Macquarie upgrades Amaysim’s earnings forecasts and target price

Published 23-AUG-2016 17:17 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Historical share price performances are not an indication of future trading patterns. Consequently, any investment decision should not be founded on commentary, projections and data emanating from broker coverage or share price trends.

However, with the material impact of Vaya, along with other initiatives taken by the company gaining traction in the second half, AYS delivered an impressive full-year result on Friday.

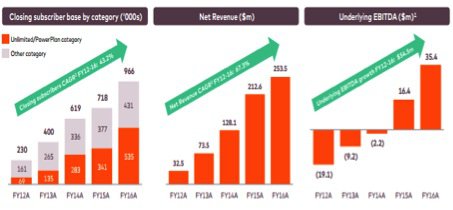

Analysts at Macquarie Wealth Management noted that the underlying fiscal 2016 EBITDA of $35.4 million was in line with management’s guidance which was in a range between $35 million and $36 million.

This represented robust year- It has been an up-and-down 12 months for diversified telco amaysim (ASX: AYS), both operationally and from a share price point of view.

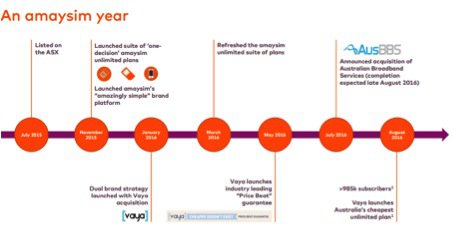

After listing on the ASX in July 2015 AYS’s shares traded in a tight range in the vicinity of $2.20 before the company announced the acquisition of Vaya providing it with a dual brand strategy, a development that has been important in terms of driving a strong performance in the second half of fiscal 2016.

AYS’s share price was hammered in February, falling from more than $3.00 to an all-time low of $1.30 after the company delivered a poor first half result.

Year-on-year growth of $19 million. However, more importantly it restored faith in the business model and this was evident in the share price response as it increased from the previous day’s close of $1.79 to hit an intraday high of $2.20 before closing at $2.09.

From an operational perspective, the headway AYS has made in a short period of time since it listed on the ASX in July 2015 is impressive. The table below indicates acquisitions made during this period as well as strategic initiatives aimed at attracting mobile users to its brand.

Macquarie is of the view that this has laid a strong foundation for future growth, evidence of which was provided in its full-year result and this prompted the broker to upgrade earnings per share forecasts for fiscal 2017 and 2018 by 7.5% and 2.2% respectively.

The broker also substantially increased its share price target from $2.00 to $2.50 while maintaining an outperform recommendation.

The price target implies a 25% premium to Monday’s closing price of $2.00. While some shareholders may have sold into last Friday’s strong rally it should be remembered that AYS is recovering off what could be considered an oversold base.

Based on yesterday’s closing price, AYS is trading on a PE multiple of 12.9 relative to Macquarie’s fiscal 2017 earnings per share forecasts. As can be seen in the table below, AYS is generating strong growth in revenues, earnings and subscriber numbers, perhaps suggesting that its current forward PE multiple does not take into account the company’s growth profile.

It should be noted that broker recommendations can change, and earnings projections and target prices may not be met.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.