GTI Resources expands its position in WA goldfields region

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

GTI Resources Ltd (ASX: GTR) has strengthened its position in the Kookynie region in Western Australia’s goldfields, as the gold price continues to hit record highs of US$2037 per ounce or $2840 per ounce in Australian dollar terms.

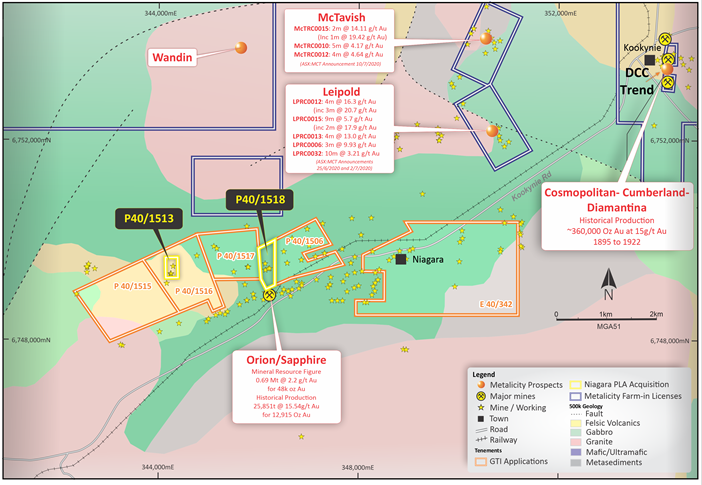

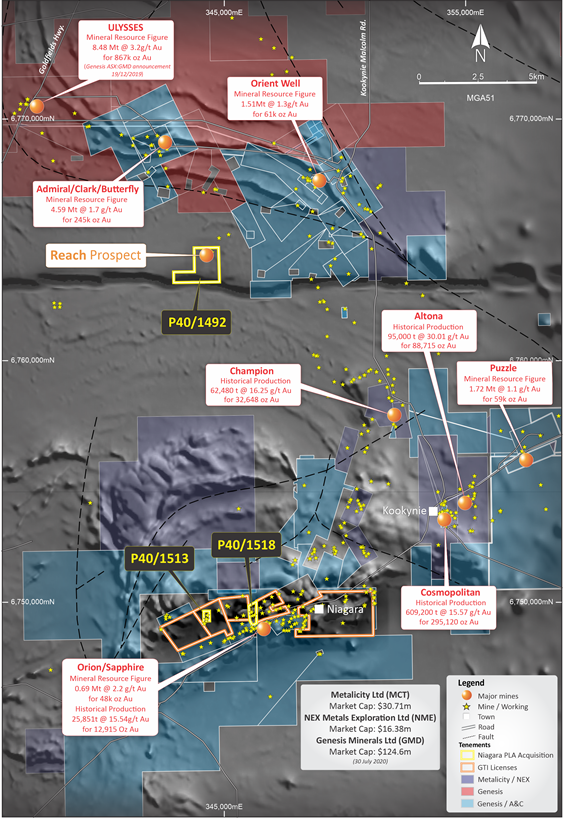

GTR has acquired two additional licences which consolidate its landholding over the 5km mineralised trend at Kookynie, with another license acquisition located close to Genesis Minerals (ASX: GMD)’s Greater Ulysses Project, which holds a Mineral Resource of 17Mt at 2.34 g/t Au for 1.28Moz.

Adding to the heightened activity in the Kookynie region, Genesis is currently undertaking a major new drilling programme at the project, comprising 25,000m of RC and diamond drilling. Genesis’ work follows a recent $9.5M rights issue. The company’s share price has risen 270% since March, with the company currently capped at over $120M, highlighting the market’s interest in this WA gold region.

GTR’s newly acquired P40/1492 (the Reach PL) is a granted prospecting licence located approximately 15 kilometres north-west of Kookynie, near Genesis’ Ulysses resource. The vendor of the Reach PL will be issued 1,666,667 ordinary shares in GTR.

GTR’s other two new prospecting licence applications P40/1513 and P40/1518 (New Niagara PLAs) adjoin GTR’s existing applications at Niagara near Kookynie, which are contiguous with the company’s existing E40/342 tenement.

The New Niagara PLAs will be GTR’s in exchange for the issue of 2,500,000 GTR shares at a deemed issue price of 3.1c per share to the vendors.

Both tranches of shares to the vendors will be issued pursuant to ASX Listing Rule 7.1.

GTR now has a consolidated gold belt at Kookynie to explore

The newly consolidated belt, which hosts numerous historical shafts and workings within the Niagara gold trend, offers GTR an opportunity to focus exploration within this highly prospective and historically underexplored mineralised corridor.

Exploration on GTR’s ground has been limited to date, and thus GTR’s project remains essentially untested with the drill bit.

By way of background, the Niagara project is within the central part of the Norseman-Wiluna greenstone belt and the geology of the area is characterised by large rafts of semi-continuous greenstone stratigraphy.

Numerous historical workings occur within and to the north of the project area, with a number of major historical mines located in the immediate vicinity of Kookynie, including the Cosmopolitan Mine which produced circa 300,000 ounces of gold at average grade of 15 g/t gold from 1895 to 1922.

Contiguous package spans 5 kilometres

The latest acquisitions comes less than a month after GTR received a five-year term extension for the Kookynie exploration licence E40/342, developments that triggered a 20% surge in the company’s share price.

As shown below, acquisition of the new Niagara PLAs creates a contiguous package of applications covering approximately five kilometres of the historical Niagara gold trend in addition to the company’s existing E40/342 tenement.

As indicated above, there are a number of ASX-listed companies with neighbouring projects, and most are actively exploring. GTR has previously indicated an intent to drill its Kookynie project in the coming months.

Within reach of 1 million ounces of gold

The Reach PL is located close to the Greater Ulysses Project held by Genesis Minerals, including the Ulysses, Admiral/Clark/Butterfly and Orient Well gold mines which hold combined defined resources of more than 1 million ounces of gold.

The Reach PL includes the Reach prospect where exploration, including reverse circulation (RC) drilling, by earlier workers identified anomalous gold associated with historical workings and outcropping quartz veining.

Previous exploration at the Reach prospect, within P40/1492, was conducted between 2011 and 2013 by Midas Resources (now Hammer Metals Ltd ASX: HMX).

During early 2011, rock chip sampling of historical mine waste dumps associated with an outcropping 1.5 metre wide north dipping quartz vein at the Reach prospect returned a number of anomalous gold assay results.

Shallow historical shafts and workings extend along the strike of the quartz vein for approximately 100 metres.

RC drilling identifies near surface mineralisation

In August 2011, Midas completed an RC drilling program targeting the historical workings and quartz veining at the Reach prospect.

A total of seven RC holes (RERC001 to RERC007) were completed for 634 metres, on three north-south oriented lines about 50 metres apart.

The drilling that was conducted using spacings of between 30 metres and 40 metres intersected a shear zone within basalt and chloritic schists, with quartz veining occurring in a number of holes over intervals of between 100 centimetres and 3 metres.

Anomalous gold assay results were returned from four holes, including two significant intercepts of 1 metre at 2.3 g/t gold from 25 metres and 4 metres at 0.5 g/t gold from 32 metres.

The highest gold values reported in these non-JORC compliant results coincided with the most massive quartz intercepts, closest to the historical workings.

It should be noted that GTR has not independently validated Midas’ exploration results and therefore the company is not to be regarded as reporting, adopting or endorsing those results.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.