BPM’s Lead-Zinc Project Finally Granted - Now They Can Drill It

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 1,670,000 BPM shares and 850,000 BPM options at the time of writing this article. S3 Consortium Pty Ltd has been engaged by BPM to share our commentary on the progress of our investment in BPM over time.

We invested in BPM Minerals (ASX:BPM) back in May 2021 because we liked their lead-zinc project next to Rumble Resources' discovery that saw it’s share price spike 800%.

We were expecting to see BPM’s newly acquired Hawkins lead-zinc project get fully granted and “drilled before Christmas” last year...

The BPM share price almost hit 60c in anticipation that the Hawkins project was going to be granted and drilled in the expected time frame...

It didn’t... and short term investors moved onto the next shiny thing, and BPM has been bouncing around the low 20s for a couple of months.

We are pleased to report that today we have finally received the crucial news we have been waiting for over the last 8 months:

BPM announced that Hawkins project has FINALLY been granted, and with a bit of prep work still to do it looks like it will be drilled sometime in H2 this calendar year.

Drilling of the Hawkins project is the main reason we are invested in BPM.

Some exploration investments require a lot of patience.

BPM’s Hawkins project sits along strike to the north-west of Rumble Resources' lead-zinc discovery which took the market cap of Rumble as high as ~$430M.

Rumble, who will end up owning 75% of the Earaheedy Basin projects after they deliver a BFS, managed to re-rate significantly on this discovery.

BPM is right next door in the basin, with ground pegged before the Rumble discovery, and - is only capped at ~ $13M, with $4.4M in the bank.

We have always re-iterated that our investment in BPM was centred around BPM’s low market cap and leverage to a discovery the size of Rumble Resources’ - it us a very early stage exploration investment and is high risk.

We think that the Hawkins project is BPM’s shot at getting that big discovery.

Today’s announcement is the final milestone we were waiting on before BPM can start seriously exploring its Earaheedy Basin projects.

We expect the BPM team to now push ahead with all of the drill target generation work (soil sampling, mapping, surveying) necessary to identify the highest priority drill targets with the highest probability of getting us that discovery.

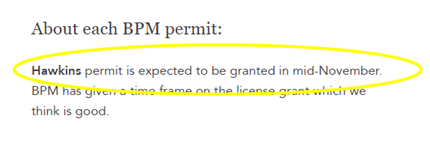

Back in October 2021 we said we expected BPM to be granted the project in mid-November, so seeing it come through a few months late is not ideal and the share price was punished accordingly, but at least it is now finally granted.

Generally, project granting is outside of the control of management and can be prone to delays.

It was a tough wait, but we are very pleased that BPM have managed to get the permitting finally sorted.

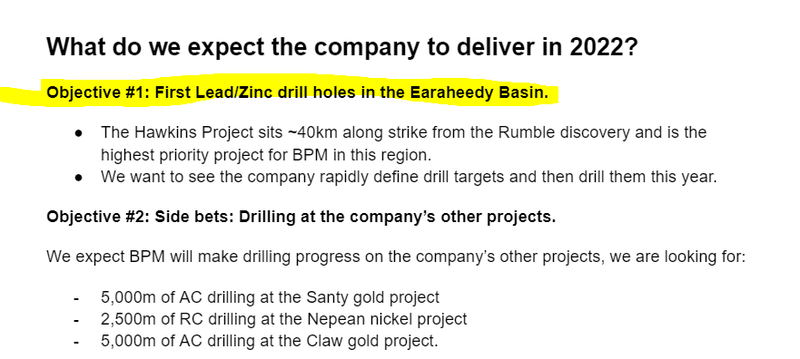

One of the key objectives we set for BPM in our 2022 Investment Memo was for the company to drill its Earaheedy Basin tenements. Today’s news is the first step towards BPM achieving this.

After today’s news, we were eager to get onto this note and do a deep dive into what the granting of the project means for BPM. Our deep dive will focus on the following:

- Why we think the Hawkins project is the best prospect for BPM to drill

- Why the Earaheedy Basin is the place to be (regional context)

- Commentary on the Zinc markets

For a quick high-level summary of why we invested in BPM, why we continue to hold BPM, the key objectives for 2022, and risks, see our 2022 investment memo for BPM or click the button below:

What's next for BPM at the Hawkins project?

With the Hawkins project now granted we expect BPM to get started on pre-drilling works as soon as possible.

In today’s announcement BPM detailed the following work programme as the immediate next steps over the Hawkins Project:

- Getting heritage and cultural clearances from traditional land-owners in the region. (Expecting this to be done by early March).

- At the same time BPM will get Earthworks and pad-clearing works started.

- 8,000m AC/RC drilling program to start as soon as the earthworks are completed.

We are most looking forward to the 3rd point - the 8,000m AC/RC drilling program.

We particularly like that BPM have managed to secure the same ‘lucky rig’ that was used by Rumble Resources on the Chinook discovery. Hopefully the drilling contractor can apply their learnings onto BPM’s grounds.

We also like that BPM recognises the modern day discoveries in the Earaheedy Basin have all been drill-lead discoveries and previous programs missed key mineralised zones because of underpowered rigs.

BPM said the following in today’s announcement “BPM has ensured that its drill contractor has a powerful rig capable of punching through tough drilling conditions”.

Like any micro cap stocks, an investment with BPM is risky.

What are the risks?

- Licensing risk: There is always a risk with exploration projects that the necessary approvals/agreements like land-access, heritage & native title agreements are not reached and permits can go un-granted.

- Exploration risk: BPM's projects are very early stage, most are yet to have high-priority drill targets identified, any drilling programs done in the near-term could return no mineralisation.

- Timing Risk: We originally invested in BPM back in May 2021, hoping they would drill the Hawkins prospect before Christmas 2021... that definitely didn't happen so we now take BPM’s timelines with a grain of salt - timelines may be delayed.

- Financing risk: BPM is a junior explorer with early stage projects. They still need to do a lot of target generation work before the projects are ready to drill, markets may lose momentum and funding for early stage higher risk exploration like this could dry up.

- Commodity Risk we are primarily invested in BPM for the lead/zinc drilling at Earaheedy, but the market may lose interest if lead and zinc prices cool off.

Why we think the Hawkins project is the best drilling prospect for BPM.

When we announced our initial investment in BPM we highlighted the Hawkins project as the main reason for our interest.

At the time, Rumble Resources had recently put out the drilling results from its Chinook prospect and the market cap had moved up as high as $500M.

We particularly liked that BPM had pegged the Hawkins project’s well in advance of Rumble’s discovery, picking up these tenements before the market became interested in the basin.

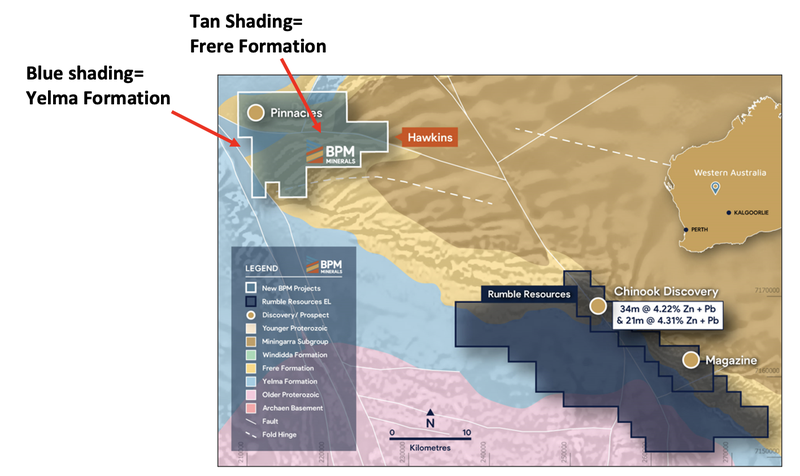

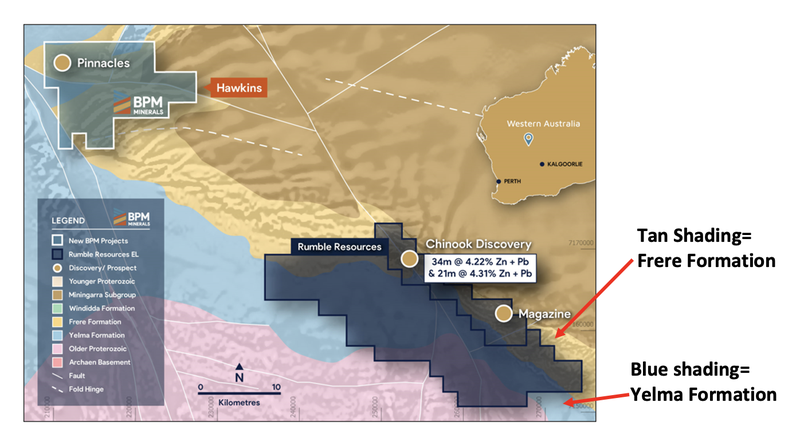

BPM’s Hawkins project sits ~40km northwest along strike from the Rumble Resources Chinook lead-zinc discovery and has similar “structural geological fundamentals” - which essentially means it sits on similar rock formations to the discovery.

Most importantly for us there are three key similarities between Rumble's discovery and the grounds that BPM now have access to after today’s news.

This next section gets a little bit technical, so bear with us.

The first similarity between Rumble’s discovery and Hawkins is related to the geological structure.

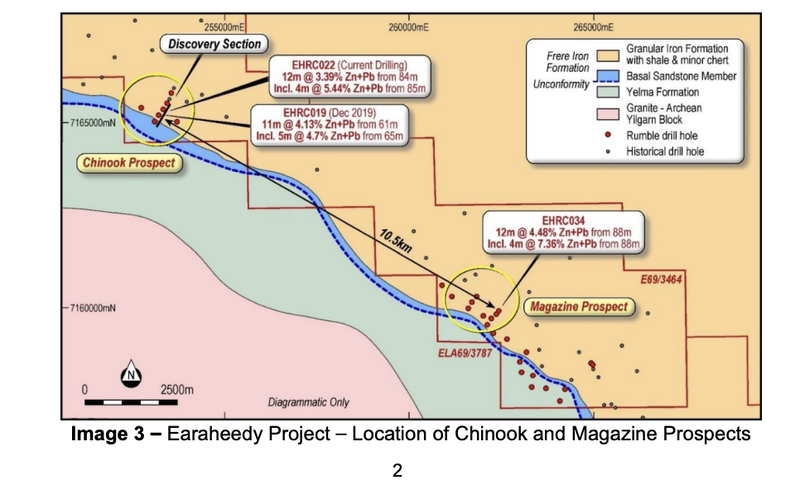

Looking at the image below, Rumble's discovery was made in an area where two rock formations meet, the Frere Formation (tan shading) and the Yelam Formation (blue shading).

BPM’s Hawkins Project covers ground where these two formations also meet in a different area of the Earaheedy Basin.

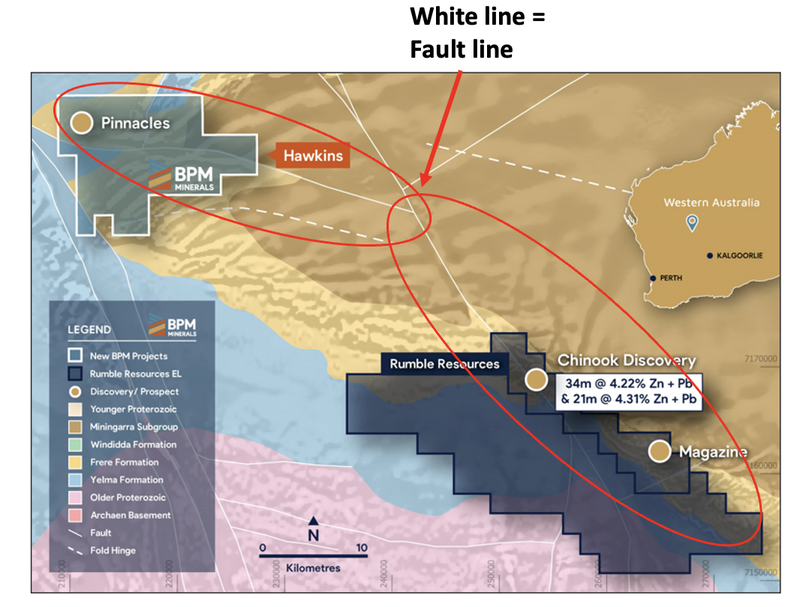

The second similarity is related to the fault-lines that run through the Earaheedy Basin

Rumble’s Chinook discovery sits right on top of a massive fault line that runs all the way through its tenements, northerly and then west straight through BPM’s Hawkins Project.

Importantly, the north-west trending fault line runs almost identically through both of these packages of tenements.

Another really important thing to note is that the Hawkins Project sits directly on top of this north-west major fault line that extends from the fault line on Rumble’s deposit.

Our arm-chair geologists interpretation is that fault-lines and secondary fault lines are where an increased probability of mineralisation occurs, which comes about from thousands of years of rock-movements well below the surface.

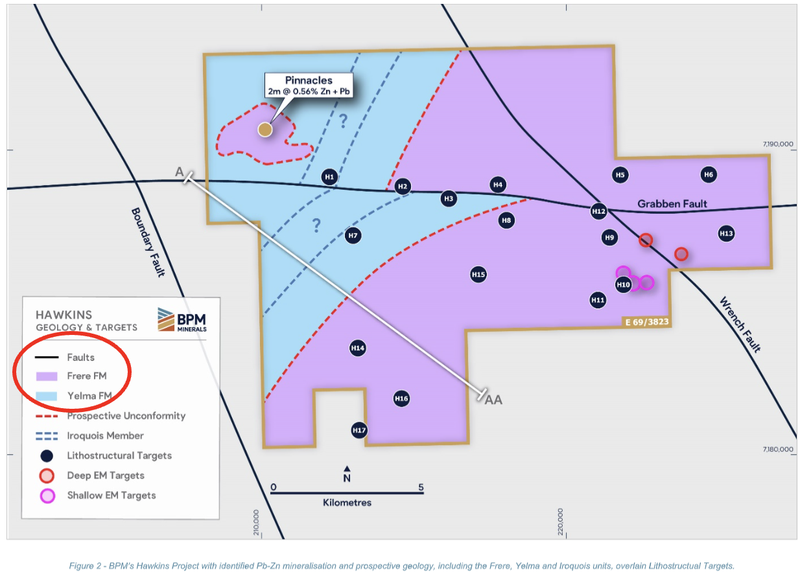

Below is a close-up of the Hawkins Project, where we can see the primary fault-line running north, the Frere and Yelma formations shaded blue and purple and the secondary fault-lines running west.

The third similarity is that there has been previous lead-zinc mineralisation hit over this ground.

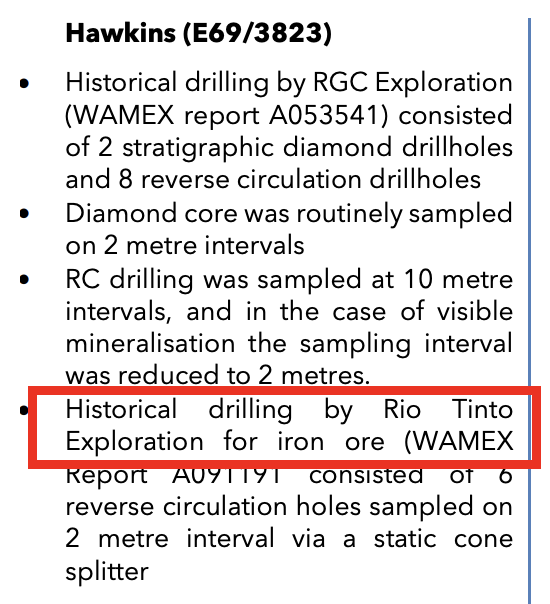

This isn't the first time the Hawkins Project has been drilled and we already know that there is lead-zinc there. The issue with the previous drilling programs was that the focus was on making an iron ore and manganese discovery.

Historic RC drilling returned mineralisation at the Pinnacles Prospect, with the best intercept being 2m @ 0.56% Lead-Zinc, indicating that something is there.

Most of the drilling and soil sampling within the project area wasn't even assayed for lead-zinc so the project remains largely unexplored for lead-zinc potential.

The important part about all of this is “where there is smoke there is usually fire” and we think this is the same with BPM’s tenements.

Below is an image of Rumble’s discovery before it became what it is today, the Chinook discovery now sits on top of those historic 11-12m intercepts.

With BPM’s Pinnacles Prospect showing lead-zinc mineralisation only 40m from surface at the Frere-Yelma intersection, we believe the setup here is almost identical to Rumble Resources Chinook discovery.

Another thing that stands out is that previous Earaheedy Basin explorers intersected lead-zinc mineralisation in the late 90s, with large-scale discoveries in and around the area following years later by the current group of Earaheedy explorers.

Geophysical reviews done over the tenement in 2014 are also showing deep EM anomalies that BPM believe represent bedrock conductor targets relating to sulphide hosted mineralisation.

None of this information has been followed up in the past.

This obviously doesn't mean exploration success is a guarantee - however this collection of early signs are certainly positive.

Putting all of this together - BPM’s Hawkins Project has all of the right ingredients for a large-scale Chinook style discovery to be made:

- The Hawkins Project sits on grounds sharing the same stratigraphic fundamentals as Rumble Resources Chinook Discovery. On the intersections of the Frere and Yelma formations. ✅

- The Hawkins Project and Rumble’s tenements both sit along the same fault line that runs north and then west in the Earaheedy Basin.✅

- Historic RC drilling results from the iron ore and manganese scout drilling have intersected lead-zinc mineralisation. Wherever lead-zinc mineralisation has been insersected historically, the current batch of explorers in the Earaheedy basin have gone on to make large-scale discoveries. ✅

With the project granted it's now “game on” for BPM to try and see if a Rumble resources “Chinook” style discovery can be made over the Hawkins Project.

Rumble also very active - we will keep watching

There is still some work to do before BPM can start drilling with soil sampling, gravity and EM surveys, and maybe some geophysical surveying, before the highest priority drill-targets can be identified.

All of this should take BPM several months so we don't expect drilling to start before at least late 2022.

That doesn't mean we won't be eagerly waiting for the results of the pre-drilling works.

We will be looking out for the data to confirm that there are indications of high-priority targets and that there are clear conductors that need to be tested.

In the meantime, there is still a lot happening in the area. After success at the Chinook discovery, Rumble Resources have already committed to a further 40,000m+ of drilling to expand the discovery and will do step-out drilling trending towards BPM’s Hawkins Project.

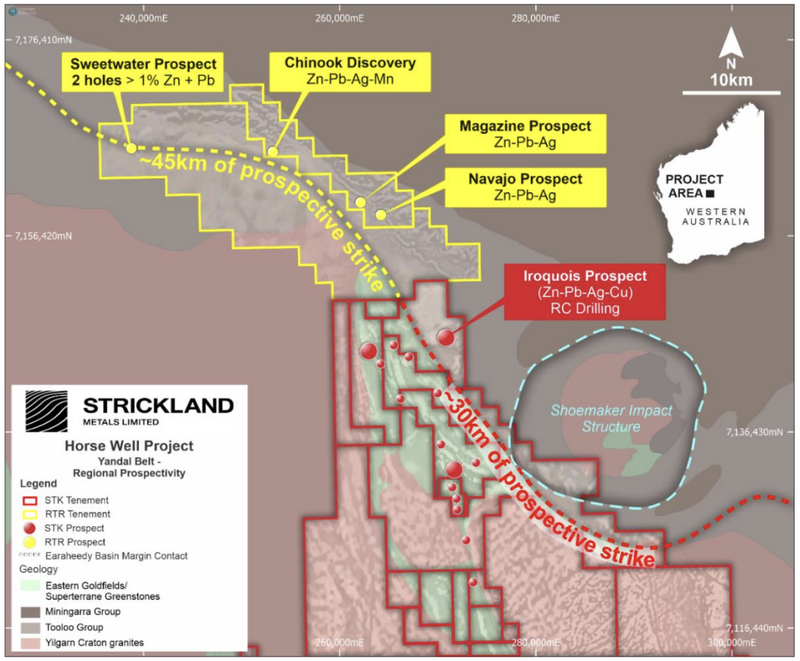

We also know of the $78M capped Strickland Metals who are actively drilling the Earaheedy Iroquois Lead-Zinc Prospect immediately adjoining the Rumble tenements.

While we wait for BPM to identify its highest priority targets, we will be watching all of the drilling programs happening in the vicinity to see if any mineralisation is trending towards BPM’s Hawkins Project.

Earaheedy Basin - The place to be.

The market is waking up to the Earaheedy Basin’s potential.

Located ~820km northeast of Perth and 125km north of Wiluna, the focus in the Earaheedy Basin in the past has been on Iron ore/Manganese exploration.

Only after the recent discovery made by Rumble has the area become interesting enough for a number of other explorers to pour capital into drilling programs.

With interest in the area renewed, there are now multiple listed companies that are having a crack at exploration in the area.

Castle Minerals recently started pegging tenements in the Earaheedy Basin & have already been re-rated by the market to a fully-diluted market cap of ~$57M.

The key difference between BPM and Castle Minerals is that their tenements are still Exploration Licence Applications (ELAs) so are far less advanced than the tenements BPM owns.

These tenements were also pegged in 2021, after the area had already been put on the map. Unlike BPM who’s project was pegged before Rumble’s discovery.

Another ASX-listed explorer in the region is Strickland Metals which has tenements adjoining Rumble’s Chinook discovery.

Strickland is currently capped at $78M and has had its share price move from ~1.8c to highs of ~9c off the back of some very decent lead-zinc drill intercepts at there Iroquois Prospect which also sits along the same prospective strike zone (similar to BPM’s grounds) as the Rumble discovery.

Another ASX-listed explorer that recently joined the group of explorers getting active in this region is Blaze Minerals who recently had tenements granted in the region and are currently trading at a market cap of $14.3M.

This is despite Blaze’s tenements not having the 3 key similarities we mentioned earlier in today’s note.

Recent price action for Blaze suggests the market has just started taking notice of the exposure though with Blaze’s share price moving from ~2.2c to ~4c.

We think the prize on offer for BPM is massive, especially considering BPM has a market cap of $13.7M, $4.4M in cash and a tiny enterprise value of $9.3M.

Significantly lower than any of its peers in this region, giving the cheapest entry, highest leveraged entry to a Rumble style discovery in the region.

Lets not forget BPM owns its tenements 100% outright, so any discovery is all BPM’s.

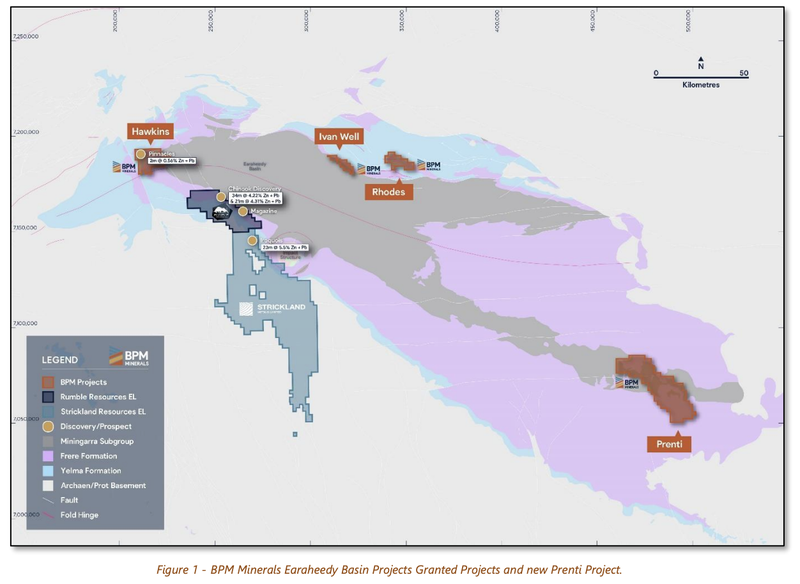

BPM recently increased its landholding in the basin:

BPM holds 4 different projects in the Earaheedy Basin with the Hawkins Project being the most prospective for a Rumble style discovery.

With recent pegging activity BPM also added the “Prenti project” to its stable of tenements in the Earaheedy Basin taking its total land holding to over 800km^2 across the basin.

The newly pegged Prenti project will also be targeting lead-zinc-silver mineralisation over a ~555km2 project area and now gives BPM exposure over the Iroquois formation as a new exploration target.

The most interesting part about these new grounds is that the Iroquois Carbonate Formations haven't been targeted by any of the other Earaheedy Basin explorers.

This gives BPM massive optionality should this style of grounds become of interest in the region. Think of this as almost a first-move into grounds with this style of geological fundamentals.

Our BPM Investment Memo for 2022

Below is our 2022 Investment memo for BPM where you can find a short, high-level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company's performance against our expectations 12 months from now.

In our BPM Investment Memo you’ll find:

- Key objectives for BPM in 2022

- Why we continue to hold BPM in 2022

- What the key risks are

- What our investment plan is

To access the BPM Investment Memo simply click on the button below:

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 1,670,000 BPM shares and 850,000 BPM options at the time of writing this article. S3 Consortium Pty Ltd has been engaged by BPM to share our commentary on the progress of our investment in BPM over time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.