Mustang releases “outstanding” results from graphite-vanadium play

Published 25-JUN-2018 14:05 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Mustang Resources Ltd (ASX:MUS) has today announced positive results from further graphite metallurgical testwork at its Caula Graphite-Vanadium Project in Mozambique.

The company consider the results of the metallurgical tests to be genuinely outstanding, having delivered a significant increase in flake size and a reduction in the costs of processing reagents.

The tests were conducted on samples of oxide, transition and fresh material taken from the area of Caula drilled in 2017.

Results of this calibre act as further indication that the Caula Project has considerable potential as a low-cost supplier to the expandable graphite and lithium battery industries. As such, the results will be incorporated into the company’s Scoping Study, which is well underway.

Mustang Managing Director Dr Bernard Olivier said of the results, “These metallurgical results are outstanding and provide further evidence of the exceptional quality of the graphite at Caula.

“We managed to achieve an extraordinary 27% increase in the cumulative proportion of large to super jumbo flakes (>180μm) while maintaining our exceptional concentrate grade of 97%. The large to super jumbo flake-sizes in the fresh zone increased from 55% to 68% while the cumulative oxide zone increased from 44% to 60%.”

MUS’s Caula Project is unique due to its high-grade, shallow mineralisation combined with the potential for excellent recovery rates, as demonstrated by today’s results. In addition, Caula contains top graphite concentrate flake-size distribution and purity, and is located along strike from Syrah Resources’ (ASX:SYR) world-class Balama graphite project in Mozambique.

It should be noted it is still early stages here, so investors should seek professional financial advice if considering this stock for their portfolio.

Test work results in more detail

The latest test work flowsheet created by MUS was a modification of a similar flowsheet it used previously.

By graphite industry standards this latest flowsheet is remarkably simple, and has also been extended to allow integrated extraction of both graphite and vanadium from the same feed material.

MUS expects to release results in the not too distant future regarding the initial vanadium concentration work it is currently undertaking.

In addition to other improvements to the flowsheet, a simpler and lower cost reagent scheme was used in the current test work. The new reagent scheme will cost less than half that used in the test work for the company’s 17 December announcement, further adding value to the project.

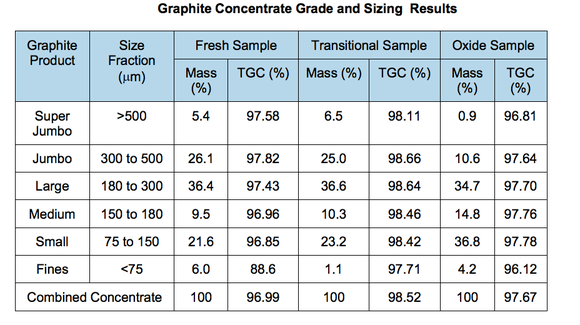

The below table shows the graphite concentrate grade and sizing results from the company’s latest round of test work:

MUS stated that it greatly welcomes the prospect of developing a low-cost high-grade graphite product, with the high head-grade and simplified flowsheet presenting even more substantiation for its Scoping Study set to be completed in the third quarter.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.