First Growth tech investment drives shares higher

Published 21-FEB-2019 13:53 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

First Growth Funds Ltd (ASX:FGF) secured an investment in GlobexUS Holdings Corp for US$250,000 in February, and in this month alone the company’s shares have increased more than 30%.

Globex is a technology company, with offices in Europe and the US, providing a software platform for issuing, managing and trading of regulated security tokens that are fully compliant and operate under a financial services licence.

This makes it a good fit with First Growth, a diversified investment company focused on investing across a broad range of asset classes including listed equities, private equity, blockchain and token offerings.

Globex is expanding into multiple markets by selling its solution to investment banks that provide institutional grade digital asset advisory, capital raising and secondary trading.

It isn’t surprising that this initiative has been well received by First Growth’s shareholders given the benefits that stem from teaming up with experienced partners when targeting relatively new industries.

A proven management team shapes the direction of GlobexUS Holdings Corp with founder Brian Collins having previously built proprietary equity trading solutions for Credit Suisse, and the group’s head of strategy Mitch Edwards brings extensive experience in the security token exchange industry from his time at tZERO.

Adapting to Australian regulatory conditions

Just as Globex’s technology is fully compliant with US regulatory authorities, the platform will be authorised under an AFSL in Australia.

The group is powering the security token offerings for New York-based and fully licensed investment bank TriPoint Global Equities.

First Growth’s investment in Globex provides exposure to the growth of this technology around the world and also the opportunity to partner with leading players in bringing this solution to the Australian market via First Growth Advisory.

First Growth Advisory has signed a partnership agreement with Globex granting the exclusive rights to sell the Globex technology platform in Australia and New Zealand to other investment banks, advisory firms and brokers.

TriPoint dealer agreement provides US exposure

First Growth has also signed a dealer agreement with TriPoint that will allow Australian companies to raise capital, providing exposure to US investors.

This will also mean that institutional and wholesale investors in Australia will have exclusive access to US and Australian security token offerings.

On this note, executive chairman Anoosh Manzoori, said, “We see these new exclusive partnerships as an opportunity to support local companies wanting access to funding in new markets.

“We can also help enable and support local investment banks and advisory firms to gain liquidity of illiquid assets.”

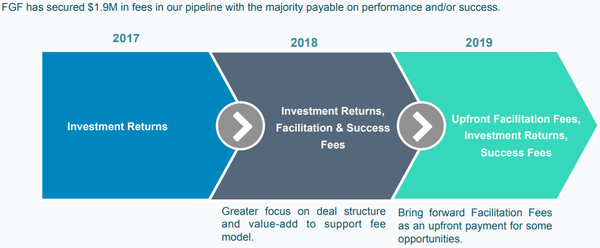

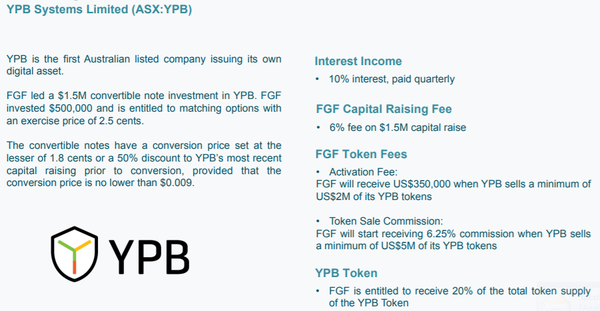

The following demonstrates First Growth’s success in assisting ASX listed entities.

First Growth Advisory can receive fees from advising on security token offerings, listing fees, capital raising and transaction fees.

Additionally, it can receive fees from licensing the technology in Australia and NZ.

Consequently, this is an important development for the group as it opens up new sources of revenue and the potential to grow its client base through providing a broader product offering.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.