Morgans sees Regis Healthcare as oversold

Published 09-SEP-2016 11:58 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Scott Power from Morgans CIMB sees recent share price weakness in Regis Healthcare (ASX: REG) as presenting a buying opportunity. The company’s shares have been sold down substantially over the last few months as a result of uncertainty within the age care services industry.

Since the start of August the company’s share price has slumped from $5.25 to hit an all-time low of $3.45 last week before staging a recovery in recent days. Thursday’s closing price of $3.91 represents a sizeable discount to Powers’ price target of $5.13.

It should be noted that analyst’s forecasts and price targets may not necessarily be met. Similarly, historical trading patterns should not be used as the basis for an investment decision as these may not be replicated in the future.

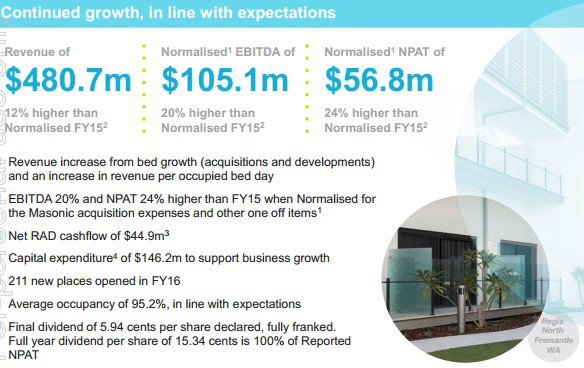

The company’s fiscal 2016 performance was impressive having grown net profit by 24%, opened up 211 new places during the period and achieved an average occupancy rate of 95.2%.

Fundamentally, the company is starting to look cheap, trading on a PE multiple of circa 18 relative to Powers’ fiscal 2017 forecasts. He is projecting compound annual earnings per share growth of approximately 27% between fiscal years 2016 and 2018.

This represents superior growth to most of the group’s peers and it is worth noting that the industry group average PE multiple based on fiscal 2017 forecasts is 28.5.

In terms of the industry environment, Powers noted that the Department of Health has provided more clarity over the charging for additional care and services in residential aged care, including capital refurbishment type fees.

It was uncertainty regarding this issue that largely impacted sentiment towards the sector in recent months.

Recent commentary from the Department of Health indicated that it considers capital refurbishment fees, asset replacement contributions and similar fees would not be supported by the legislation where the fee does not provide a direct benefit to the individual or the resident cannot take up or make use of the services, or where the activities or services subject to the fee are part of the normal operations of an aged care home and fall within the scope of specified care and services.

Powers noted that there appears to be poor communication between the government and the operators and that unconfirmed news indicates that the government may look to review the cuts that had been flagged, a development that would restore faith in the sector.

Consequently, he has not made any changes to fiscal 2017 and 2018 forecasts, but taken on a more conservative stance regarding fiscal 2019 forecasts should changes be introduced. This indicates that there is near-term earnings reliability, suggesting that the extent of the sell-off is unwarranted.

Powers summed up his stance on the overall sector saying, “We believe the underlying demand for aged places remains strong and we believe a sensible compromise will be reached between the government wanting to curtail the growth rate of expenditure and the operators who are facing residents entering their facilities with higher levels of acuity”.

From an operational perspective, fiscal 2016 yielded some promising developments, particularly in relation to the acquisition of Masonic Care Queensland which effectively added 711 operational places, increasing the group’s portfolio by 14%.

Management recently reaffirmed that the acquisition was on track to be earnings per share accretive in fiscal 2017, with the expectation that it will boost EBITDA by as much as $12 million.

Regis offers strong geographic diversification with operations in all states and territories except for Tasmania and the Australian Capital Territory. The table below demonstrates the pipeline of projects that should underpin robust growth over the next three years.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.