Hot Chili drilling confirms large extension at Cortadera

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hot Chili Limited (ASX:HCH) has released highly promising drilling results in relation to its Cortadera copper-gold porphyry discovery in Chile, triggering a share price surge of more than 10%.

Diamond drilling (DD) has expanded the growth potential of the Cortadera copper-gold deposit, confirming larger potential than management had anticipated.

As a backdrop, Cortadera is privately-owned and historical world-class discovery drill results have only recently been publicly released by Hot Chili.

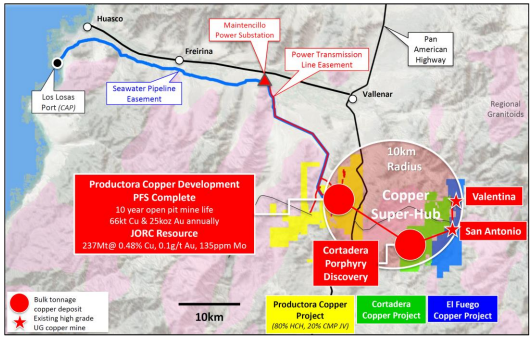

Importantly, Cortadera lies 14 kilometres from Hot Chili’s large-scale Productora copper development and adjacent to the high grade El Fuego satellite copper projects, as indicated below.

In February, Hot Chili negotiated a formal option agreement to acquire a 100% interest in Cortadera, and in early April the company commenced a drilling program aimed at confirming and extending areas of surface enrichment and wide, higher grade copper-gold sulphide mineralisation which had not previously been closed off by 23,000 metres of historical drilling.

Results for the first two DD holes are expected to be received in the coming fortnight.

However, at an early stage it is evident that both holes potentially point to significantly larger scale of the main porphyry (Cuerpo 3) at Cortadera than the company had first recognised.

Given Cortadera’s close proximity to the large-scale Productora copper development it will fit with management’s strategy of establishing two bulk-scale deposits as part of a large regional copper production hub.

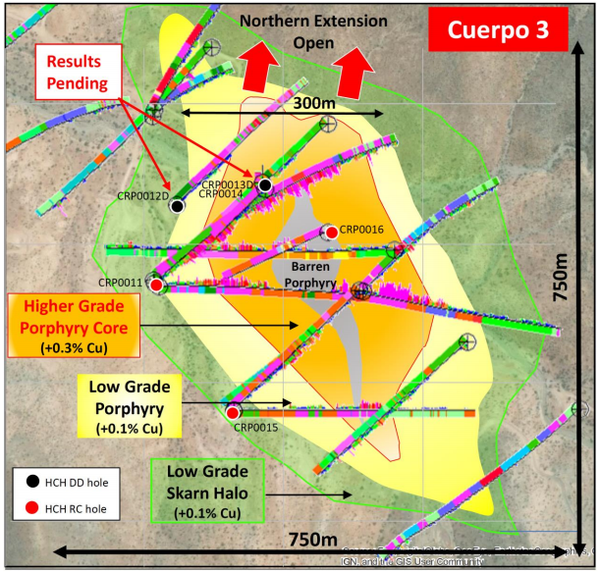

Management’s initial confirmation drilling programme is currently focused across the Cuerpo 3 deposit, the largest of the three porphyry centres discovered to date at Cortadera.

Several deep reverse circulation (RC) drill holes completed across the near-surface extent of Cuerpo 3 had ended in wide intersections of mineralisation at the limit of RC depth penetration, approximately 350 metres down-hole.

Recent results confirmed this, highlighting increasing grade with depth down-hole in several of the RC holes at Cuerpo 3.

Consequently, the potential upside from deep diamond drilling could be significant.

The results have already confirmed significant up-dip extensions to copper sulphide mineralisation recorded in deeper historical diamond drilling.

New significant RC pre-collar drill results include 156 metres grading 0.4% copper and 0.1 grams per tonne gold from 206 metres and 64 metres grading 0.5% copper and 0.2 grams per tonne gold from 140 metres.

The first DD hole completed was designed to test and close-out the north-west extent of the Cuerpo 3 porphyry.

Surprisingly, the hole recorded a wide intersection of porphyry from much deeper down-hole than expected, while extending further north than anticipated.

Though the majority of the wide porphyry intersection in that hole appears to be moderately mineralised, it highlights a distinct change in the orientation of the porphyry body towards the north.

This is important as it indicates Cuerpo 3 is now extending north with approximately 300 metres of width not closed off by any drilling as indicated below.

Management is now completing a vertical DD hole (CRP0013D), indicated above by the ‘results pending’ red arrow.

This will test the extent of a potential higher grade core of Cuerpo 3 as indicated on the left of the above schematic.

The hole is currently at a depth of approximately 840 metres and is now planned to extend to a depth of about 1000 metres following visual confirmation of increasing alteration and vein intensity associated with copper sulphide mineralisation.

Previous work had highlighted a potential increasing grade profile with depth (evident for copper, gold and molybdenum) across Cuerpo 3.

The company is dedicating two DD holes from the current phase of drilling to test this observation.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.