Bell Potter initiates coverage on Money3 with robust price target

Published 12-OCT-2016 17:26 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Despite shares in Money3 Corporation (ASX: MNY) nearly doubling in the last five months to close in on the group’s all-time high of $1.82, Bell Potter analyst, Lafitani Satiriou, is of the view that there is substantially more upside to come.

He initiated coverage on the stock with a buy recommendation on Wednesday, supported by a price target of $2.40. If past performance is a guide as to the company’s prospects in fiscal 2017, MNY looks in good shape having delivered a stellar fiscal 2016 result which resulted in its share price increasing from $1.46 on the day prior to the release of the result to hit a high of $1.69.

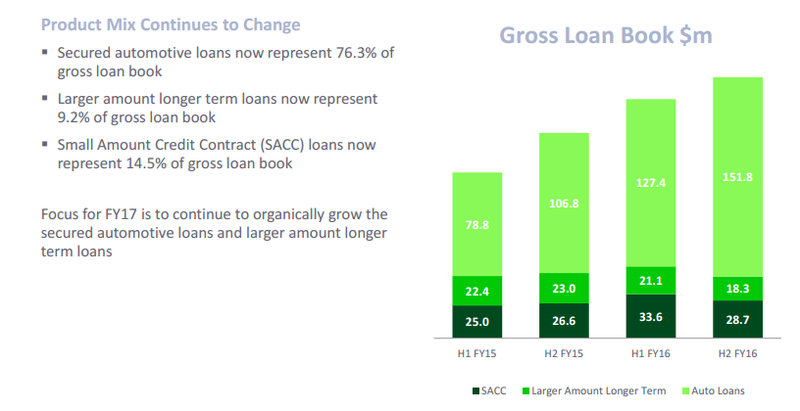

Features of the group’s fiscal 2016 performance included circa 40% growth in revenue, EBITDA and net profit. Gross Loans Receivables increased 27.1% and secured automotive loans increased by 42.1% $251.8 million.

There is no guarantee this rate of growth is set to continue, so if considering this stock for your portfolio, seek professional financial advice.

Automotive finance is a key focus for the business with managing Director, Scott Baldwin noting at the time of the result, “Consistent with our strategy to maintain the strong growth momentum in secured automotive finance, we are pleased to have delivered over 50% growth in both revenue and EBITDA from this product offering, driving overall group revenue and net profit by 40% and 44% respectively”

Management to expand secured automotive finance book

Baldwin said he expects to expand the offering of secured automotive finance through all of the group’s distribution channels. He also noted that larger amount longer term unsecured loans continue to grow and represent more than 50% of the group’s branch network loan book.

While small amount credit contracts continue to generate solid revenue he expects this area the business to reduce as a proportion of the gross loan receivables and make a lower proportionate contribution to overall income as product diversification increases.

Providing further share price momentum at the time of the result was management’s fiscal 2017 profit guidance of $26 million representing year-on-year growth of 30%. Also working in the group’s favour is the fact that it has traditionally been conservative with its guidance, suggesting there could be upside to this figure.

However, for the moment Bell Potter has adopted management’s guidance as there fiscal 2017 forecasts. This represents earnings per share of 16.8 cents, indicating that the company is trading on a PE multiple of 10 relative to Tuesday’s closing price of $1.68.

The share price retracement that has occurred in the last week could only be attributed to the company’s shares going ex-dividend (October 6: 2.5 cents), suggesting this may represent a useful entry point.

Bell Potter price target implies 43% upside

Bell Potter’s price target implies 43% upside to yesterday’s closing price. However, the target price appears fundamentally sound as it implies a PE multiple of approximately 14, and this is supported by forecast compound annual earnings per share growth of 14% over the next two years.

In highlighting MNY’s merits, Sotiriou alluded to the group’s strong growth, as well as pointing to its improved operating leverage as a result of consolidating its lending platform so that the various brands are all funnelled by the one system, a development that should deliver long-term earnings traction.

Sotiriou also referred to the group’s new banking facility which could potentially fund entry into new markets, such as moving up the credit quality chain in automotive lending. While such a development hasn’t been factored into the broker’s earnings projections this is seen as a major opportunity.

It should be noted that broker projections and past share price performances are not an indication of future earnings and trading patterns, and should not be used as the basis for an investment decision.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.