Blackham resource continues blooming at Matilda Gold Project

Published 11-FEB-2016 14:44 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

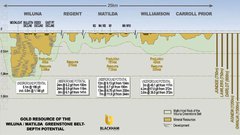

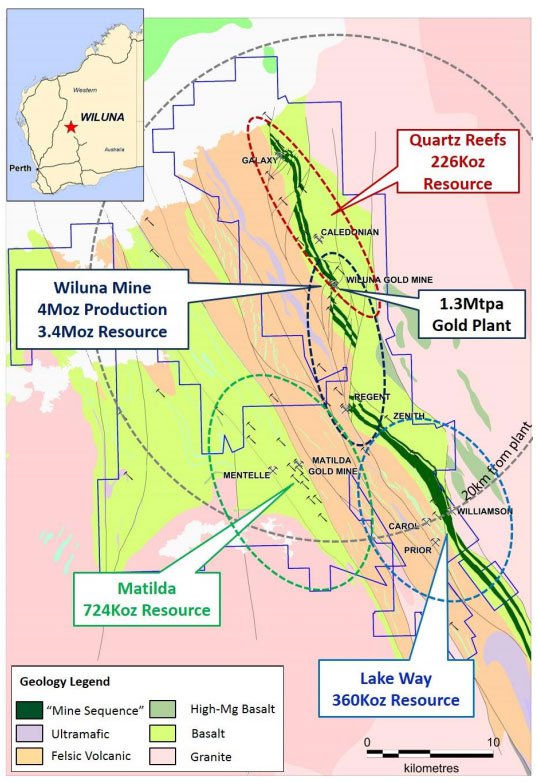

Blackham Resources (ASX:BLK) has upgraded the gold Resource at its flagship Matilda Gold Project. The Matilda Gold Project has 45Mt @ 3.2g/t for 4.7Moz within 20km of BLK’s Wiluna Gold Plant that’s capable of producing 1.3Mtpa for over 100,000oz per year.

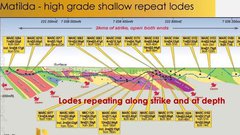

Less than two weeks since its previous Resource upgrade, BLK continues to conduct fervent exploration at Matilda with a view of boosting its overall Resource and progressing to production as soon as possible. Currently progressing its Definitive Feasibility Study, BLK could well be back with further upgrades in the near term.

BLK’s share price has risen steadily since the start of this year, rising from $0.22 per share at the start of January to $0.49 today – a gain of 122%.

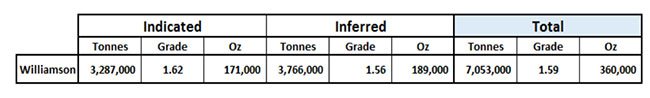

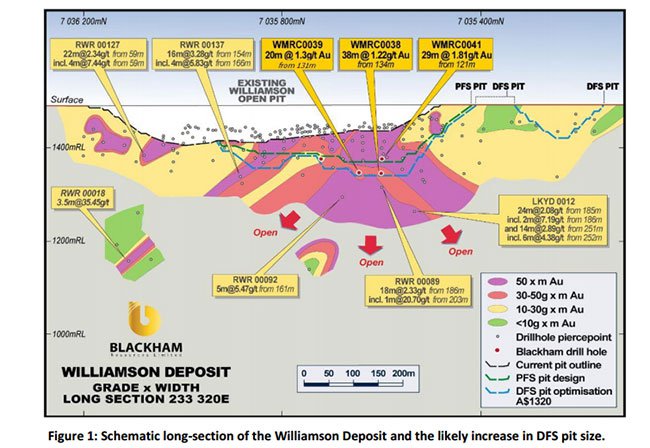

In its latest update to shareholders, BLK reports its Williamson resource has increased to 7.1Mt @ 1.6g/t for 360,000oz with Indicated Resources increasing to 3.3Mt @ 1.6g/t for 171,000oz.

Map showing BLK’s Project site

BLK says that the “increased confidence in the Williamson block model was the result of the inclusion of 5 diamond and 41 reverse circulation holes that were drilled in late 2015”. Williamson is a bulk-tonnage gold deposit with geological similarities to Thunderbox belonging to Saracen Mineral Holdings (ASX:SAR) and Gruyere operated by Gold Road Resources (ASX:GOR).

As part of its operations, BLK has also built up a “low-grade stockpile containing 100,000t of gold @ 1.4g/t for 4,500oz”, adding that the “material is ready for haulage and early production of gold”.

The entry into early production is likely to be a welcome revenue generator, balking at the assumption that junior explorers cannot become producers as part of exploration activity.

The Williamson gold mine is located 26km south of the Wiluna Gold Plant in Western Australia. The site was previously mined by Agincourt Resources between 2005 and 2006, producing a total of 663,871 tonnes at 1.98g/t for 42,353 ounces.

According to BLK’s exploration and resource estimates, its own mining will generate higher grade ore compared to Agincourt, with a larger quantity to boot.

Metallurgical test work on the ore at Williamson shows that it is free milling with estimated recoveries of 95%. Oxide gravity results confirm 65%-71% gravity recoveries and total recoveries of 98.3%-99.5% after 24 hours of leaching.

As a comparison, the previous operator of the Williamson project was able to achieve a meager 31%-65% gravity recovery rate.

The Williamson region continues to be regarded by many gold mining analysts as under-explored which BLK means to address having initiated a detailed ground-based gravity and seismic reflection survey over the Lake Way area to “locate additional Williamson-style gold deposits under the alluvial cover” said BLK in a market update.

After recently completing a Pre-Feasibility Study (PFS), BLK is now progressing with its DFS which is expected to be completed by the end of February 2016. BLK could potentially announce further Resource improvements when its DFS is finalised.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.