Castillo reveals confidence boost for cobalt mineralisation at Broken Hill

Published 19-MAR-2018 11:09 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

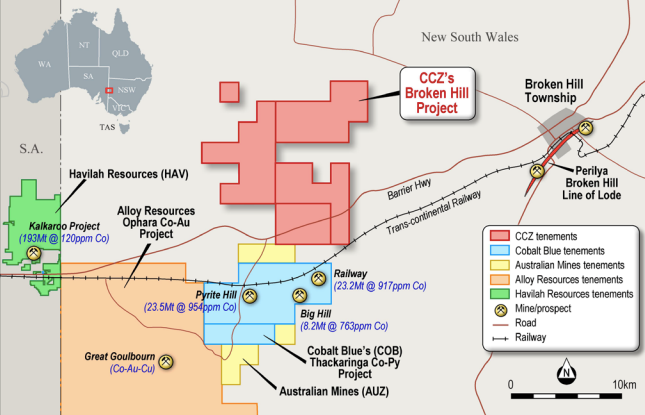

Castillo Copper (ASX:CCZ) has today informed the market than an encouraging desktop report from geology consultant, Xplore Resources, has highlighted considerable potential for additional cobalt mineralisation and favourable zones of outcrops across the company’s Broken Hill Project.

This prolific NSW region is steadily emerging as a new global supply chain hub, especially given current cobalt sentiment.

CCZ’s peers, Cobalt Blue (ASX:COB) and Havilah Resources (ASX:HAV), have confirmed cobalt resources here. Alloy Resources (ASX:AYR) and Australian Mines (ASX:AUZ) have also recently revealed encouraging exploratory results.

Specifically, HAV has reported 193.3Mt at 120 parts per million of cobalt. COB’s Thackaringa resource, on the other hand, contains 54.9Mt at 910 parts per million of cobalt.

Broken Hill’s location in relation to peers

Previous exploration here has primarily focused on traditional Broken Hill mineral systems – zinc, lead and gold – but with rapidly growing demand for battery grade minerals, the economics are increasingly favourable for cobalt.

With the cobalt price sitting at around US$85,000 per tonne, CCZ is keen to fast-track its exploration program to ascertain the full extent of cobalt mineralisation across the tenure, with a core focus on targeting known host mineralised areas.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice

Interestingly, there is also material exploration upside within the tenure, as some 75 per cent is covered in alluvial sand, especially significantly where the outcrop is visible, with legacy assay results indicating the presence of cobalt.

To uncover incremental target areas of sulphide-hosted cobalt mineralisation below the alluvial sand, CCZ plans to deploy heliborne electromagnetic geophysical survey technology – this has been successfully utilised by both COB and AUZ. Also beneficial for CCZ is that extracting cobalt from sulphides is proven to be materially simpler and more cost effective than laterites.

Importantly, re-opening the Cangai Copper Mine remains CCZ’s primary focus, with the second drilling campaign set to target supergene ore – an update on legacy stockpiles is expected in the near future.

Xplore Resources are currently reviewing additional available geophysical survey data, with a further update expected shortly.

CCZ chairman, Peter Meagher, said: “With the cobalt price around US$85,000/t, the board has mandated Xplore Resources to fast-track understanding the extent of cobalt mineralisation and develop the inaugural drilling program for our Broken Hill asset.”

“Indeed, the board is cognisant the region is emerging as a new potential supply chain hub for cobalt which augurs favourably for CCZ, particularly given its proximity to peers with defined JORC resources.”

“CCZ believes focusing on reopening the Cangai Copper Mine and concurrently gaining a deeper understanding of the cobalt potential at the Broken Hill asset are key forward value drivers,” added Meagher.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.