Hardey Resources’ Pilbara gold highlighted by recent report

Published 06-SEP-2018 09:46 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Hardey Resources Limited (ASX:HDY) has released a new geology report in regards to its four conglomerate-hosted gold projects in the Pilbara region, Western Australia.

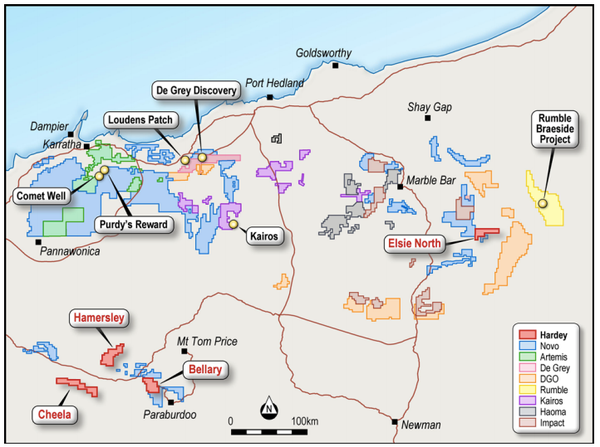

HDY’s new geology consultant has completed an updated study on the four Pilbara projects — Cheela, Bellary, Hammersley and Elsie North — which highlighted the potential for subsurface target mineralisation for conglomerate-hosted gold and polymetallic deposits.

Overall, the consultant believes there is ample evidence, given widespread occurrences of Hardey Formation and Mount Roe Basalt, to verify material exploration upside for conglomerate hosted-gold mineralisation, especially for the Bellary project which is contiguous to Novo Resources (TSX-V:NVO) ground near Tom Price.

Clear positive observations from the report that demonstrate the potential for material exploration upside across the four projects include:

- Peers, such as NVO, making significant gold mineralisation discoveries in the Pilbara associated with Lower Fortescue Group lithologies — Hardey Formation and Mount Roe Basalt; and

- The favourable setting for conglomerate-hosted gold deposits comparable with similar geological and chronological settings in South Africa and India.

HDY’s Board is now reviewing plans to fast-track a high-level exploration program to garner a greater understanding of the underlying conglomerate gold-hosted mineralisation across the four projects.

The Board considers this updated overview timely as it can now confirm it has recently been approached by Australian and international groups interested in the four projects.

Interestingly, the consultants’ review highlighted the potential for sub-surface target mineralisation, particularly the Bellary project which is contiguous to NVO’s tenure. The geology consultant has recommended closer scrutiny of this project, given it has numerous conglomerate-hosted gold formations.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

Pilbara conglomerate-hosted gold

HDY has four conglomerate-hosted gold projects in the Pilbara region that are within the Lower Fortescue Group — Bellary, Elsie North, Hammersley and Cheela. Of these, Bellary and Elsie North are contiguous to high profile NVO’s ground.

HDY stated that a key takeaway from the report was the clear need to progress with an advanced exploration program as soon as possible, given the positive findings.

A priority for the Board now is to optimise the Pilbara conglomerate-gold hosted assets through leveraging the expertise of a high calibre strategic partner, with a focus on the Bellary project.

HDY Executive Chairman, Terence Clee commented on today’s announcement: “While considerable resources have been devoted to closing out the two vanadium transactions, our geology consultants have been conducting reviews on the gold assets.

“This initial update on Cheela, Bellary, Hammersley and Elsie North is highly encouraging, particularly the prospect of subsurface target mineralisation being apparent. More importantly, recent approaches by Australian and international groups is timely, with the Board seeking to optimise these assets through bringing in prospective strategic partners,” he said.

Next steps for Hardey

HDY remains focussed on its newly acquired vanadium projects, while at the same time optimising legacy assets. According to the company, this twin objective is being progressed to maximise value for shareholders.

For the conglomerate-hosted gold assets under review, particularly the Bellary project, the key next steps are commencing the high level exploration program and opening discussions with prospective strategic partners.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.