Gold the only winner as investors head for the exits

Published 13-APR-2017 09:17 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After teetering on the edge for most of the week the Dow finally gave way on Wednesday, falling 0.3% to 20,591 points.

The other major indices also lost ground with the S&P 500 and the NASDAQ falling 0.4% and 0.5% respectively.

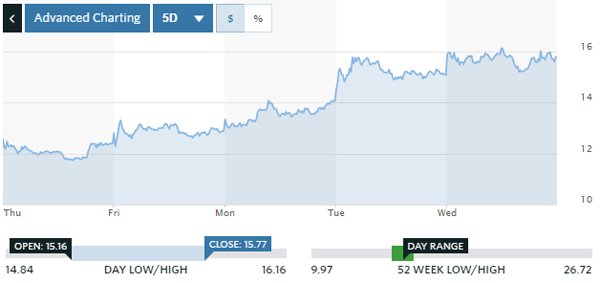

As mentioned by FinFeed throughout the week, it is a combination of instability and uncertainty that is weighing on markets and this is reflected in the CBOE Volatility Index which as can be seen below has increased circa 35% in the last week.

While there are concerns regarding geopolitical issues undermining the market, US investors will also receive their first glimpse of reporting season tonight when three of the big banks deliver their first-quarter earnings.

What is worth noting is that they will be cycling against outstanding performances in the previous quarter which set the bar relatively high in terms of first quarter 2017 expectations.

With negative market sentiment being driven by external factors, companies that underperform are likely to be sold down heavily, particularly those that have experienced strong share price gains on the back of the Trump trade.

There were mixed performances in European markets with the main theme being some strong moves in the auto sector after BMW reported first quarter year-on-year sales growth of 5.3%.

Iron ore plunges as gold surges

Offsetting this trend were some sharp falls amongst the miners after iron ore plummeted approximately 8% to US$68.04 per tonne and copper fell 2.5% to US$2.54 per pound, a level it hasn’t traded at since January.

Looking at individual indices, the FTSE 100 shed 0.2% and the DAX gained 0.1%, while the Paris CAC 40 was flat.

Elsewhere on the base metals front, nickel fell more than 1% to US$4.38 per pound. Lead only came off marginally, while zinc recovered some recent lost ground, increasing 1.2% to US$1.18 per pound.

With this backdrop, the likes of Rio Tinto and BHP Billiton are likely to emulate the significant falls they experienced in overseas markets.

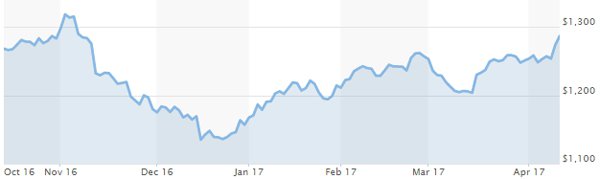

The one commodity that should buck the trend is gold after it surged another 1.1% to US$1289 per ounce, closing in on its five month high as can be seen below. The precious metal has now gained circa 7% since mid-March.

The Australian dollar strengthened overnight, and is fetching US$0.753.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.