Berkeley paves the way for construction at Salamanca

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Emerging uranium producer, Berkeley Energia (ASX:BKY), has announced details of recent developments that will be important in facilitating the construction process at its Salamanca mine in Western Spain.

The group has acquired and leased more than 500 hectares of land which will allow it to complete initial infrastructure work and commence construction of the processing plant in the first quarter of 2017.

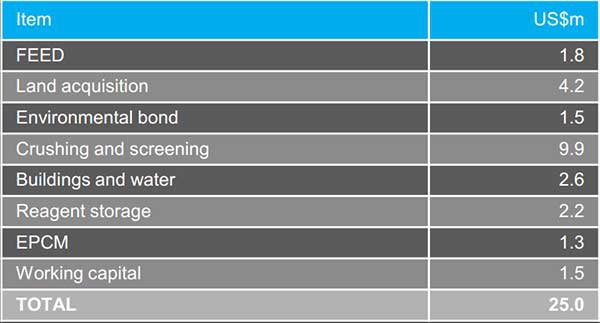

This follows the recent oversubscribed US$30 million equity raising which assisted in providing the funds to accelerate the development of Salamanca. As can be seen below, the company is off to a quick start in ticking the boxes regarding use of proceeds outlined in the capital raising.

Purchase orders for big ticket items to be completed by the end of 2016

BKY also said that contractual enquiries for key equipment for the crushing circuit had been made with the intention of completing purchase orders by the end of 2016.

Given BKY began initial construction of the Salamanca mine in August with the re-routing of the existing electrical power line to service the project and a 5 kilometre realignment of an existing road, the company is well progressed along the path to being one of the world’s lowest cost uranium producers.

Yet, whether it can become a dominant producer in Europe is speculative at this stage and BKY has some work to do before it achieves this aim, stage, so take a cautious approach if considering BKY for your portfolio and seek professional financial advice.

Summing up recent developments, BKY’s Managing Director Paul Atherley said, “Following the strong financial backing from London’s blue-chip institutions we are accelerating the development of the Salamanca mine, bringing forward the commencement of construction of the processing plant by several months and moving closer to our goal of becoming one of the world’s lowest cost uranium producers, reliably supplying long-term customers from the heart of the European Union”.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.