Classic returns to high grade Kat Gap Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There has been a flurry of promising news from Classic Minerals Ltd (ASX:CLZ).

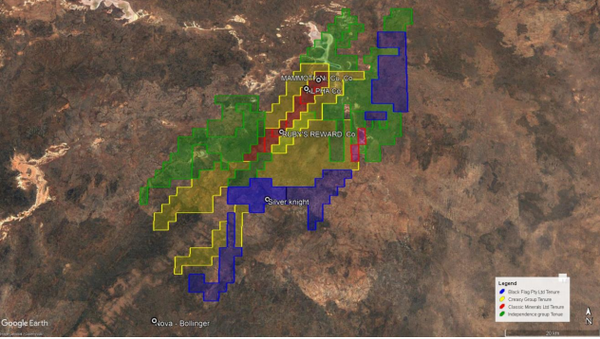

The most significant news is that management has negotiated an Earn-in and Joint Venture Agreement over the company’s Fraser Range tenements with Independence Newsearch Pty Ltd, a 100% owned subsidiary of one of Australia’s largest diversified miners in Independence Group NL (ASX:IGO).

Having Independence Group as a partner is a good sign as the group has a strong history of identifying quality assets, as well as having an intimate knowledge of the Fraser Range region.

Under the agreement, Independence will continue to advance the Fraser Range Project allowing Classic to focus exploration efforts on its emerging high-grade Kat Gap Gold Project located in the Forrestania area of Western Australia.

While there are a number of aspects to the agreement, if Independence Group elects to buyout Classic then it would have received aggregate value of $4.55 million in cash and tenement expenditure, as well as retaining a 1% net smelter royalty from the transaction.

This really demonstrates that while Classic is an emerging mining company, it is punching above its weight as highlighted by the company’s chief executive Dean Goodwin in saying, “This is an exciting development for Classic shareholders.

“The Agreement we have reached with Independence demonstrates the highly prospective nature of our Fraser Range tenements.

“Independence is a highly regarded exploration and mining company and we look forward to working with them for both parties’ mutual benefit.

“Their commitment to inject cash and tenement expenditure to a maximum of $4.55 million and providing a 1% NSR (net smelter royalty) gives the company confidence in the value of these tenements.”

Goodwin also pointed out that the agreement will help to simplify the group’s operations, allowing its exploration team to focus its efforts on the emerging high-grade Kat Gap Gold Project in the Forrestania region of Western Australia.

Classic pursues further high-grade mineralisation at Kat Gap

Providing further interest is Classic’s return to drilling at Kat Gap after a highly successful exploration campaign was conducted in 2018.

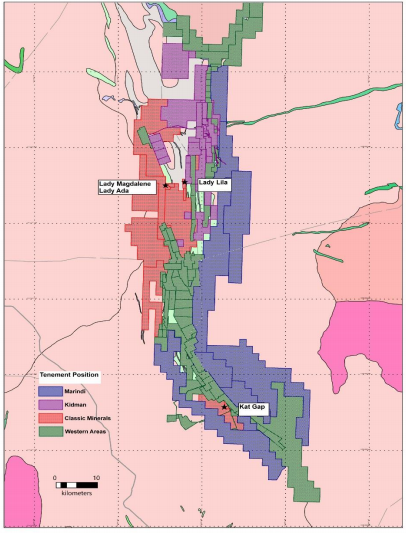

The Kat Gap Project is strategically located, approximately 70 kilometres south-south east of the company’s Forrestania Gold project containing the Lady Magdalene and Lady Ada gold resources.

Kat Gap also adjoins the Forrestania Nickel Project currently operated by Western Areas Ltd (ASX:WSA).

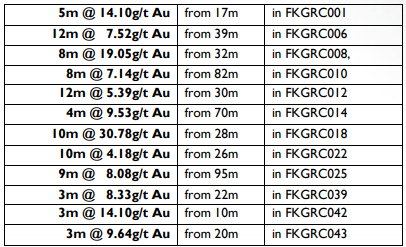

Reverse circulation (RC) drilling by Classic at Kat Gap has returned outstanding high-grade gold intercepts from shallow depths as highlighted below.

Scoping study conducted by Sons of Gwalia

Kat Gap has an interesting history in that the project contains a shallow unmined gold deposit discovered in the 1990s which was the subject of resource estimations and a scoping study by Sons of Gwalia in 2003.

Resources were estimated at 283,000 tonnes at 3.9g/t gold for 36,000 ounces at a 1.5g/t cut-off grade.

Though this resource estimate was not reported in compliance with the JORC Code (2012), it doesn’t take away from the promising results which have been backed up by high-grade RC drill intercepts including 15 metres at 15.1 g/t gold from 39 metres and 6 metres at 19.1 g/t from 17 metres.

The open-ended deposit lies within a five kilometre long geochemical gold anomaly that has seen very little drill testing, and there is potential for the discovery of a substantial gold deposit within the project area.

Previous exploration work includes airborne geophysical surveys, including aircore, RAB, RC and diamond drilling and soil geochemical surveys.

Classic has drilled a total of 57 holes for nearly 3900 metres at Kat Gap over the 6 months from May to November 2018.

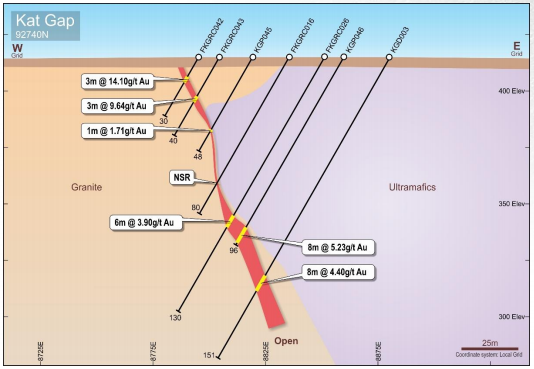

The early drilling was focused on testing the up-dip and down dip projection of previous historical high-grade gold intersections along the main granite-greenstone contact adjacent to a cross-cutting Proterozoic dyke.

Later drilling was then concentrated on an area north and south along strike from the dyke, covering a strike length of some 200 metres on the granite-greenstone contact.

Classic has completed 4 drilling campaigns at Kat Gap all returning significant high-grade gold intercepts.

The majority of the drilling is relatively shallow, down to approximately 60 metres vertical depth below surface.

However, several deeper RC holes have also been drilled to approximately 120 metres to test the main contact zone at depth.

These holes were primarily designed to test a potential plunge zone detected by the shallow RC holes, and some of the better results included 9 metres at 8 g/t gold from 95 metres and 1 metre at 18.8 g/t gold from 86 metres, indicating that economically viable high grade mineralisation could be present down dip.

Potential share price catalysts in July

Understandably, management is upbeat about heading back to the Forrestania Gold Project to undertake further follow up drilling.

This latest round will be focused solely on the Kat Gap project, as it has delivered outstanding results over the previous four drill campaigns.

Drilling will again focus on the main granite – greenstone contact of which only 200 metres of a total 3.5 kilometres of potential strike has been tested by the company.

Management is planning to drill 100 metres north along strike and also test for high grade gold mineralisation up-dip from previous bonanza intersections to see how close the gold gets to the surface.

This information will be extremely important in any future mine planning and pit design work.

Future drilling programs at Kat Gap will focus on testing an 800 metre long section of the main granite – greenstone contact where current drill line spacings are 100 metres apart and also within the granite itself where previous geochemical surveying detected high grade gold near the surface.

The granite has for the best part been overlooked by previous explorers, and management is confident that significant gold mineralisation can be identified in the granite.

Assay results are expected to emerge in mid-July, possibly providing share price momentum.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.