MinRex snaps up three promising cobalt-scandium tenements

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

ASX junior, MinRex Resources (ASX:MRR), today revealed that it has entered into an agreement to strategically acquire 100 per cent of Clean Power Resources (CPR).

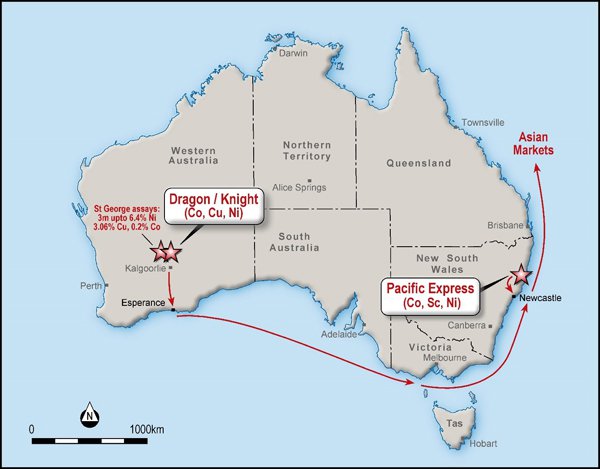

CPR has three high-quality, exploration-stage project areas in NSW and WA that are highly prospective for cobalt, scandium, copper and nickel. These tenements are also located in close proximity to supporting infrastructure and key ports.

This well-engineered acquisition comes on the back of favourable commodity sentiment, with the speciality and base metal upcycle gaining momentum. In particular, the cobalt price has recently reached a decade-high of US$95,000 per tonne on the London Metal Exchange (LME).

The Pacific Express Project is situated near Port Macquarie in NSW and was previously owned by Jervois Mining (ASX:JRV). This project has confirmed cobalt-scandium-nickel laterite mineralisation from legacy drill-holes that were used to historically model and report to a JORC (1996) Indicated Resource of 4.6Mt at 0.09 per cent cobalt, 40 grams per tonne scandium and 0.61 per cent nickel.

Once the acquisition is completed, MMR’s priority will be to fast-track a desktop review, legacy database compilation, geological modelling and Resource estimation and reporting to the JORC 2012 code.

Encouragingly, according to the CPR geology team’s analysis, recent aeromagnetic geophysical imagery of the Pacific Express tenure shows that legacy drilling is over significant magnetic anomalies.

The WA tenements, Knight and Dragon, sit near St George Mining’s (ASX:SGQ) tenure, which delivered solid drilling results (3 metres up to 6.4 per cent nickel, 3.6 per cent copper, and 0.2 per cent cobalt), while legacy assay results confirm a 7,290 part per million of cobalt hit just outside the project area.

This region is highly prospective for massive cobalt-copper-nickel sulphide mineralisation, which SGQ has confirmed in its 2017 drilling program, while Talisman Mining (ASX:TLM), which has contiguous ground to Knight and Dragon, produced 1.6Mt at 2.44 per cent nickel between 2008 and 2013.

All tenements to be acquired in both NSW and WA are still subject to grant.

MMR will update the market as the due diligence phase is progressed.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

MMR executive director, Simon Durack, said: “The opportunistic acquisition of these highly prospective assets delivers exposure to in-demand specialty metals cobalt and scandium in the first instance, then nickel and copper.”

“The board was highly encouraged by the geology across all three assets, noting the indicated resource for Pacific Express in NSW can be reassessed under the JORC (2012) code, then potentially deliver an upgrade, as well as the high level of sulphide mineralisation apparent near Knight and Dragon in WA,” added Durack.

The assets to be acquired by MMR.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.