Elixir finishes on strong note, but wait, there’s more ...

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Elixir Energy Limited (ASX:EXR) has provided a promising update in relation to its 100% owned Nomgon IX CBM PSC in Mongolia.

Management has been awaiting critical information regarding adsorption results from the Nomgon 2 core-hole well.

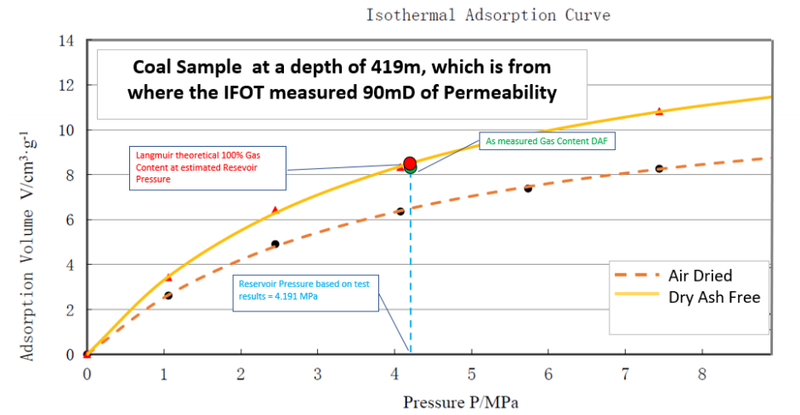

COVID-related issues have caused some delay as the laboratory results are being processed in Beijing, but the news was worth waiting for as it demonstrated that the lower 100 series coals at Nomgon-2 are fully gas saturated.

This is consistent with the Nomgon-1 well, representing a best-case scenario as it will greatly reduce the costs and other issues associated with water handling in future testing and production phases.

Proof of consistently strong adsorption results will positively impact the company’s production testing in 2021.

Elixir provides exposure to China’s five-year energy plan

With its extensive PSC landholding providing ready access to high demand markets in China, Elixir represents a compelling investment play for Australian investors in that it is one of only a few ASX- listed companies that offers exposure to the globally significant thematic of a de-carbonising and increasingly energy security-conscious China.

China’s new “5 year plan” dramatically reduces its reliance on other global powers for key resources, especially its energy supply with the added advantage of transitioning from burning dirty coal for energy.

Commenting on recent developments, Elixir’s managing director Neil Young said, "The consistent adsorption result from Nomgon-2 indicates that the earlier high gas saturation levels from Nomgon-1 were not a one-off and this is already feeding into our production testing plans for next year.

"COVID has been a universal factor for all of us in 2020 and although Elixir (and Mongolia) has generally been impacted much less than others, shutting in our operations for a month or so in the midst of the Mongolian winter is ultimately a prudent move.

"All 7 wells drilled this year intersected coal and we are already advancing the processes and plans required to hit the ground running in the New Year.

"Our planned technical program for 2021 will greatly expand upon 2020’s excellent work.”

The company’s outstanding progress has been reflected in its share price, up six-fold since January with the potential for further upside in 2021 given multiple catalysts are on the horizon.

Elixir now focused on 2021 production testing and exploration program

With the Mongolian winter now upon it, Elixir’s shut down of its operations over the next few months has proven to be fairly timely as some COVID restrictions have recently been applied due to community transmission.

However, Mongolia has been one of the lucky countries in that broader region with little interruption from COVID, and apart from some inconveniences in recent weeks, it has been business as usual for Elixir.

However, management isn’t taking any risks as it looks towards 2021.

In order to effectively manage health issues, as well as supporting the local community, Elixir has purchased 30,000 masks and 600 bottles of hand sanitiser for donation to the local authorities in the region of its PSC.

Elixir anticipates commencing its 2021 program in or around February with the drilling of a fully tested core-hole to follow up on the highly promising Yangir 1S strat-hole.

Some gas samples were obtained from the bubbling cores extracted in the Yangir well and these will be tested for gas composition shortly (gas content cannot be accurately measured given the absence of an on-site laboratory for what was only a low-cost strat-hole).

Management has recently submitted its formal budget and plan for 2021 to the Mineral Resources and Petroleum Authority of Mongolia (MRPAM) as part of an annual regulatory process required under the terms of the Nomgon IX PSC, which will also involve procuring subsequent environmental approvals from the relevant Ministry.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.