Fair Work Commission wage decision no time for middle ground thinking

Published 30-MAY-2019 11:04 A.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a decision that is likely to immediately impact consumer confidence and discretionary retail spending, the Fair Work Commission is about to hand down its annual minimum wage decision that will impact 2.2 million workers from July 1, 2019.

Encapsulating the various scenarios that could emerge, particularly given the wide range of expectations between political parties, employee groups, industry bodies and the unions, The Australian reported:

The Fair Work Commission will tomorrow hand down its annual minimum wage decision revealing the quantum of the pay rise that will flow through to 2.2 million workers from July 1.

The Australian Council of Trade Unions (ACTU) wants the minimum wage lifted by $43 a week to $762.20 a week but employers have called for the rise to be limited to about $13 to $14 a week in line with the inflation rate.

On top of this year’s claim for a six per cent rise, unions want the minimum wage lifted by a further 5.5 per cent next year to bring the minimum wage to 60 per cent of median earnings.

The Australian Chamber of Commerce and Industry has urged the commission to grant a maximum $12.95-a-week increase, describing it as an “appropriate and prudent level of increase”.

Scott Barklamb, the chamber’s workplace relations director, said a 1.8 per cent increase would see the minimum wage keep pace with price increases, while maintaining the purchasing power and living standards of lower-paid workers.

Is keeping pace enough or too much?

However, some economists say that we need to be doing more than just keeping pace, particularly in light of the long-term stagnant wage growth that workers having endured for some years now.

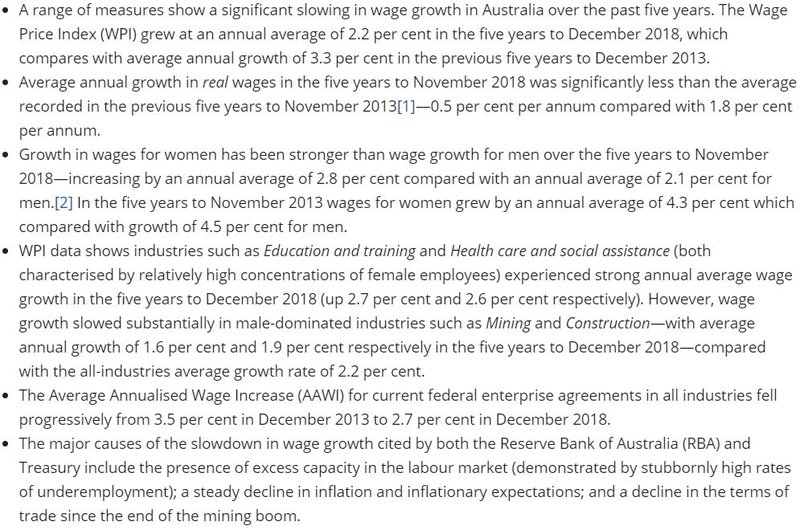

In raw figures, the Wage Price Index tells the story with five-year growth to December 2018 of 2.2% well below the 3.3% achieved in the five years to December 2013, with the latter coming off the back of the global financial crisis.

The spotlight turns to productivity

It could be argued though, that today employers are more cognisant in terms of linking productivity to employment, with an accelerated trend of transitioning full-time employees to permanent or non-permanent part-time positions.

As indicated above, there is consensus between the RBA and Treasury in determining the causes of the slowdown in wage growth with the main factors being the presence of excess capacity in the labour market, a decline in inflation and inflationary expectations and a decline in the terms of trade since the end of the mining boom.

However, with headline unemployment numbers at historically low levels, using ‘excess capacity in the labour market’ would appear to be difficult to substantiate.

The headline numbers though don’t reflect the substantial drift from full-time employment to part-time employment.

Labour is akin to any other commodity

Just as the supply/demand dynamics for commodities drives prices in various directions, the same situation applies in the labour market, and manipulation or price-fixing always ends badly.

Artificially fixing labour prices at a certain level upsets the equilibrium - it won’t work in the commodities market and it won’t work in the labour market.

It comes back to productivity which can be externally stimulated by measures such as government incentives for business investment.

A good example of this was the introduction of the First Home Owners Grant which was reintroduced in response to the introduction of the GST, an initiative that impacted the housing industry and the providers of all that goes with the house from televisions to furniture to taps and toilets.

Employing a top-down approach provides equilibrium, as businesses generate income from investments which can then be used to hire more staff and/or increase the number of staff.

Both scenarios are healthy for wage growth as the former has the impact of reducing supply in the labour market, generally forcing employers to pay more at a time when the labour pool is shrinking.

However, it would be economically damaging for regulatory bodies to impose an arbitrary wage increase that will shut the doors of some businesses and lower the income generation from others, as this would reduce their capacity to pay wages.

As the famous German economist, philosopher, historian and political theorist, Karl Marx said, ‘The worker need not necessarily gain when the capitalist does, but he necessarily loses when the latter loses.’

Consequently, when aspirations for a middle ground decision which appeases the ACTU at $43/week is weighed up against the beleaguered manufacturing and retailing industry’s request for a $13.50/week increase, the populist path could be the most dangerous.

The former is for the best part an arbitrary figure intentionally aimed high with a view to asserting upward pressure on a decision which seems most appropriate, albeit not attractive on face value for workers.

Conversely, the latter is tied to hard and fast data in the way of the inflation rate, and it could be argued that it is more likely to maintain a healthy equilibrium which could then provide the platform for productivity driven wage growth.

Granted, in theory an inflation rate tied wage increase will only allow consumers to tread water, but as Marx said this is better than drowning when the capitalists go under.

And by capitalists we don’t mean Shorten’s ‘big end of town’, it will be businesses like the local corner store, coffee shop and pub that have to review their staff roster.

Businesses are already doing it tough

Retailers and distributors of goods to the sector have already been hard-hit as evidenced in the following chart which shows the 12 month performance of the S&P/ASX 200 Consumer Discretionary Index (ASX:XDJ) against the S&P/ASX 200 Index (ASX: XJO), home to Australia’s top 200 stocks across a range of sectors.

It was in the December quarter of 2018 that a sizeable disconnect between the XDJ (red line) and the broader market (blue line) started to emerge.

There has been a slight closing of the gap since the election with voters seemingly recognising that business confidence was directly related to job creation, employment stability and eventual wage growth when the forces of economic equilibrium are allowed to shape wage movements.

The XDJ is impacted by the share price performances of the many retailers and distributors of goods to the retail sector.

Share price performances are intrinsically linked to gyrations in earnings with growth driving share prices higher.

Constrained spending is one of the reasons why earnings growth has slowed in the sector.

The imposition of penalty rates or excessive wage increases will further diminish earnings, highlighting the fact that substantial arbitrary wage increases will upset the equilibrium, more than likely leading to diminishing sales as unemployment increases, consumer confidence is eroded and businesses react negatively to diminishing returns on investment.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.