CPH deliver Financials and Confirms US Cannabis Market Entry

Creso Pharma (ASX: CPH) has been a bumpy ride for us all over the last few years.

After riding the share price up, (then all the way down) following a failed $122M acquisition in June 2019, we decided to re-enter CPH as a short term trade in early October 2020 at 3c.

We liked the debt clean up and their valuation was crunched given the assets CPH holds.

We find that undervalued, turnaround stories offer the best bang for buck if you can find them, and we already had a good understanding of CPH.

We generally always hold long term positions, but our plan with CPH was to hold until the end of 2020. We wrote about CPH again in December when it was trading at 8c.

The stock then rocketed all the way up to 47c and seems to have found a base at around 20c.

As planned, we sold a portion of our position and locked in some profits (unfortunately for us we comprehensively missed the high point...).

In January, we changed our plan and decided to hold onto a significant position in CPH for at least three to six months, after we were encouraged by the progress made by the company on its turnaround plan and the CPH share price performance.

The company just released its preliminary financial reports for the year, which as expected show a bunch of impairments, debt clean ups and other scary looking one off costs that come with a balance sheet clean up - these are all out of the way now.

Sales in the reporting period were also impacted by COVID from the previous corresponding period, but we expect them to ramp back up now.

This was all expected.

Looking forward, the CPH share price seems to have consolidated around 20c and a $200M market cap and the company has begun 2021 with record sales and purchase orders.

We have decided to hold on to what has become a pretty decent sized position in CPH now that the clean up and turnaround is progressing nicely...

... and almost on cue CPH has just lobbed in a nice new announcement:

CPH just entered the US market - A$5M sales target

The US market is just about to break open with new legislation set to unlock a massive market. CPH is looking to capitalise on this immediately.

CPH today confirmed the signing of a non-binding Letter of Intent with CERES - an established provider of plant based medicines and CBD products, with US$35M in revenue since 2013.

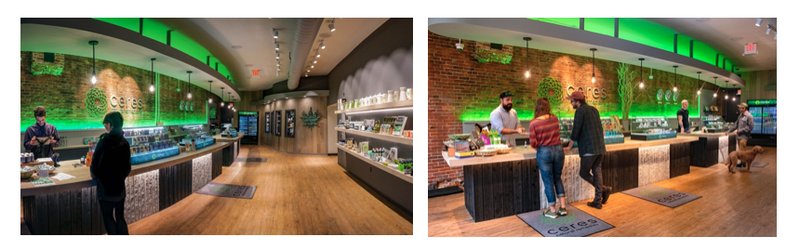

The company has 50,000 outlets in the US: its flashy flagship store in Burglinton, Vermont is shown below. We could definitely imagine CPH’s products on the shelves here.

Whilst initially only a Non binding Letter of Intent; under the agreement the parties are to enter into a formal commercial agreement on or before 1 April 2021.

This is only a few weeks away and should provide a share price catalyst.

CPH and CERES are aiming to sell A$5M of CPH over the first two years - subject to US federal legislation of CBD.

And from what we can see, Federal legislation reform is imminent: 2021 is shaping up to be a big one for marijuana reform.

Activists and lawmakers are finding allies in governors across the country, with numerous State of the State addresses and budget speeches including calls for legalisation.

From New York to New Mexico, top policymakers have signalled that cannabis policy reform is a legislative priority for 2021.

This is good news for CPH, given it has already lined up an established distribution partner.

Number of POs signed recently

On top of today’s news, CPH continues to sign up all important Purchase Orders (POs), which ultimately translates to revenue into the company’s bank account.

A few weeks ago the company secured four new POs totalling over A$500,000.

CPH’s Canadian subsidiary is on track to deliver a record quarter of POs.

The company also secured a distribution agreement to enter Pakistan with a minimum order quantity of A$2.48M.

Today’s news is a big milestone for CPH and sets the stage for a bumper 2021.

Read our full analysis on the CPH News

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.