engage:BDR integrations growth lifts revenue

Published 25-MAR-2019 10:46 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

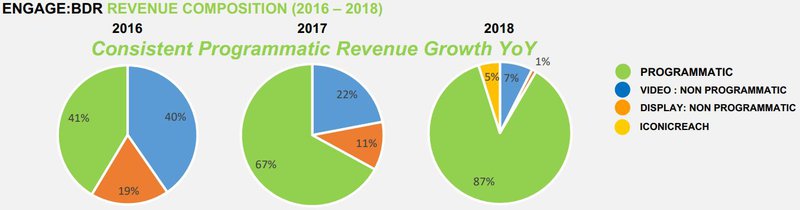

engage:BDR (ASX:EN1) has today provided a market update on its programmatic integration process, including time and cost expenditures.

The company’s proprietary technology acts as an intermediary between advertisers and website and app publishers by consolidating advertising inventory (video and display content); automating the sales channels and workflows for both advertisers and publishers; and offering precise targeting capabilities at scale to advertisers.

This automated process of online advertising inventory trading is called “programmatic advertising”.

EN1 has over 175 programmatic integrations including many large players in the US, European and APAC marketplaces.

Historically, advertising campaigns were purchased and sold manually with expensive sales people, paper contracts and 6+ month sales cycles (non-programmatic), which was both costly, political and inefficient. This streamlined integration process cuts out all external costs, only requiring engineer labour.

Beginning in 2018, EN1 had about 80 integrations on its platform; a year later and it has more than doubled that figure. More integrations mean more ability to generate revenue for every ad opportunity that a publisher produces.

And thanks to recent publisher activations, over the past few days, EN1’s end of quarter daily revenue through its programmatic integrations has been trending stronger than previous quarter’s average revenue per day.

This comes after EN1 last week announced the activation of dormant partnerships, which were generating about US$20,000 (~A$28,000) per day. Management has now reported that revenue per day has significantly exceeded those figures in the past few days and say a market update will be provided shortly with regards to these results.

EN1 reported that the vast majority of its integrated partners were challenging to obtain. That’s because viable programmatic players are very selective, seeking to only integrate with top-tier, highly credible companies that provide significant value within the programmatic ecosystem. These companies look to share their traffic, buyers, and demand with strong partners.

Following EN1’s acquisition of AdCel, integration opportunities grew significantly with the addition of AdCel’s 40+ incremental demand partners onto EN1’s platform. Note that AdCel’s 40+ demand partners are not included within the 175 engage:BDR integration figure, but are expected to be boarded over the next 18 months.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.