitions of the historically mined quartz reefs, and it anticipates drill testing towards the end of the year.

Recent soil samples have identified several other prospect areas on the tenement which will also be targeted during the coming drilling season.

Navarre is presently compiling and reviewing historical reports and datasets prior to commencing a first-pass field evaluation program.

In 2020, the company will conduct detailed mapping, computer modelling and surveying of geology and historical mine workings.

Management will also address the issues of planning and regulatory approvals for initial drilling programs.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.