EMH drilling off to a solid start

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

European Metals Holding’s (ASX:EMH) drilling program at its flagship Cinovec lithium-tin-tungsten project is off to a solid start as it moves closer to a London listing.

The ASX-listed company has been hard at work on a drilling program at the project in the Czech Republic since August, aiming to move more of its inferred resources to the indicated category.

At the moment, EMH has its foot on an inferred resource of 514.8 million tonnes of Lithium Oxide ore @0.43% grade, and 72.7Mt of Tin ore @ 0.23% grade.

EMH is planning on drilling 13 holes as part of the program, but told investors today that it had gotten the results back from the first hole in the program.

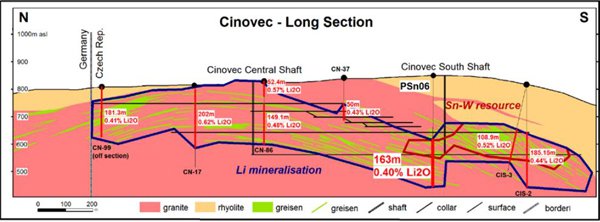

A cross-section of drilling at Cinovec

The hole intercepted 163m @ 0.4% lithium oxide from 238m to the end of the hole at 401.5m.

It twinned a historic drillhole, meaning EMH CEO Keith Coughlan said while the result were broadly expected, it was still an excellent intercept.

Meanwhile, it said that it had added a second rig to the drilling, meaning the drill rate has effectively doubled.

London calling

Alongside the drilling, EMH is attempting to list on the AIM of London.

Late last week it told its shareholders that it had gained admittance to the ‘AIM Schedule One’ list.

The Schedule One essentially starts the company’s formal admittance process onto the AIM, and the expected listing date is now December 10.

It has also been adding to its board in anticipation of the listing, with it aiming to bring on Kiran Morzaria as a non-executive director.

Morzaria is the chief executive and director or Rare Earth Minerals PLC, which is a major shareholder in EMH.

Rare Earth Minerals is best-known for being one of the two companies in joint venture at the Senora lithium project in Mexico, which was the subject of a conditional deal swung by Tesla Motors for lithium supply back in August.

It is expected Telsa will be a major purchaser of lithium going forward to power its Gigafactory, which manufactures lithium-ion batteries for its fleet of electric cars.

EMH also has a tie-up with Lithium Australia (ASX:LIT) via a non-binding heads of agreement to see whether material from the area could be used to produce high-quality lithium carbonate.

LIT is trialling new technology, licensed from private company Lepidico, which it hopes could be used to produce from lower-grade lithium micas, which would then be ready to sell.

EMH is also seeking to prove that its ore can be produced at scale using the process.

Interestingly, LIT also recently did a deal covering acreage next to that being exploited by Rare Earth Minerals in Mexico.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.