MNB Signs Offtake MoU for 66% of Stage 1 Phosphate Production

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 8,645,000 MNB shares at the time of publishing this article. The Company has been engaged by MNB to share our commentary on the progress of our Investment in MNB over time.

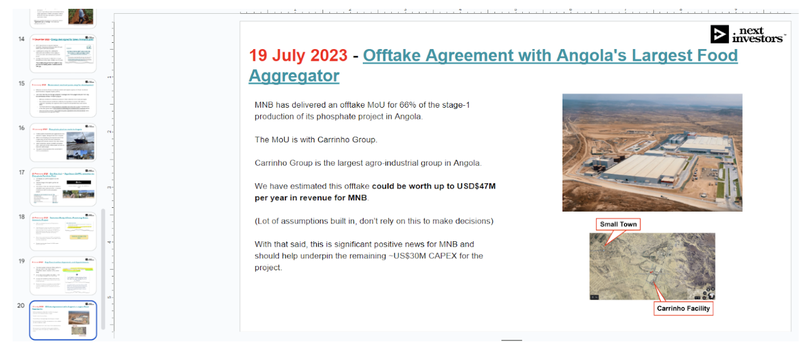

Minbos Resources (ASX:MNB) has just delivered an offtake MoU for 66% of the stage-1 production of its phosphate project in Angola.

The buyer is Angola’s largest food aggregator.

The fertiliser supply agreement is for up to 869,000 tonnes of Cabinda Phosphate rock over the first 7 years of production (to 2030).

The first supply is due for the 2023/24 planting season.

The pricing mechanism is in line with the previously released Definitive Feasibility Study, pegging the relative agronomic effect of MNB’s fertiliser to the price of Triple Super Phosphate.

We have estimated this offtake could be worth up to USD$47M per year in revenue for MNB.

However - there’s a number of assumptions made to arrive at that headline number, many of which can vary significantly. We will dive deeper into our calculations and assumptions made further down...

Offtake deals are when a customer pre-commits to buying the future production of a mining project.

They are always a great validation that a project is on the right track.

Not only do investors like offtake deals, financiers like to see them too, as it reduces the risk of putting capital into a project for something nobody wants.

MNB said this offtake deal was on the cards last month, which we also flagged to readers - and today it happened.

The offtake Memorandum of Understanding (MoU) announced today is with “Carrinho Group” - the largest agro-industrial group in Angola.

In Angola, Carrinho Group is ubiquitous, trusted and a company that operates at massive scale.

This MoU - to be later formalised into a formal offtake and distribution agreement - paves the way for MNB to quickly get its phosphate product into the hands of buyers and end users.

MNB is our 2022 Wise-Owl Pick of the Year, and we are long term Investors in the company.

Here is our quick take on the MoU:

- Carrinho will buy 869,000 tonnes of Phosphate Rock over the first 7 years, representing 66% of Stage 1 production.

- Carrinho Group has the resources, infrastructure and networks to reach millions of freehold (small scale) farmers in Angola, and MNB only has to sell to one supplier - Carrinho Group.

- The price is pegged to Triple Super Phosphate, which tends to sell higher than Phosphate Rock.

- There is still 34% production that MNB can sell, potentially to large scale farms. On this front, MNB recently hired Rob Newbold to head up sales and marketing in Angola. Newbold has previous management and marketing experience at $5BN capped Incitec Pivot (major fertiliser company) and $2BN capped Nufarm, a major ASX listed agricultural chemical company.

- 100% of Stage 2 production for “yellow phosphorus” (which is ideal for LFP battery chemistry) is yet to be sold.

- Stage 1 production slated for 2023/24 planting season, meaning sales should be coming soon.

How much could it mean to MNB?

As we hinted above, we have done some back of the napkin calculations on what this deal might be worth to MNB.

We have run some numbers that demonstrate that it could be in the region of USD$47M per year.

There's a number of assumptions made here, and we should preface all this by saying that commodity pricing is highly volatile and difficult to predict.

Obviously, do not rely solely on any of this information to make an investment decision.

Our assumptions made in arriving at the above rough estimate are based on the DFS:

- Price of Triple Super Phosphate: US$422 per tonne, based on the DFS base case TSP price (revenue assumptions are sensitive to this pricing - both up and down).

- Production spread evenly each year (in reality production is likely to start slow and ramp up over time).

- Relative agronomic effect of 90% of compared to MAP fertiliser (in line with results from the field trials recorded in the DFS).

Again - these assumptions should not be relied upon to make investment decisions.

That TSP price is always changing, and it can be volatile. Pricing is driven by global market forces, and out of the direct control of MNB. Additionally, the agronomic effect of MNB’s product could change.

With that said, the US$47M number we’ve put up here (based on 66% of Stage 1 production) is reasonably close to the projected average annual revenue of US$70M in the DFS (total revenues of US$1.4BN divided by 20 year mine life):

(Source)

The key will now be securing the rest of the CAPEX funding...

In the March quarterly report, MNB confirmed that the remaining CAPEX for the project was ~US$30M.

That quarterly also outlined how MNB is seeking non-dilutive funding i.e debt, with “with several parties being engaged.”

Construction is already underway and the DFS announcement said that the first bag of fertiliser is expected to be produced by Q4 this year.

While this could change, it’s clear to us that MNB is moving quickly towards first production.

MNB has already released photos showing site clearing and fencing works underway, which were completed last month:

We are looking forward to getting more updates re: the reminder of CAPEX funding, and will also be keeping an eye out for the June quarterly report which will be due by the end of this month.

More on today’s offtake deal - who is Carrinho Group?

We’ve been to Angola to visit the MNB project - and we that experience underlined how important this offtake agreement is to MNB’s future prospects.

With this agreement, MNB can lock away sales for 66% of the Stage 1 production with the most well resourced agro-industry company in Angola.

The Carrinho Group has 17 food processing factories in Benguela (a town in Angola), processing rice, wheat, corn, pasta, biscuits... the list goes on.

The company also has a fleet of trucks and other transport means to move over 1.4 million tonnes of load throughout the sub-Sahara of Africa.

And strong relationships with farmers, food distributors, local partners and more...

What they don’t have is a fit-for-purpose fertiliser product for the Angolan climate that can drastically improve crop yields and can be bought locally (without the need to pay expensive import taxes for fertiliser from overseas).

That’s where MNB comes in.

MNB has today signed an MoU with the Carrinho Group to supply up to 869,000 tonnes of Cabinda Phosphate rock over the first 7 years of production (to 2030).

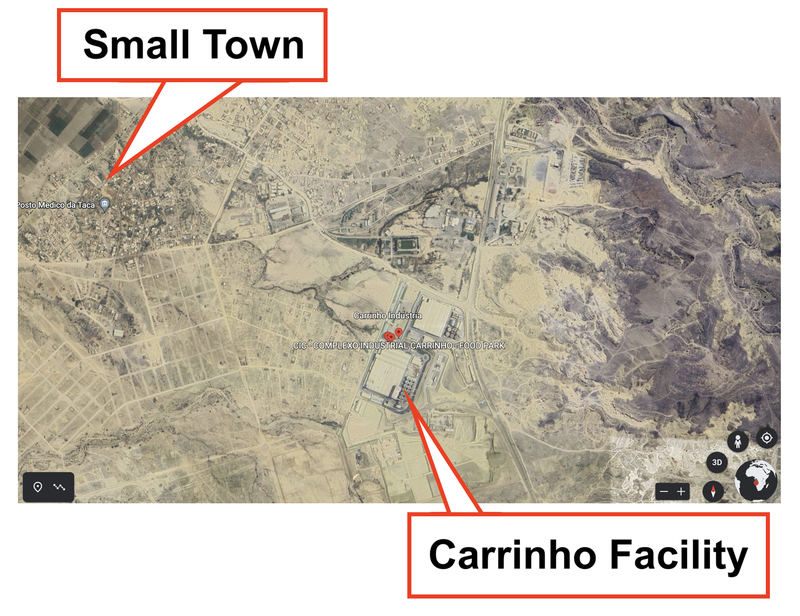

Here is a photo of a Carrinho Group food storage facility that we drove past in Benguela, and this is just one of multiple facilities that the company owns in the area.

This facility is massive.

Here is how they look on Google Earth:

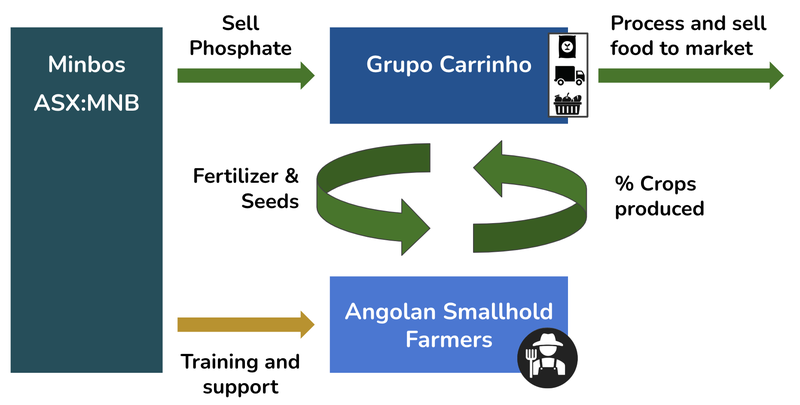

The Carrinho Group is an Angolan private company, developing a vertically integrated supply chain in the Angolan food and agriculture industry.

Carrinho has relationships with the millions of smallhold farmers in Angola that will soon (hopefully) use MNB’s fertiliser to grow crops.

MNB can tap into the in-built distribution networks that Carrinho has cultivated, in particular transport across the country, and relationships with farmers to train and support the agricultural industry.

This is how we see the relationship working:

During our journey we drove past many small farming villages that were doing the exact type of farming that Carrinho Group has relationships with.

If MNB is able to get its product into the hands of these small hold farmers, it will significantly increase the crop yields and food availability in the country.

The ultimate goal is to turn Angola into the agricultural centre of Africa, and we think that the partnership with Carrinho is a big step towards this goal.

Why MNB’s project is of national importance to Angola

Angola has 35 million hectares of arable land of which only 10% is cultivated.

Today’s offtake deal comes at an important time, as Angola is making a concerted effort to reduce its reliance on the oil and gas industry by diversifying into agricultural products and mining (including battery materials).

There is a massive opportunity for the country to grow its agricultural footprint and diversify its key industries beyond oil and gas.

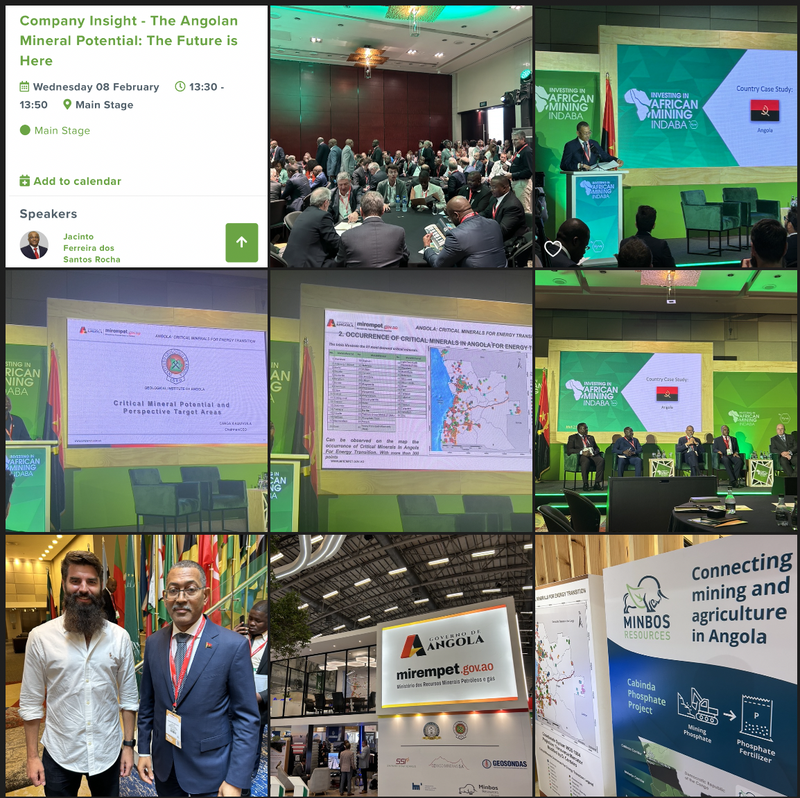

Listening to the Angolan Minister of Mineral Resources at Mining Indaba earlier this year we heard first hand about the importance of growing both the mining and agricultural industries in the region.

Angola is a relatively young country, but it is clear from some of the developments (in particular the new Lobito Corridor that the US government will put US$250M towards) that it is a strategic region in Africa.

As we noted above, the ultimate goal is to turn Angola into the agricultural centre of Africa.

Food security has become more prominent in the headlines of late, with the ongoing conflict in Ukraine continuing to have repercussions across the agricultural supply chain:

(Source)

Closer to home, Nigeria has declared a state of emergency as food prices surge for the country.

(Source)

We see MNB as playing a critical role in addressing food security in southern Africa - and given that Carrinho Group is now signed up for 66% of Stage 1 production, we expect this to have a very positive impact on MNB’s ability to secure debt financing for the remainder of the CAPEX to build the project.

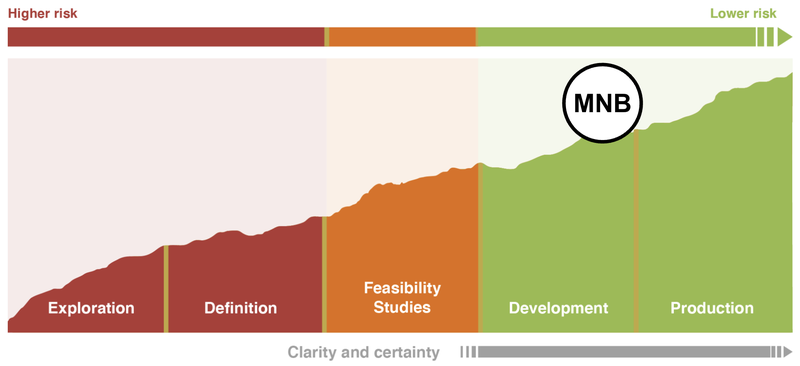

We Invested in MNB to see it get into production - which is the next step on the mining life cycle chart below, and we think the company is very close to making that a reality:

By moving into profitable production we hope that this ultimately contributes to our MNB Big Bet:

Our MNB Big Bet:

“MNB delivers a 10x return by building a profitable phosphate project AND progressing its green ammonia project to construction phase.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our MNB Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress MNB has made since we first Invested and how the company is doing relative to our “Big Bet”, we maintain the following MNB “Progress Tracker":

What’s next for MNB’s fertiliser project?

🔄 Funding for the remainder of CAPEX on the project

Previously, MNB confirmed that progress was being made on non-dilutionary funding (debt and/or prepayment) for most of the remaining project CAPEX.

In the March quarterly report MNB confirmed that the remaining CAPEX for the project was ~US$30M.

MNB expects this to be finalised in August/September.

🔄 First production

While MNB’s primary focus is for now on the phosphate project, we are also looking for the following key bits of news flow on its green ammonia project as well...

What’s next for MNB’s green ammonia project?

🔄 Pre Feasibility Study (PFS)

MNB is now working on a PFS for its green ammonia project, which will provide us with more information about the operating costs, revenues, and Net Present Value (NPV).

Ultimately the feasibility study will determine whether or not the project is commercially viable.

🔄 Market feasibility study

MNB intends to undertake a market feasibility study on opportunities to sell its green ammonia in Angola and to take advantage of the recently announced Lobito Corridor rail link (Angola, Democratic Republic of Congo and Zambia).

🔲 Binding power agreement Angolan power network operator

We want to see MNB convert its Memorandum Of Understanding (MoU) with Angola’s National Electricity Transmission Network (RNT-EP) into a binding power agreement.

We expect this to come after feasibility studies are completed.

🔲 Sign technical, offtake, and investment development partners

Much of the world's ammonia is produced using fossil fuels which makes MNB’s green ammonia project unique.

As MNB’s project advances, we are hoping potential offtake and development partners start to become more interested in the project and a deal is signed with MNB.

What are the risks?

In the short term the key risks are around project financing.

MNB has said that a funding agreement is being negotiated BUT there is always a risk that these negotiations fall through and nothing is agreed.

Below are the risks we have listed as part of our MNB Investment Memo.

It is also worth highlighting the “commodity pricing” risk for MNB as it moves closer to production.

MNB’s revenue will be directly tied to the TSP price, if the TSP price drops below the levels that the company anticipated in its DFS, then the project may be less economic than expected.

Our MNB Investment Memo

Click here for our Investment Memo for MNB, where you can find a short, high level summary of our reasons for Investing.

In our MNB Investment Memo, you’ll find:

- Key objectives for MNB

- Why we are Invested in MNB

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.