Gold junior EganStreet muscles in on Rothsay Project in WA

Published 07-SEP-2018 11:51 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

EganStreet (ASX:EGA) is an emerging WA gold company focused on exploring and developing the Rothsay Gold Project, which is situated 300 kilometres north-east of Perth in WA’s midwest region.

The Rothsay Gold Project currently hosts high-grade Mineral Resources of 401koz at an average grade of 8.8g/t gold (Indicated 820kt at 9.3g/t gold and Inferred 600kt at 8.0g/t gold) and a production target of 2.1Mt mined and 1.4Mt processed at 6.9g/t gold for 250koz of gold produced.

As it announced to the market yesterday, the company is continuing to make strong progress with pre-development, permitting and ongoing Resource development activities at Rothsay.

EGA recently completed a positive Definitive Feasibility Study (DFS) for Rothsay, which confirmed the potential for a low-cost, high-margin project capable of delivering strong financial returns for shareholders.

Following on from that, a number of work programs are now underway, aiming to advance Rothsay towards construction and development.

Initial site-based civil works are scheduled to kick off as early as next month, with major construction activities scheduled for Q1 2019, and first gold targeted for Q4 2019.

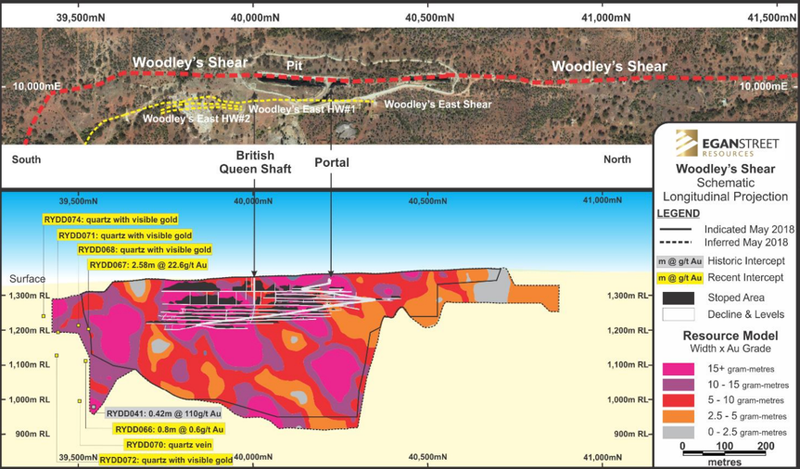

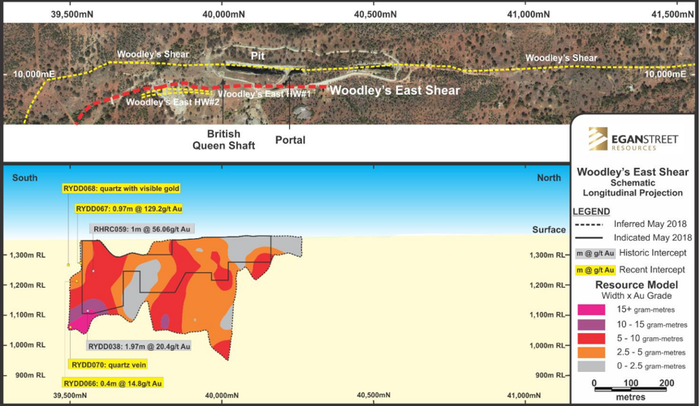

In parallel with project development activities, EGA is undertaking a 16-hole, 4,000 metre diamond drilling program, targeting potential southern extensions of the Woodley’s and Woodley’s East Shears.

This program is now well-advanced and already generating highly encouraging initial results, which point to extending the Mineral Resource south in both the Woodley’s and Woodley’s East Shears. To date, 10 holes have been completed.

Bonanza grades have been received from the first two holes assayed on the southern boundary of the Woodley’s and Woodley’s East Mineral Resources, including:

- 0.97m at 129.2g/t gold from 73.0m – Woodley’s East

- 2.58m at 22.6g/t gold from 150.55m – Woodley’s Shear

- 0.4m at 14.8g/t gold from 131.7m – Woodley’s East

- Visible gold logged from a further four holes, on the boundary or south of the current Mineral Resource – assays pending

Results confirm that mineralisation on both the Woodley’s and Woodley’s East Shears remains open to the south, in an area that has never previously been drill tested.

Given the high grade of these latest intersections, infill drilling in this region has the potential to increase the current Resource of 1.42Mt at 8.8g/t for 401,000 ounces of contained gold.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

Woodley’s Shear, showing significant and recent intersections:

Follow-up reverse-circulation (RC) drilling is planned to test the shallow, up dip extensions of the mineralised shears, with further diamond drilling now also in the works to extend drill coverage to the south. This work will be completed in parallel with the planned development works at Rothsay.

All holes drilled to date are on the southern boundary or outside the May 2018 MRE. As such, given the positive results so far, there is considerable potential to extend Mineral Resources on Woodley’s and Woodley’s East Shears further south, as those zones are open and contain high-grade results at their southern extremities.

To date, 10 holes have been logged and sampled, with seven submitted for assay. Further results from the current program are expected within the next few weeks. The balance of assays from the most recent RC drilling program at Rothsay are still pending.

On top of that, procurement of major packages for the development of the Rothsay Project, as well as key contractor proposals, is also progressing well.

Underground mining contract procurement will begin in Q4 this year.

The team has also appointed an experienced construction manager as the project continues to ramp up. Further appointments are scheduled later on this month.

Further to that, project approvals are now in their final stages, with the Mining Proposal and Project Management Plan submitted to the Department of Mines, Industry Regulation & Safety (DMIRS). Additional approvals are expected to be progressed during the December quarter.

PCF Capital Group (PCF), EGA’s financial advisor, has begun engaging with a range of financing groups. A Financing Information Memorandum outlining the Rothsay opportunity has been provided to help these groups better understand the project, with a financing solution anticipated to be completed over the coming months.

EGA’s longer-term growth aspirations are based on a strategy of utilising the cash-flow generated by an initial mining operation at Rothsay to target extensions of the main deposit and explore the surrounding tenements, which include a 14 kilometre strike length of highly prospective and virtually unexplored stratigraphy.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.