Grant of patent enhances D13’s drone defence capabilities

Published 25-OCT-2016 15:34 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Department 13 (ASX: D13) spiked 15% within minutes of an announcement being released regarding the grant of a new patent for the sharing of wireless resources between networks used in counter drone systems or any high bandwidth datalink.

The intraday high of 15.5 cents isn’t too far off the group’s all-time high of 16.5 cents struck in early June. Given the group is substantially more advanced strategically in terms of acceptance of its technologies and the establishment of partnerships it could be argued that a premium to its June share price is warranted.

However, historical share price performances should not be used as the basis for an investment decision and independent professional advice should be sought if considering this stock.

As a backdrop, D13 is developing cutting-edge software and communication systems that have the potential to transform the networking and communication fields as well as current applications in drone defence, mobile phone IT security and secure enhanced android phone systems.

As can be seen below, there is no getting around the fact that drone defence systems will be front and centre in terms of defence initiatives in the near to medium-term.

What are the implications of patent approval

The issue of US Patent Number 9473226 announced today touches on most of these areas of the group’s operations as the technology at the centre of this development enables more efficient use of the radio spectrum, allowing different networks to concurrently use the same frequencies.

However, in particular this technology enhances D13’s drone defence capabilities and advanced communication networking as it allows more sensors and devices to operate efficiently within the limited radio spectrum.

Management highlighted that from a broader perspective the technology can permit licensed cellular spectrum to be used for other communications without interfering with cellular networks.

Chief Executive, Jonathan Hunter highlighted that this development was particularly important at a time when the radio environment was becoming increasingly crowded. Being able to share resources between wireless networks has substantial advantages for devices communicating in the shared, unlicensed frequency space.

On this note, Hunter underlined the fact that through the use of this technology, devices currently using the 2.4 GHz industrial, scientific and medical (ISM) radio band can be enabled to make use of the cellular network without interfering with any other device in the network.

Effectively this allows the device to use a lower frequency cellular channel instead of the ISM radio band, increasing the range by about ten-fold or greatly reducing the required radio transmission power.

Key details of the patent approval are that it has been licensed to D13 by GenghisComm Holdings, the IP holding company of D13’s Chief Science Officer (CSO), Steve Shattil, under the terms of the existing exclusive license with D13 which covers the fields of drone defence and US and Australian government agencies and departments business.

It is worth noting that Shattil is the inventor of dozens of US and foreign patents essential to wireless and radio protocol standards.

New patents, new revenue streams, improved investor appeal

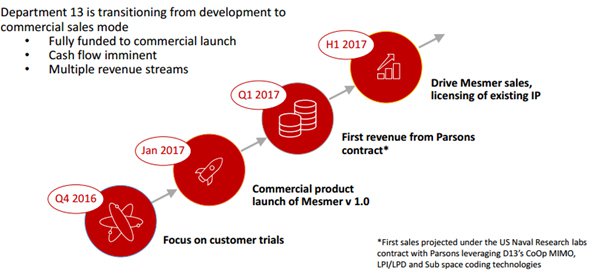

While D13 now has 12 granted patents, expect more news flow given that it has 22 patent applications in its IP portfolio. More importantly though, it is worth looking at the company’s milestones over the next 12 months which if achieved would see a transition from development to commercial sales with cash flow and diversified revenue streams.

This would change the company’s profile and contribute towards derisking some of its areas of operations, arguably making it a more readily considered investment prospect for a wider investor universe.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.