KBL gets closer to drilling at Pearse North

Published 09-AUG-2016 12:54 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

KBL Mining (ASX:KBL) is one step closer to drilling the Pearse North deposit, saying it’s on track to receive final environmental approvals by late 2016.

KBL previously told shareholders that it would start drilling the Pearse corridor in August, but this represents the first confirmation of the timetable for drilling the Pearse North deposit.

The deposit, which lies about 200m north west of the operating Pearse open cut gold mine, has an ore reserve estimate of 179,000 tonnes at 2.5 grams per tonne gold and 21 grams per tonne silver.

This is an estimate and there are no firm numbers at this stage, so don’t use these numbers as the foundation of any investment decision with regard to this stock and invest with caution.

The submission of its Statement of Environmental Effects is the last major work to be completed by KBL before it gets the approval to start mining at the deposit.

The company said as part of the statement, it was able to confirm that 50 people would be employed at the project on an ongoing basis in addition to 30 contractors.

KBL is aiming to develop Pearse North as a shallow, open pit to get gold to market as quickly as possible given the sentiment for gold at the moment.

The sentiment was in evidence last week during the annual Diggers&Dealers event in Kalgoorlie.

Thanks to an upswing in the gold price, 29 of the 43 presenters were from the gold sector.

About KBL and Mineral Hill

KBL’s flagship project in the Mineral Hill project in the centre of NSW.

The project includes several deposits, including the Pearse which is producing, and the Pearse North deposit which is next on the slate for development.

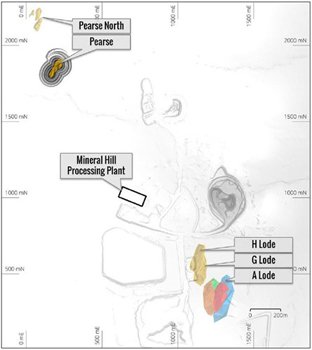

Prospective targets include the Jack’s Hut, and the A,B, G, and H lodes within the Southern Ore Zone.

A map of deposits in the area

During the first quarter of 2016, KBL’s Mineral Hill operation produced 9,209oz of gold and 111,826oz of silver, with gold production up 95% and silver 226% from the previous quarter.

KBL’s deposits and targets are all within close proximity to the company’s 100% owned CIL and floatation production plant which has recently received over $30 million worth of upgrades, allowing it to process various ore types and improve recovery rates by over 50%.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.