Canyon increases indicated resource at Minim Martap by 850%

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

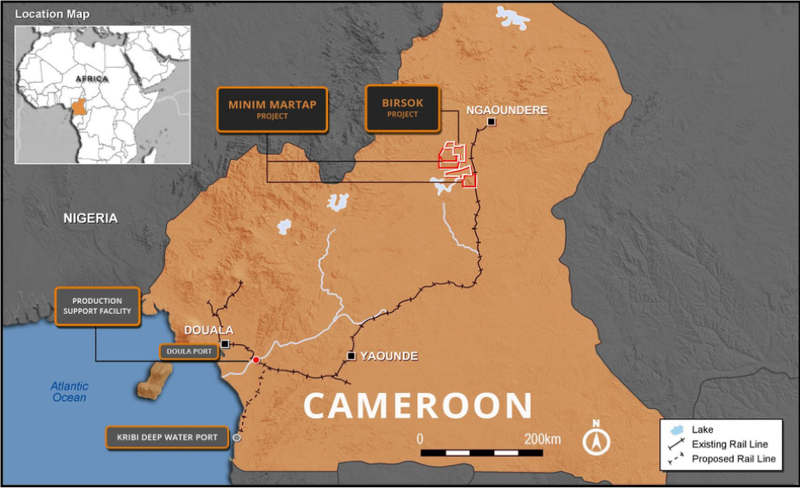

Canyon Resources released a substantial resource upgrade for its 100%-owned Minim Martap Bauxite Project in Cameroon, a development that will have a significant impact on the company’s upcoming prefeasibility study.

The total tonnes have increased by 62%, and the 850% increase in the Indicated Resource component confirms the Minim Martap Project is a global tier 1 Guinea style bauxite resource.

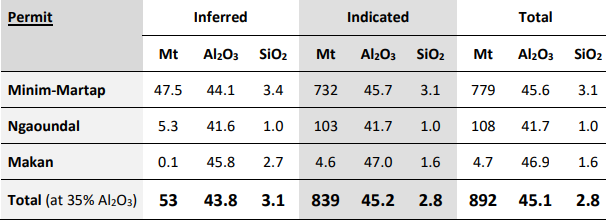

The Minim Martap Project now has a total resource estimate of 892 million tonnes at 45.1% alumina (Al2O3), 2.8% silica (SiO2) (cut-off Grade 35% Al2O3).

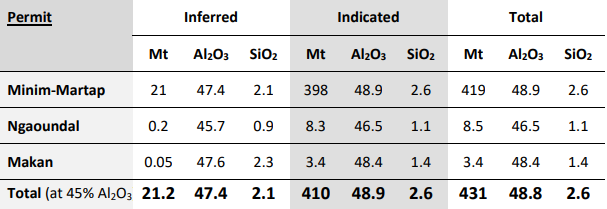

This includes an Indicated Resource of 839 million tonnes at 45.2% Al2O3, 2.8% SiO2 (Cut-off Grade 35% Al2O3), and a high-grade Indicated Resource of 431 million tonnes at 48.8% Al2O3, 2.6% SiO2 (Cut-off Grade 45% Al2O3).

Prior to the upgrade, Canyon had 466 million tonnes grading 46.2% Al2O3 in the Inferred category and only 88 million tonnes in the Indicated category.

The revised estimate has resulted in the higher confidence Indicated category increasing by 343 million tonnes to 431 million tonnes at the superior grade of 48.8%, a key takeaway in terms of the substantially higher value that can now be attributed to the resource.

Management to broaden the scope of the PFS

The resource upgrade was a much anticipated development for the company, and promising drilling results in the lead up no doubt provided investors with a significant degree of confidence.

This quite likely contributed to a significant increase in Canyon’s shares in the last fortnight as they surged nearly 20% prior to entering a trading halt last Wednesday.

As investors digest the impressive numbers embedded in the resource upgrade, further share price upside could be expected.

The scale of this upgrade, along with other positive developments that point to a potentially larger premium quality resource than initially expected has prompted management to broaden the scope of the PFS which is due to be released in the March quarter of 2020.

Canyon managing director Phillip Gallagher said, “Upgrading the Minim Martap resource to nearly 900 million tonnes of high-grade and low contaminant bauxite confirms Minim Martap Project as a global tier-1 bauxite asset.

“We are now in a stronger position to negotiate off-take deals and commence discussions with major companies to advance development of the project.

“The bauxite is proven to be very gibbsite-rich with negligible boehmite, making it suitable for use in both high and low temperature alumina refineries.

“The Minim Martap Project is now one of the largest, if not the largest Guinea-style, high-grade, low contaminant bauxite deposit located outside of Guinea with accessible and operating infrastructure including an existing rail and two potential port options.

“As more than half the world’s seaborne bauxite supply is sourced from Guinea, Minim Martap will be a valuable and strategic global asset for major refiners looking to secure different streams of high-grade bauxite.”

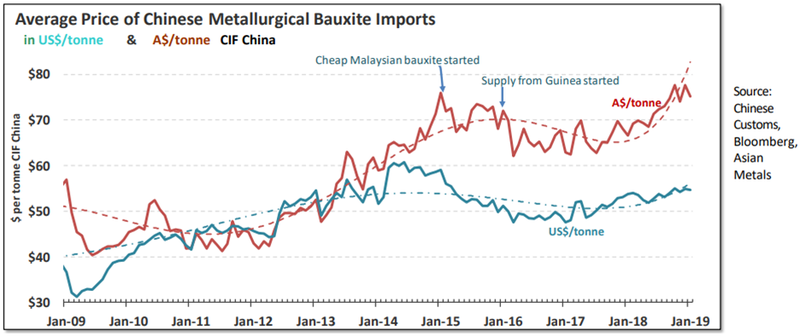

Indeed, as the chart below demonstrates, the high grade product that became available from Guinea only in the last few years has experienced strong demand.

This resource upgrade follows the successful first year of extensive evaluation and detailed fieldwork completed by Canyon since being granted the project on July 11, 2018.

Work focused on reviewing and verifying past exploration findings, identifying and mapping all the target bauxite plateaux and testing new previously unexplored bauxite plateaux.

Combined exploration completed on the project by both Canyon and the previous owners of the project has tested less than 50% of the identified bauxite plateaux, with some of the larger plateaux yet to be drilled.

Importantly, this section is close to the rail link which will facilitate transport to a deep water port.

This is how the numbers read at a lower cut-off grade - take note of the extremely low level of SiO2, a deleterious by-product that at higher levels can significantly decrease the value of the end product.

Minim Martap Project Resource JORC (2012) – Cut-off Grade 35% Al2O3

The 45% plus AI2O3 resource as indicated below is highly sought after for use in Chinese smelters.

Positive impact on PFS

Resource estimation work completed on the bauxite ore shows the bauxite is near-surface and contains minimal levels of lower grade bauxite as overburden or intra-burden material.

Canyon completed a series of digestion analyses on bauxite ores within the Minim Martap Project, confirming the suitability of the ore for processing, and the low levels of deleterious elements.

The test work confirmed the high quality nature of the bauxite present and the suitability of the ores to both low and high temperature digestion within Bayer Process alumina plants globally.

The PFS will evaluate the economic and technical viability of the existing bauxite resource to support a bauxite mining operation.

This work is focused on delivering an optimal rail and port solution for the project along with an ongoing ESIA study.

As part of an ongoing geological evaluation, Canyon is reviewing the remaining plateaux throughout the tenements which were previously identified as prospective for bauxite resources.

Recent exploration yielded very high-grade bauxite results in the Makan tenement.

Management is confident that the recent success of this first program in the Makan tenement can continue throughout the identified plateau areas yet to be explored.

The Makan drilling explored a very small percentage of the new plateau areas identified by the company’s geological team, with large areas of identified yet unexplored plateau remaining to be tested.

Canyon has arguably flown under the radar for some time, but with the release of the expanded PFS looming large and news regarding further exploration, and infrastructure initiatives on the horizon it is likely to remain under the spotlight.

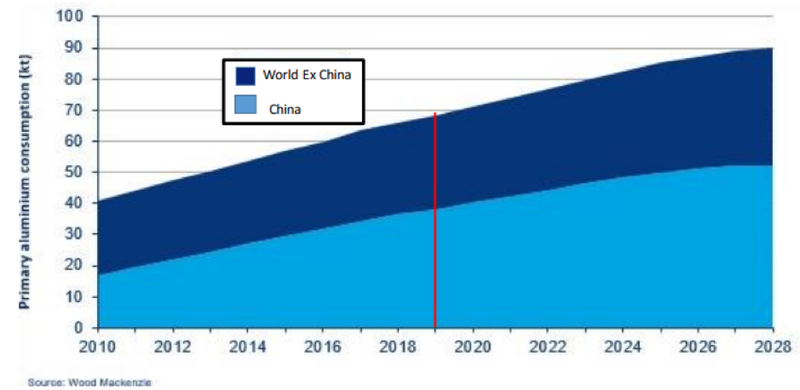

The company also has macro factors working in its favour as indicated by the following graph which highlights the increase in consumption that is forecast to occur over the next 10 years.

Guinea is forecast to mine more than 65% of global bauxite by 2028, and there is scope for Cameroon which lies not far to the south to ride on the coat-tails of this trend, particularly given the premium quality product aligns closely with that mined in Guinea.

As a means of measuring Canyon’s ability to take a similar path to companies that have developed a strong position in Guinea, this is a snapshot of one of the major players.

Following the discovery of high grade sedimentary bauxite in the Sangaredi basin, CBG was a joint venture established to exploit the resource between the government of Guinea (49% share), and Halco Mining, which is itself a consortium of Rio Tinto with (22.95%), Alcoa (22.95%), and Dadco Mining (5%).

Under the management of Alcoa, the 16 million tonnes per annum operation extracts bauxite with over 50% alumina and between 2% and 4% silica content, with the majority of production exported to Alcoa and Rio Tinto's downstream refineries.

Canyon can easily match it with this operation in terms of the minimal silica content, and various sources indicate that the alumina content of Guinea bauxite fluctuates from just under to just over 50%, comparing favourably with Minim-Martap’s high-grade ore which has an alumina content of 48.9%.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.