GTR is leveraged to growth in US uranium demand

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 41,043,000 GTR shares and 1,579,715 GTR options at the time of publication. The Company has been engaged by GTR to share our commentary on the progress of our Investment in GTR over time.

Forget Oppenheimer - the real US nuclear story is happening in Wyoming.

Public support for nuclear power is at record levels and US politicians are listening.

In late July, an important piece of law supporting the US domestic nuclear industry supply chain passed with a resounding 96-3 vote in favour.

This type of consensus is rare in US politics.

Despite a large amount of historical inertia - the planets are now aligning for significant growth in the US nuclear industry.

A groundswell of support and funding could see the US restored to its position as a dominant uranium producer.

Because we all know - nuclear power needs uranium.

In fact, the US wants uranium so bad that the US government has been buying uranium at a 30% premium to the prevailing spot price.

So it’s a great time to have pounds in the ground in the USA’s uranium capital - like our Investment GTI Energy (ASX:GTR).

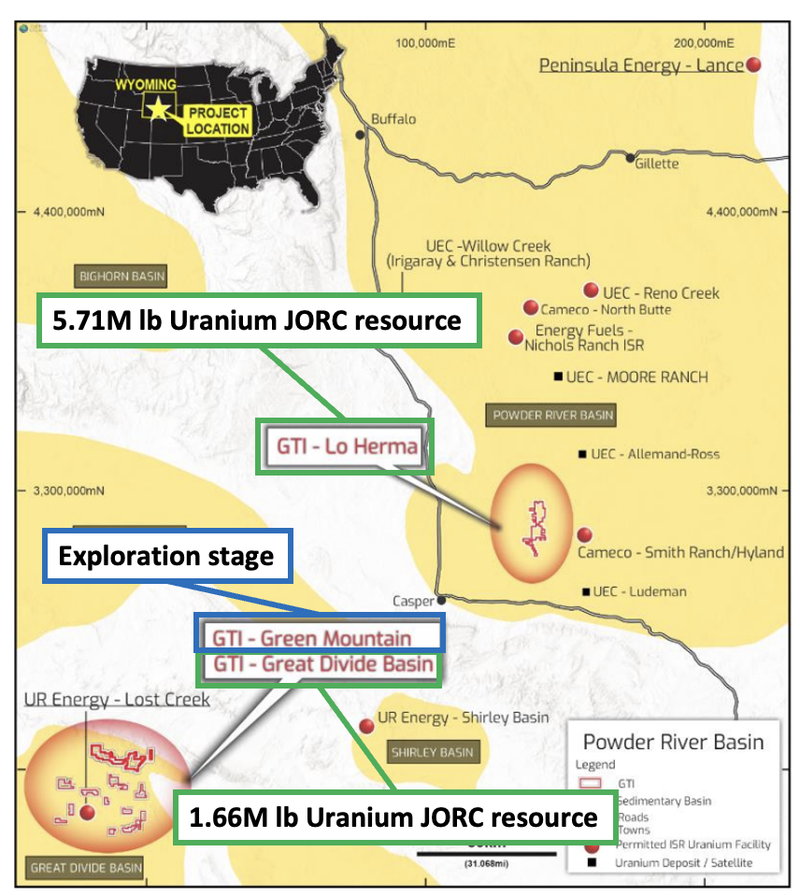

GTR has an in ground uranium resource of ~7.37 million lbs across three projects in Wyoming, USA.

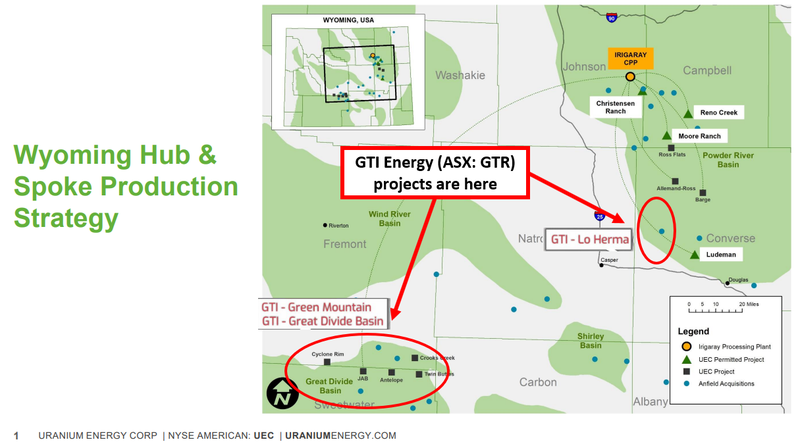

GTR’s projects sits within ~80km from five permitted, ready to go In-Situ Recoverable (ISR) uranium processing plants.

ISR uranium projects are the same type responsible for most of the low cost production coming out of Kazakhstan - they have lower environmental impact, CAPEX and operating costs versus traditional hard rock uranium projects.

All of the uranium majors in Wyoming are looking to bring their ISR processing plants back online.

These plants are owned by majors ranging from the $2BN Uranium Energy Corp to the $22BN Cameco, and are all part of what we think will eventually become a regional Hub and Spoke operating model.

The “Hub and Spoke” model is something GTR’s neighbour Uranium Energy Corp’s neighbour has been talking about for years now.

(Source)

GTR’s neighbour Uranium Energy Corporation (UEC) has been the most active neighbour on the Merger and Acquisitions (M&A) front with its recent acquisition of the nearby Uranium One.

In that deal, UEC paid ~US$134M for ~100m lbs of uranium, which is ~US$1.34 per lb of uranium resource.

That deal to buy out Uranium One was done when the uranium spot price was trading at ~US$42 per lb in 2021.

Now the uranium spot price is trading at almost 12-year highs at US$56.25 per lb.

As the uranium price starts to rise, every lb of defined uranium JORC resource becomes more valuable to a major with processing infrastructure that is all ready to go.

GTR’s geographic positioning is one of the key reasons we are Invested in GTR - the company has pounds in the ground with proximity to regional processing plants. This is the place any uranium junior wants to be when the uranium price is rising.

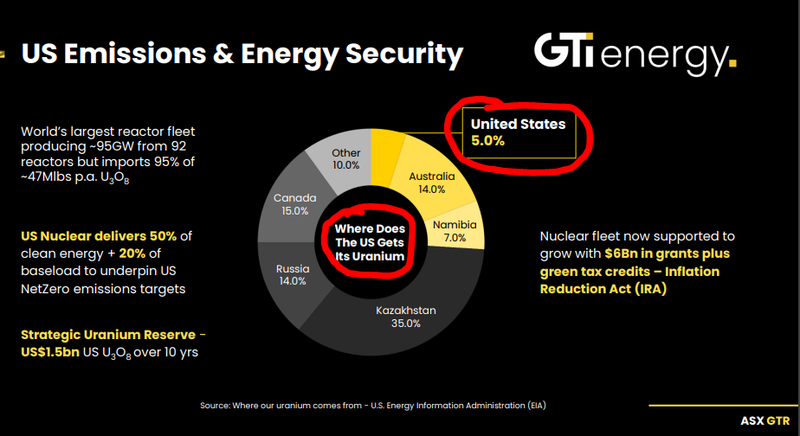

With the US currently reliant on imports for ~95% of its uranium supply we see the demand/supply imbalance growing inside the US.

The US government is adding to the imbalance with two proposed bills which would ban Russian supply (~14% of imports) and invest upwards of US$3.5BN in domestic supply chains:

- Bill #1- Seeks to ban Russian uranium.

- Bill #2- Seeks to invest ~US$3.5BN in onshore nuclear fuel supply chains. Just last week the US senate voted 96-3 in favour of this.

(Source)

Nuclear power is the cleanest, most reliable and cheapest form of producing baseload energy supply - and uranium is the primary fuel source for nuclear reactors.

Unlike wind and solar, it isn't intermittent and can support 24/7 power generation - this is what's called “baseload energy generation”.

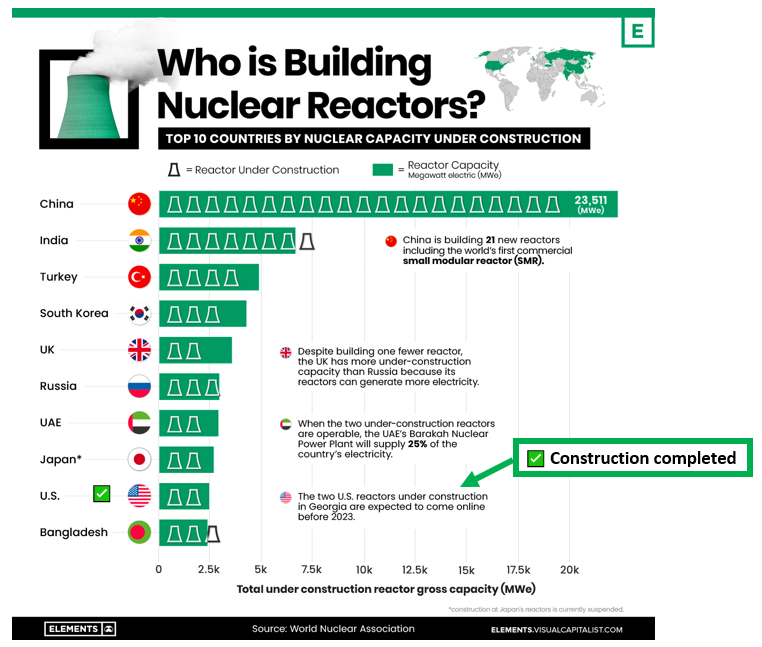

Countries all around the world have set long term net-zero emission targets - the east have recognised the role of nuclear power and have started building out new plants, the west on the other hand has largely ignored it... for now.

(Source)

We think the west will eventually catch onto the importance of nuclear energy in the clean energy mix and start investing more capital a lot faster.

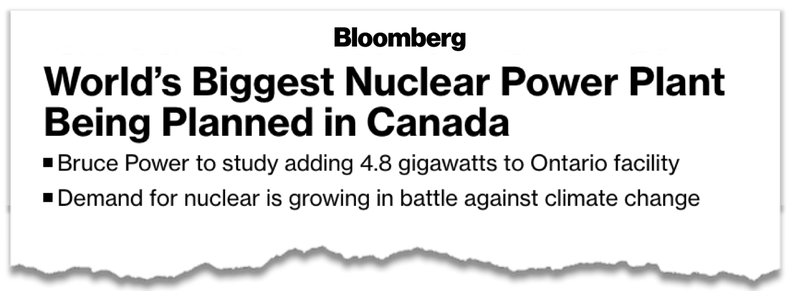

A prime example is the flip in Ontario, where previous governments had shunned nuclear power and the new government has committed to building the world's largest nuclear power plant.

(Source)

Put simply - for the world to decarbonise, it will need to embrace nuclear energy - and that means more uranium is needed.

Why are we Investing in the US, and why GTR?

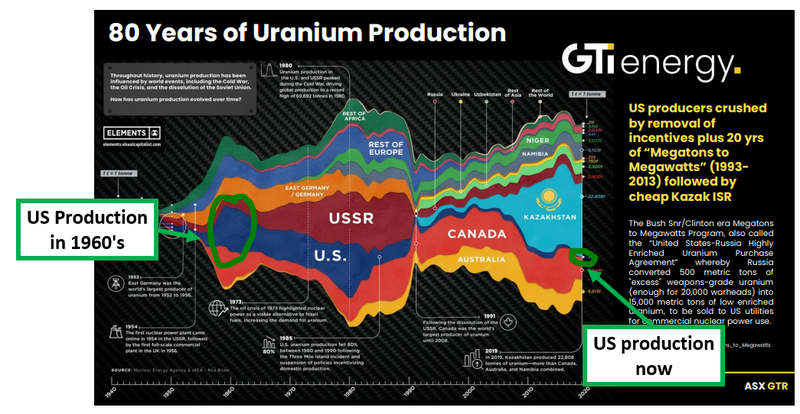

The US was once the world’s biggest uranium producer.

Over the last 3 decades it lost that position to Kazakhstan and now produces almost nothing domestically.

(Source)

The US is now almost solely reliant on imports for its nuclear power industry - importing ~95% to be exact.

Recognising this, the US government introduced up to ~$10BN in funding support for the domestic uranium/nuclear industry:

- US$6BN to maintain and upgrade existing nuclear power plants

- US$4.3BN to wean itself off Russian uranium supplies.

We expect Wyoming to be the centre of the US uranium renaissance - Bill Gates and Warren Buffet also seem to agree, with a US$4BN investment in a new nuclear power plant recently made in the state.

Right now, we see an imbalance in the valuations of uranium companies that are close to or in production AND junior companies like GTR.

Capital is currently flowing into companies that are closest to production.

As the uranium price moves higher, we expect to see investor capital shift from the bigger companies into the higher risk/higher reward junior companies.

What’s next for GTR?

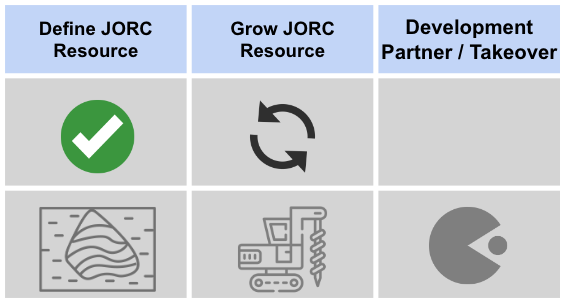

The first stage of GTR’s plan was to establish a resource base - the company did that by announcing two maiden JORC resources across two projects this year.

Now GTR has a 7.37m lb uranium resource base across two of its three projects in Wyoming.

(Source)

The company is now moving into the second phase of its strategy.

GTR is aiming to increase its resource base, show size/scale potential to a level where GTR’s projects become ideal bolt on acquisition targets for majors in the region.

GTR is firmly in the “Grow JORC Resource” phase. Which means lots of drilling, and hopefully more uranium discoveries.

The definition of a large-scale uranium resource and a potential takeover of the company forms the basis for our GTR Big Bet, which is as follows:

Our GTR Big Bet:

“GTR proves out a large resource base in the “uranium capital” of the USA and generates offtake or acquisition interest as the USA moves to secure local uranium supply”.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GTR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Our new GTR Investment Memo

The two main objectives of our first GTR Investment Memo was to see the company announce maiden JORC resource estimates.

Now that GTR has an in ground JORC resource base of 7.37m lbs’s we have completed a review of our original GTR Investment Memo.

See how GTR went versus our expectations here.

GTR’s next round of drilling is planned for later this year/early next year and so today, we will be launching our new GTR Investment, where you can find:

- Why we are Invested in GTR

- Our long term Big Bet - what we think the upside Investment case for GTR is.

- The key objectives we want to see GTR achieve

- The key risks to our Investment thesis

- Our Investment Plan

Click here to see our Investment Memo

Investment Memo, GTI Energy (ASX:GTR)

Memo Opened: 4-Aug-2023

Shares Held at Open: 41,043,000

Options Held at Open: 1,579,715

What does GTR do?

GTI Energy (ASX:GTR) is a US focussed uranium explorer and developer with projects in the state of Wyoming, the leader in domestic uranium production.

GTR is aiming to grow its current uranium JORC resource base of 7.37m lbs in the state.

What is the macro theme?

Nuclear power has the lowest carbon footprint and highest utility rate of all renewable energy technologies.

Uranium is the primary fuel source for nuclear power, which makes it a critical mineral for a green energy future.

We expect to see uranium production increase across the world, buoyed by the transitions away from highly pollutive base-load energy generation like coal and oil.

The US is also allocating US$6BN in credits under the Inflation Reduction Act (IRA) to expand its nuclear fleet which we expect to increase demand for domestic uranium supplies.

Our Big Bet for GTR

“GTR proves out a large resource base in the “uranium capital” of the USA and generates offtake or acquisition interest as the USA moves to secure local uranium supply”.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our GTR Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

Why we are Invested in GTR:

Uranium price at ~12 year highs

Uranium prices have moved from ~US$32/lb in 2021 to now trade near US$56/lb.

US Government is investing in domestic uranium supply chains

The US launched a US$1.5BN strategic uranium reserve & is investing US$6BN in its existing nuclear reactor fleet.

At the same time the US is home to the world's biggest nuclear reactor fleet and imports ~95% of its uranium supplies. In short the US is desperate to rebuild its nuclear power supply chains.

GTR’s projects in the uranium capital of USA

Wyoming is the capital for uranium production in the US and was once the biggest producing region in the world.

Wyoming has also attracted US$4BN in funding for a nuclear power plant from Warren Buffet and Bill Gates.

GTR’s projects are ISR uranium projects

ISR (In-situ recoverable) uranium projects have the lowest environmental impact, lowest CAPEX and lowest operating costs. ISR projects can be put into production a lot quicker than conventional hard rock uranium projects.

Existing JORC resource base and low enterprise value

GTR has an existing JORC resource base of 7.37m lbs of uranium. At our most recent Investment price of 0.9 cents, GTR trades at an Enterprise Value (EV) of $14M, giving it an EV/resource ratio of ~$1.90/Lb of uranium. Producers in Wyoming trade at >$15 per lb of uranium resources.

GTR’s projects sit near existing processing infrastructure

GTR’s Wyoming projects sit near ~9 central processing plants, with five fully permitted for production. GTR’s projects have the potential to be a part of a regional “hub and spoke” production model.

What do we expect GTR to deliver?

Objective #1: Drilling at first Wyoming Project - Lo Herma

We want to see GTR define drill targets and then drill its most advanced Lo Herma uranium project in Wyoming. We want GTR to upgrade its existing 5.71m lb JORC resource for the project.

Milestones

🔄 Geophysics/Geochemical surveys

🔄 Permitting/planning

🔲 Define drill targets

🔲 Drilling started

🔲 Drilling results

Objective #2: Drilling at second Wyoming Project - Green Mountain

We want to see GTR define drill targets and then drill its earlier stage exploration project - Green Mountain. We want to see GTR get enough drilling data to put together a maiden resource estimate or exploration target.

Milestones

🔄 Geophysics/Geochemical surveys

🔄 Permitting/planning

🔲 Define drill targets

🔲 Drilling started

🔲 Drilling results

Objective #3: Increase global resource base and start feasibility studies

Ultimately we want to see GTR increase its total in-ground resource base and then take one of its projects into the feasibility study stage.

Milestones

🔲 Resource upgrade commenced

🔲 Resource upgrade completed

🔲 Feasibility study commenced

What could go wrong?

Commercialisation risk

GTR now has a total in-ground JORC resource base of ~7.37 million lbs of uranium. There is no guarantee that this resource can be economically extracted. Project development is risky and a range of issues can always come about leading to projects being considered stranded.

Exploration Risk

GTR is still drilling exploration targets to grow its in-ground uranium resource. This may or may not return any uranium mineralisation. Exploration drilling that does not lead to economic uranium resources may occur.

Commodity Risk

In recent decades, governments have often shunned uranium because of the issues related to spent radioactive uranium cells needing to be disposed of somewhere.

A lot of countries have abandoned commitments to nuclear power due to the risks of accidents like Chernobyl and Fukushima.

This may slow the adoption of nuclear power globally and impact the demand for uranium. Other energy sources may be more popular than nuclear.

Funding Risk

GTR is a junior explorer with no revenues to fund exploration and ongoing costs. This means the company is reliant on capital raises to fund exploration programs. Assuming no JV partner appears, GTR will need to come to the market and raise additional capital from investors leading to dilution for existing shareholders if raises are done at lower prices.

Market Risk

If the broader market sells off, investors may shy away from high-risk investment opportunities like junior explorers. During market downturns, investors will look to pull capital away from the high risk investments. GTR is a junior explorer and may be impacted by these market wide sell offs.

Investment plan

With the GTR share price well below our Initial Entry Price of 1.8 cents, we took the opportunity to “average down” our GTR investment while sentiment was relatively low.

We hope this is a strategy that pays off.

We will look to sell ~30-40% of our holdings if the company if the share price materially increases either from:

- A new uranium discovery

- Anticipation of material drilling event

- An increase in JORC resource

- A macro event that spotlights uranium stocks

To read our investment retro for our last GTR memo click this link and select the “GTR-IM1” tab.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.