The first arrow of Abenomics: why is it not working?

Published 24-NOV-2016 12:23 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

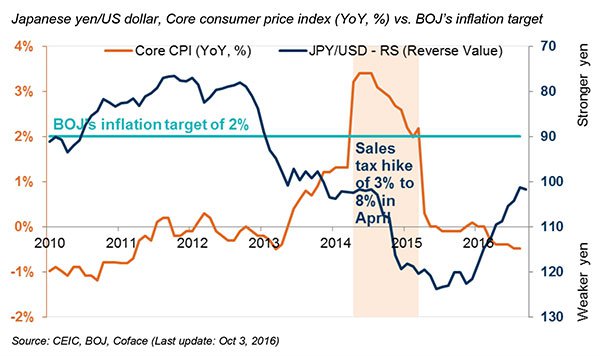

Since the launch of Abenomics in early 2013, the Bank of Japan (BOJ) has been aggressively easing its monetary policy, commonly known as “the first arrow of Abenomics”.

These measures have included the introduction of “Quantitative and Qualitative Monetary Easing (QQE)” in April 2013, the modified “QQE with a Negative Interest Rate” in January 2016 and the most recently announced “QQE with Yield Curve Control”, in September 2016.

Just over 3.5 years since its launch, the impact of the first arrow has become less effective, particularly on Japan’s exports and the yen.

Why did the yen depreciation, which occurred during the early success of the first arrow, not boost Japan’s merchandise export volumes?

The muted impact of the yen depreciation on exports could be easily explained by the external forces of subpar world economic growth, which has been weighing on global merchandise trading activities, including Japan’s exports.

A more structural reason is the “pricing-to-market” behaviour of Japanese exporters, which is keeping export prices steady at the foreign-currency equivalent of their domestic prices – despite the level of the yen. This is limiting the stimulation of demand for Japanese exports.

Which industries could be impacted most when the yen price fluctuates?

Due to this pricing-to-market behaviour, the growth in operating profits of Japanese manufacturers emulates fluctuations in the yen. The BOJ’s aggressive monetary stimulus should therefore have cheered Japanese manufacturers.

Another important factor determining the impact of the yen’s fluctuations on the profitability of Japanese manufacturers could be the share of invoice currency in their exports. Industries with a lower degree of exported product differentiation, resulting in a smaller share of invoicing in yen, are more sensitive to fluctuations in the yen.

These industry players are therefore more vulnerable during times of yen strengthening, but enjoy boosted profitability during times of yen weakening.

Combining these theoretical and empirical assessments, the textile and chemical industries are more vulnerable in times of yen strengthening, while the general machinery industry is relatively less so.

The strengthened expansionary monetary policy appears to be losing steam. What will happen next?

In theory, an increase in money supply, amid expansionary monetary policy, should lead to currency depreciation. However, against the backdrop of market turbulence in 2016, the safe haven status of the Japanese yen kept it a somewhat stronger level, despite the country’s strengthened expansionary monetary policy. With all things being equal, the marginal effects of further monetary stimulus are likely to diminish.

“The latest figures suggest that Japan could, once again, be in a liquidity trap. What is more alarming is that there has been little sign of the risks of deflation waning. With limited room for either monetary or fiscal policy, the Japanese government needs to undertake bold deregulation and structural reforms in order to boost productivity and growth in wages. Otherwise, Japan’s situation of low-growth and deflation is set to remain”, said Jackit Wong, Asia-Pacific economist of Coface.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.