Drilling Imminent at Kingston Resources’ WA Gold Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

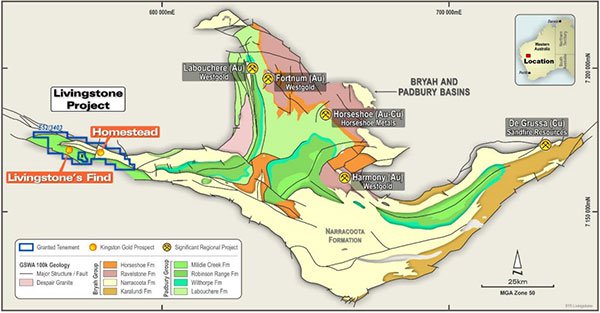

Kingston Resources’ (ASX:KSN) is set to begin drilling on its Livingston Gold Project in the Bryah Basin northwest of Meekatharra in WA.

Supported by the Western Australian Government’s 2018 Exploration Incentive Scheme, KSN will commence an 8000m RAB (Rotary Air Blast) drilling programme in mid-April. RAB drilling is designed to test for gold mineralisation at depth quickly and cheaply in variable terrain. This programme will test a number of gold-in-soil anomalies identified in KSN’s auger sampling programme last year around the Livingstone’s Find and Stanley prospects.

The programme is expected to be completed by the end of April with assay results by the end of May.

The Livingstone Gold Project hosts a 50koz gold Resource as well as a number of gold anomalies, with over 30 kilometres of prospective geological strike on the southern edge of the Bryah Basin.

The 100ppb surface gold anomalies cover more than four kilometres of strike along the southern margin of the Narracoota Formation on the Stanley trend, as well as anomalies two to three kilometres in length, striking parallel to lines of old workings at Livingstone’s Find.

Stratigraphically, the setting is similar to that at the Labouchere and Fortnum gold deposits, which are less than 80 kilometres away and can be seen on the above map.

As with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

Further auger drilling was completed in March to extend the 2017 coverage around Livingstone’s Find to the south, and to the northwest along the prospective margin of the Narracoota Formation.

A small auger grid has also tested for gold anomalism around the Winja prospect, which contains high-grade intersections in RC drilling such as 18m at 7.85g/t but with little to no exploration along strike.

KSN Managing Director Andrew Corbett said, “With drilling getting underway at Livingstone as well as Misima Island, this is the start of a very busy time for Kingston. We are looking forward to testing these auger anomalies at Livingstone’s Find, particularly given the high tenor of some of the auger results last year. With gold in the geochemistry, prospective stratigraphy, and numerous old workings throughout the area, we think this is an outstanding exploration target”.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.